Image: Bigstock

Despite the effects of the pandemic receding in 2022, generic drugmakers in the United States continue to suffer from macroeconomic headwinds like inflation and higher interest rates. The strengthening of the U.S. dollar against almost every other currency is causing unfavorable currency fluctuations. Nonetheless, these drugmakers are focusing on new product launches to support their top line.

Companies like Teva Pharmaceutical (TEVA – Free Report) , Dr. Reddy’s Laboratories (RDY – Free Report) and Amphastar Pharmaceuticals (AMPH – Free Report) are poised to offset the pressures posed by macroeconomic factors on the back of continued demand for their existing products and new product launches.

Industry Description

The Medical – Generic Drugs industry comprises companies that develop and market chemically/biologically identical versions of a brand-name drug once patents, providing exclusivity to branded drugs, expire. These drugs can be divided into two categories — generic and biosimilar — based on their composition. The generic segment is controlled by a few large generic drugmakers and generic units of large pharma companies. However, several smaller companies also develop generic versions of branded drugs. These drugs are significantly cheaper than original drugs. Competition in this segment is stiff, resulting in thin margins for manufacturing companies. A few companies in this industry also have some branded drugs in their portfolio, which help them to tap a higher-margin market.

3 Trends Shaping the Future of the Generic Drugs Industry

Loss of Patent Exclusivity of Branded Drugs: Generic drugmakers mainly rely on the loss of patent exclusivity of branded drugs. They apply to the FDA to approve their generic or biosimilar version of branded drugs, which have lost patent protection. Patent loss of blockbuster drugs like AbbVie’s Humira provides significant opportunities for generic drugmakers in 2023. Several companies like Amgen, Biogen and Novartis have already received FDA approvals for a Humira-biosimilar. This January, Amgen commercially launched Amjevita, the first U.S. biosimilar to Humira biosimilar. Like Amgen, many other companies are also expected to launch their own Humira biosimilars at different times of the year.

A company may launch an authorized generic version of a branded product, gaining exclusivity over other generic versions of the same drug for several months. Although developing biosimilars is complex, the generic players have already launched a few. These generic drugmakers may also have to face litigation to market the generic version of these drugs.

Stiff Competition:The generic drug industry provides stiff competition to the original branded drugs. Once a branded drug loses patent exclusivity and generic versions of the same are available in the market, it helps induce competition as these generic competitors set generic prices well below the brand price. Moreover, the competition amongst multiple generic drugmakers to market the same generic drug pulls generic drug prices down, benefiting the consumer. As a result, the generic drugmakers eye for first-to-file (FTF) status for the generic medicines. The current generic market is already crowded, with many drugmakers having several generic filings pending before the FDA. With several biosimilar drugs set for launch over the next couple of years, the top line of the industry players is likely to improve greatly.

Patent Settlements: The successful resolution of patent challenges continues to be an important catalyst for the growth of generic drugmakers, as these can lead to product launches. The settlement of these challenges accelerates the availability of low-cost generic products and removes uncertainties associated with litigation. However, active patent challenges require litigation, thereby leading to higher costs.

Zacks Industry Rank Indicates Sunny Prospects

The Zacks Medical – Generic Drugs industry is a small 16-stock group housed within the broader Zacks Medical sector.

The group’s Zacks Industry Rank is basically the average of the Zacks Rank of all the member stocks. The Zacks Medical – Generic Drugs industry currently carries a Zacks Industry Rank #102, which places it in the top 41% of the 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Against this backdrop, we will present a few noteworthy stocks. But before that, it’s worth looking at the industry’s stock market performance and current valuation.

Industry Outperforms S&P 500 and Sector

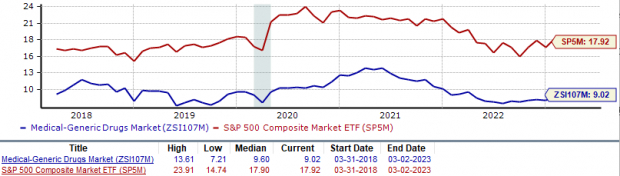

The Zacks Medical – Generic Drugs industry has underperformed the broader Zacks Medical sector and the S&P 500 Index in the past year period.

The industry has declined 4.3% over this period compared to the broader sector’s 13.6% fall. Meanwhile, the S&P 500 has declined 9.6% in the said time frame.

One-Year Price Performance

The Industry’s Current Valuation

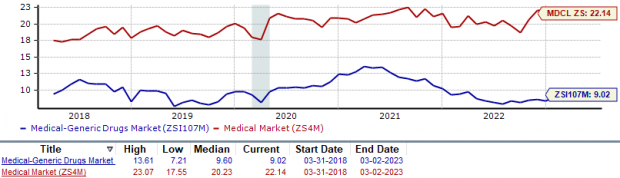

On the basis of forward 12 months price-to-earnings (P/E F12M), which is a commonly used multiple for valuing generic companies, the industry is currently trading at 9.02X compared with the S&P 500’s 17.92X and the Zacks Medical sector’s 22.14X.

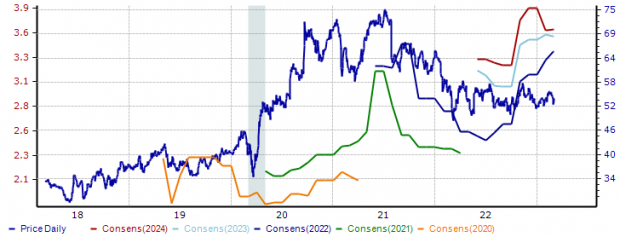

Over the last five years, the industry has traded as high as 13.61X, as low as 7.21X, and at the median of 9.60X, as the charts below show.

Price-to-Earnings Forward Twelve Months (P/E F12M) Ratio

3 Generic Drug Stocks to Keep an Eye On

Teva: Teva is the world’s largest generic drug company in total and new prescriptions. The company is seeing the continued growth of its new branded drug, Austedo’s prescriptions and market share growth for another newer medicine, Ajovy. Generic revenues are improving in Europe and international markets. With improving operational efficiencies and significant debt reduction, the company may see better growth in a few years. In January, Teva announced that it intends to move forward with its nationwide settlement agreement to resolve opioid-related claims and litigation. Management confirmed that 49 out of 50 states have settled and the sign-on process for the state subdivisions has begun. This likely removes a significant overhang for Teva.

The consensus estimate for 2023 has declined from earnings per share of $2.48 to $2.41 over the past 30 days. The stock has risen 9.2% in the year so far.

TEVA carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

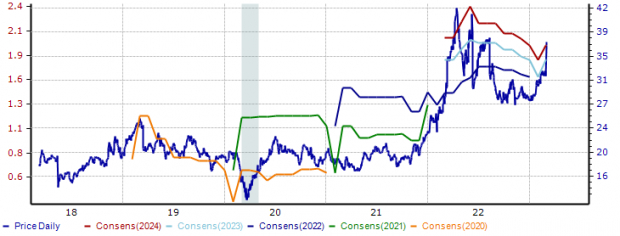

Price & Consensus: TEVA

Dr. Reddy’s Laboratories: The company enjoys a strong position in the generics market. During the third quarter of fiscal 2023, Dr. Reddy’s witnessed higher North America revenues due to the launch of new products, which helped to partially mitigate the impact of pricing erosion. During the same quarter, Dr. Reddy’s also launched five new products in North America. As of Dec 2022-end cumulatively, 78 generic filings were pending approval from the FDA (75 abbreviated New Drug Applications [ANDAs] and three new drug applications). The company also registered a 45% year-over-year growth in revenues from Russia.

The consensus estimate for fiscal 2023 (year ending March 2023) earnings has improved from $3.31 to $3.40 over the past 30 days. The stock has risen 3.7% in the year so far. Dr. Reddy’s has a Zacks Rank #3.

Price & Consensus: RDY

Amphastar: The company develops, manufactures, and markets generic and proprietary injectable, inhalation, and intranasal products, as well as an insulin-active pharmaceutical ingredient. The company is focused on expanding its portfolio of generics and biosimilars. Currently, the company has three generic drugs under review with the FDA. It is also developing three biosimilar drugs and six generic drugs with significant market opportunity. The company is currently focusing on the sale of higher margin products, including new product launches of vasopressin and ganirelix. The company is also focused on acquiring market share for its glucagon generic product following the discontinuation of branded glucagon products by competitors Lilly and Novo Nordisk.

The stock has gained 32.1% in the year so far. The consensus estimate for 2023 earnings have been stable at $1.80 per share over the past 30 days. Amphastar carries a Zacks Rank #3 (Hold).

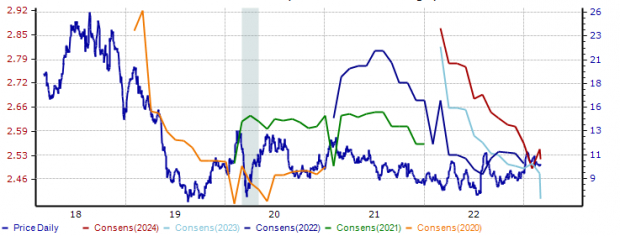

Price & Consensus: AMPH