Financially, the only thing worse than losing money is paying taxes on top of the losses.

This is a peculiar quirk with mutual funds but is likely to transpire this tax season.

You’re probably thinking to yourself, I don’t remember selling any mutual funds this year, so how in the world would I have to pay taxes? Especially since most of the funds that you are likely to own are down for the year.

Enter the not-so-transparent world of mutual funds.

This one-two punch to investors happens as a result of fund managers having to sell holdings to raise cash to pay investors who are leaving the fund. This typically will trigger capital gains taxes for those who remain in the fund. According to Mark Wilson, a financial adviser with Mile Wealth Management who tracks large mutual fund distributions at CapGainsValet.com, “This is a salt-in-the-wound year. You owe taxes when you’ve lost money, and you have less invested going forward.”

According to securities tax law, mutual fund managers can sell holdings that have declined in value and save up capital losses to offset future capital gains on holdings that have risen in value.

However, each year they must send current investors almost all net capital gains that aren’t offset by losses. The strong bull market for years gave managers mostly winning holdings. Hence, as the bear market hit this year and investors cashed out of funds, many managers had few losses with which to offset those gains, so they ended up having to sell profitable positions.

The capital gains on the sales were then spread among the remaining fund holders.

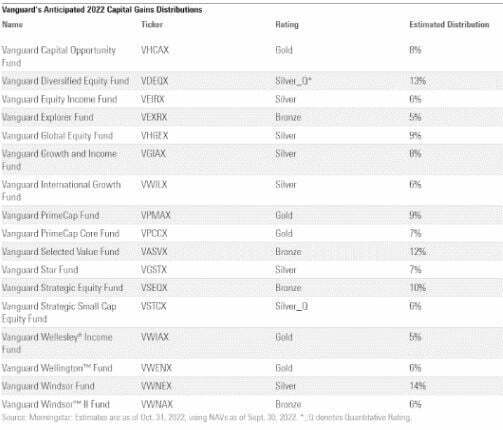

If you’re subject to capital gains, the following chart will show you what you owe.

The timing of any distribution usually happens around mid-December, after funds announce payout estimates earlier in the fourth quarter. Once you receive the estimate, you have until the “date of record,” which is the last day the fund will allow you to change your ownership position.

So which popular funds will hit investors with losses and capital gains distributions this year? Some Vanguard, Fidelity, T. Rowe Price, and other mutual funds estimate big distributions despite big losses. Fund families are still releasing their estimates, which they can still revise. Still, a preliminary look shows that many strategies in the value and blend Morningstar categories will make sizable distributions.

Fund companies have begun publishing distribution estimates on their websites, and most will make the actual payouts between late November and the end of the year.

An example of this is the behemoth Vanguard Fund, which has several actively managed sub-funds that will have meaningful distributions, as referenced below.

So how do you get around this mess, if at all?

Well, one idea is to consider tax-loss harvesting to reduce your capital gains bill. Tax-loss harvesting generally works as follows.

You sell an investment that’s underperforming and losing money. Then, you use that loss to reduce your taxable capital gains and potentially offset up to $3,000 of your ordinary income. Doesn’t sound that substantial, does it?

It isn’t the greatest benefit, but one of the few that is available under the tax law. According to Brian Schultz, a tax and investments specialist with the accounting firm Plante Moran, “Investors with small profits in a favorite fund expecting a large payout may want to sell it before the distribution and rebuy it right after.”

This technique, known as a “skip,” avoids tax on the capital gain payout. The wash-sale rules don’t apply to sales with a gain.

Think about asset allocation between taxable and non-taxable accounts. It is generally advisable not to hold mutual funds that are actively managed in taxable accounts because of the potential large payouts. These managed funds would be better candidates to be placed in a non-taxable account.

One should consider passive investments in equities, ETFs, index funds, etc., as more appropriate for taxable accounts.