As February begins to fade, one thing is certain – the first few months of 2023 have been much different from what was endured last year.

Many of those that were punished in 2022 have staged big rebounds, including NVIDIA (NVDA – Free Report) , Tesla (TSLA – Free Report) , and Warner Bros. Discovery (WBD – Free Report) . Below is a chart illustrating the year-to-date performance of all three stocks.

Image Source: Zacks Investment Research

In fact, all three are the top-performing S&P 500 stocks year-to-date. For those interested in momentum investing, let’s take a closer look at each one.

Tesla

We’re all highly familiar with Tesla, the undisputed EV leader and one of the most popular stocks over the last decade.

Shares were heavily punished in 2022, losing more than 60% in value. However, the company’s latest quarterly release pushed new life into shares, as illustrated by the green arrow in the chart below.

Image Source: Zacks Investment Research

Tesla posted better-than-expected results, penciling in a 9% bottom line beat and reporting revenue 2.5% ahead of expectations.

In addition, total EV deliveries for the quarter, a critical metric for the company, totaled roughly 405,000, 1% ahead of our consensus estimate.

Image Source: Zacks Investment Research

TSLA shares presently trade at a 6.2X forward price-to-sales ratio (F1), a few ticks below the 6.6X five-year median and beneath steep highs of 23.5X in 2022.

The stock presently carries a Style Score of “C” for Value.

Image Source: Zacks Investment Research

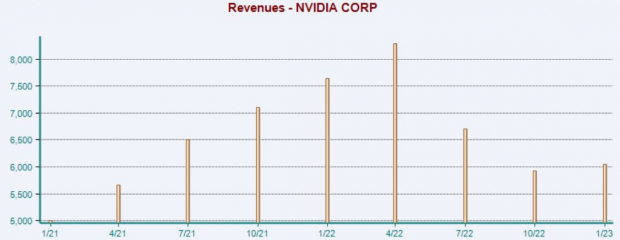

NVIDIA

Another investor favorite, NVIDIA, is the worldwide leader in visual computing technologies, evolving its focus from PC graphics to artificial intelligence (AI) solutions.

NVIDIA’s latest quarterly release was undoubtedly welcomed by the market, with shares gaining more than 10% following the print.

Image Source: Zacks Investment Research

NVIDIA reported earnings of $0.88 per share, handily beating our consensus estimate by nearly 9%.

In addition, quarterly revenue totaled $6.1 billion, modestly ahead of expectations and declining 20% year-over-year, primarily attributed to a pullback in gaming demand.

Image Source: Zacks Investment Research

However, a big focus point of the company’s release was its Data Center results; Data Center revenue totaled $3.6 billion, growing 11% from the year-ago quarter.

There were also several strategic highlights within the Data Center segment, including a partnership with Deutsche Bank (DB – Free Report) to further the use of AI within financial services.

AI is Wall Street’s new shiny toy in 2023, and NVIDIA looks to become the leader.

Warner Bros. Discovery

Warner Bros. Discovery is a media and entertainment company that creates and distributes a portfolio of content and brands across television, film, and streaming.

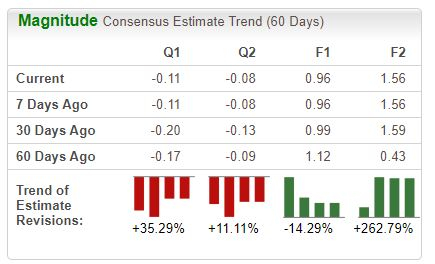

The company has seen its earnings outlook improve across several timeframes over the last several months.

Image Source: Zacks Investment Research

In its latest release on February 23rd, WBD posted earnings per share of $0.42, crushing the Zacks Consensus EPS Estimate of -$0.03. In addition, the company generated $11 billion in sales, just a tick below expectations.

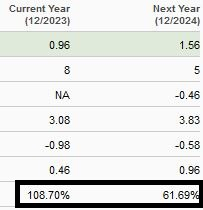

Still, the most impressive aspect of WBD could be its growth trajectory; the Zacks Consensus EPS Estimate of $0.96 for its current fiscal year (FY23) suggests an improvement of more than 100% year-over-year.

And in FY24, estimates allude to a further 60% of earnings growth.

Image Source: Zacks Investment Research

Bottom Line

Investors have undoubtedly welcomed the broader market’s rebound in 2023.

We’ve seen several stocks rebound in a big way, including NVIDIA (NVDA – Free Report) , Tesla (TSLA – Free Report) , and Warner Bros. Discovery (WBD – Free Report) .

In fact, all three have led the S&P 500’s rebound, finding plenty of buyers year-to-date. For those interested in momentum investing, all three deserve consideration.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.