Interest rates are rising. The Federal Reserve is expected to continue to raise rates multiple times over the course of the next year. In fact, in March, Fed policymakers announced they would increase the federal funds rate by 0.25 percentage points and expect six more rate hikes this year. Rising rates mean, among other things, that mortgage rates will be higher in the future.

People refinance their mortgages for a myriad of reasons. A mortgage refinance basically replaces your current home loan with a new one. Often people refinance to reduce the interest rate, cut monthly payments or tap into their home’s equity.

Others refinance a home to pay off the loan faster, get rid of FHA mortgage insurance or switch from an adjustable-rate to a fixed-rate loan. In case you’re interested, a refi works much the same as an original mortgage loan. When you buy a home, you get a mortgage to pay for it. The money goes to the home seller.

When refinancing a home, you get a new mortgage. Instead of going to the home’s seller, the new mortgage pays off the balance of the old home loan. Mortgage refinancing requires you to qualify for the loan, just as you had to meet the lender’s requirements for the original mortgage.

So the question one must ask is now a good time to refinance a current mortgage? If you look back at the past year, it was definitely a period where people looked to refinance. As a matter of fact, 17% of U.S. homeowners with a mortgage on their primary residence refinanced in 2021, according to a survey by NerdWallet. Additionally, nearly one-third of homeowners with a mortgage on their primary residence said they were considering refinancing within the next 12 months, according to the survey.

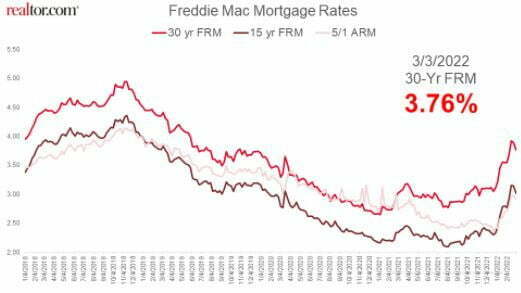

So, if you are in decision mode, you’re not alone. The chart below depicts rates as listed by Freddie Mac since 2018. You’ll notice the nadir of rates at roughly last summer, with rates currently on the rise in 2022.

There are really two distinct principles as to why one would consider refinancing a mortgage or loan. The first would be the systemic macroeconomic environment. So where are we currently in this regard? Rates can rise and fall for a number of reasons, including yields on 10-year Treasury notes, the stock market and the various economic reports. However, the main factor in the past several years has been the Federal Reserve, which has been investing trillions of dollars into mortgage-backed security bonds to keep the housing market strong and mortgage rates low during the pandemic.

Investors are concerned about the deepening Russia-Ukraine conflict and rising oil prices, and are wary of spillover effects from rising economic sanctions. Markets have their eyes on mounting inflation and expect the Federal Reserve to proceed with their rate-raising mandate. Market volatility and rising oil prices are likely to push bond yields into larger swings, while inflation will keep upward pressure on mortgage rates.

Surging prices and higher rates are creating challenges for first-time buyers looking for a home, causing them to make difficult choices in light of higher monthly costs for food, gasoline, clothing, cars and health care.

According to George Ratiu, Sr. Economist & Manager of Economic Research at realtor.com, “Real estate markets are seeing an early start to the spring buying season, with unseasonably high demand running into a small number of homes for sale.” This imbalance led to a typical home selling in just 47 days, and pushed listing prices to a new record high in February, as higher mortgage rates further squeezed buyers’ budgets.

On a microeconomic or personal level, one must ask whether it is appropriate to refinance based on current rates and the costs associated with the entire process. You’ll typically spend an average of 2% to 5% of the loan amount in closing costs, so you want to figure out how long it will take for monthly savings to recoup those costs. This is what’s known as break-even analysis, or the amount of time it will take for you to recoup the costs mentioned.

For example, if you had closing costs of $2,000 and you were saving $100 a month by doing the refinance, it would take you 20 months to break-even. Each month thereafter you will be $100 in the green for the remainder of the loan period.

Refinancing a mortgage will usually be worthwhile if the interest rate can be reduced by at least 0.75 percentage points, for example, going from a 4.75% rate to 4% or less. It may still make sense to refinance with a smaller reduction, but the smaller the rate drop the longer it will take to break-even on your closing costs. If you could garner a 75 basis point reduction that would translate into a monthly savings of roughly $300.

With current mortgage rates averaging 4.16%, there are an estimated 2.6 million well-qualified homeowners who could reduce their interest rate by at least 0.75 percentage points, according to mortgage data provider Black Knight.

Saving money on your mortgage helps you build wealth. If now isn’t the ideal time for you to refinance, keep plugging away on your current mortgage payments and improving your credit so you’ll be ready to strike when the time is right.