Image: Bigstock

Post Earnings Drift Explained

Stocks tend to drift higher after an earnings report for several reasons. The obvious reason is that the company is proving to investors that it is performing at a high level from a fundamental perspective, inspiring confidence in investors. Secondly, after analysts on Wall Street digest the earnings report, they often raise estimates and unveil new positive ratings on the stock. Lastly, large institutions such as mutual funds looking to accumulate thousands of shares of stock after a strong earnings showing typically cannot do so in a single session. Instead, to avoid “moving the market” too much and driving up shares, these “whales” accumulate shares in the weeks and months following the positive earnings report – causing “Post Earnings Drift” potential.

Pay Attention to “Strong Buy”

Investors have been using Zacks #1 Ranked (Strong Buy) stocks to make sense of markets for years. Why? Zacks utilizes its trove of in-house market data to harness the power of earnings estimate revisions and provide investors with an easy-to- understand ranking. The top 5% of stocks get the coveted “Strong Buy” rank and have beaten the market 26 of the past 31 years with an average return of +24.3% versus the S&P 500’s +10.5% yearly average during the same period.

3 Top-Ranked Stocks Poised to Drift Higher Post Earnings

Today we will cover 3 stocks in different industry groups with earnings out of the way that are poised to move higher over the next few months, including:

W.W. Grainger: A Consistent Long-Term Grower

W.W. Grainger Inc (GWW – Free Report) is a distributor of maintenance, repair and operating products and services and has been in business since 1928. Though the legacy company has been around for so long, it shows little sign of slowing. In fact, since 2020, earnings growth has nearly doubled.

Image Source: Zacks Investment Research

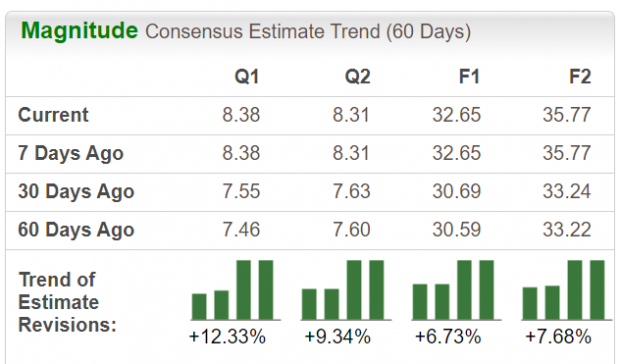

According to recent consensus estimate revisions, the growth is unlikely to slow.

Image Source: Zacks Investment Research

From a technical perspective, Grainger’s shares are also showing bullish behavior. After reporting strong earnings in early February (EPS grew 31%), shares rocketed higher by 18% on double the average volume turnover – a sign of heavy accumulation. Since then, shares have consolidated in a tight manner, signaling that shareholders who were invested in GWW before earnings are in no hurry to sell. Look for GWW to move higher as long as the stock can hold the earnings gap zone of ~ $625

Image Source: Zacks Investment Research

Las Vegas Sands: Beating the Odds

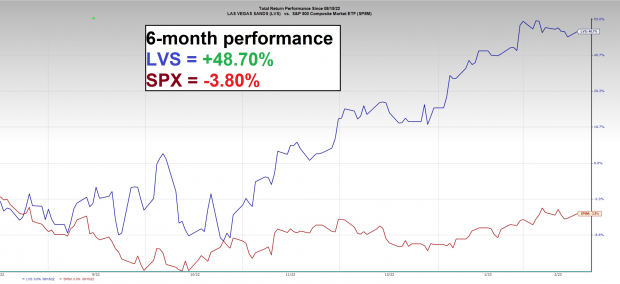

Las Vegas Sands (LVS – Free Report) is a leading international developer of resorts and casinos in the United States and Asia (Macau & Singapore). During the Covid-19 pandemic, casino operator giants such as Las Vegas Sands, Wynn Resorts (WYNN – Free Report) , and MGM Resorts (MGM – Free Report) , struggled as people stayed home. Positive earnings announcements in late 2022 have proven to investors that demand for in-person gambling is as high as ever, driving the group to be one of the top performers in the past six months.

Image Source: Zacks Investment Research

Despite Macau travel restrictions negatively impacting LVS’s last earnings, record numbers from its Singapore property helped to buoy investor confidence even though the company missed Zacks Consensus Analyst estimates by $0.09. With travel restrictions lifted and travelers itching to gamble in person, investors should expect Las Vegas Sand’s strong price trend to continue.

StoneX: A Niche Financial Services Stock Worth Watching

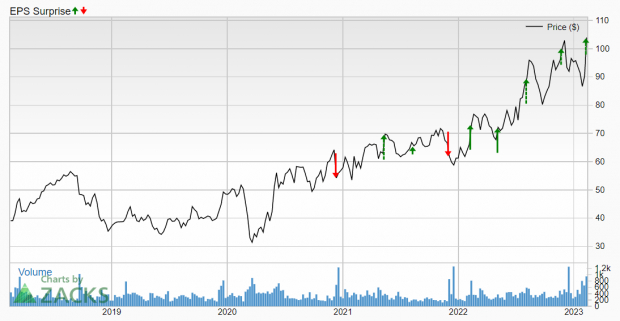

Presently, financial service companies are a tale of the “haves” and “have-nots”. For example, European banking giant Credit Suisse (CS – Free Report) just reported its worst annual loss since the financial crisis, driving shares to all-time low territory. On the contrary, domestic financial giants such as Bank of America (BAC – Free Report) , JP Morgan Chase (JPM – Free Report) , and Goldman Sachs (GS – Free Report) ) have turned the corner from a fundamental and technical perspective. However, the strongest financial stocks at the moment are the niche players such as StoneX Group (SNEX – Free Report) . StoneX is a financial services provider that offers clients niche offerings such as physical commodities, global payments, and commercial hedging. In recent quarters the company’s earnings have grown at a blistering pace. The company has grown EPS at a double- digit clip and outpaced analyst expectations for five straight quarters.

Image Source: Zacks Investment Research

Last week, the stock soared 15% after another strong report as shares briefly broke out to new all time high territory. Expect shares to outperform in the coming months if the stock can break out and holds above the previous resistance area of ~ $103.

Interactive Brokers (IBKR – Free Report) is another Zacks Rank #1 (Strong Buy) stock worth watching. Like StoneX, the IBKR’s stock is attempting to break out after a strong earnings showing. New additions to Interactive Broker’s suite of products like crypto trading have driven the company’s growth in recent quarters.

Takeaway

Investors can avoid binary risk and take advantage of the “post earnings drift” phenomenon by looking for Zacks Ranked “Strong Buy” stocks. With the market turning bullish and many industries recovering from pre-pandemic earnings slowdowns, investors can outperform the market by looking at strong fundamental and technical stocks such as W.W. Grainger, Las Vegas Sands, and StoneX.

Is THIS the Ultimate New Clean Energy Source? (4 Ways to Profit)

The world is increasingly focused on eliminating fossil fuels and ramping up use of renewable, clean energy sources. Hydrogen fuel cells, powered by the most abundant substance in the universe, could provide an unlimited amount of ultra-clean energy for multiple industries.

Our urgent special report reveals 4 hydrogen stocks primed for big gains – plus our other top clean energy stocks.