If you have bad credit it can be difficult to qualify for unsecured credit cards. The banks are taking a risk whenever they loan money and if you have bad credit the risk is higher. Luckily there are cards out there that you can qualify for even with less than perfect credit.

The best unsecured cards for bad credit have some similar features. For example, none offer a 0% introductory period. However all the cards on this list do report to the three major credit bureaus so keeping your balances low and paying on time will improve your credit over time.

A few cards have welcome bonuses which is a nice surprise as credit cards for bad credit typically don’t include this perk. There are also several that earn cash back rewards which is nice, after all, who doesn’t want free money.

But keep in mind, perks are nice, but the main goal for this credit card is to build credit. So apply for a card you qualify for and use it to increase your credit score. Once you have a higher score you can apply for a credit card with all the perks you want.

Best overall: Petal 2 Visa Credit Card

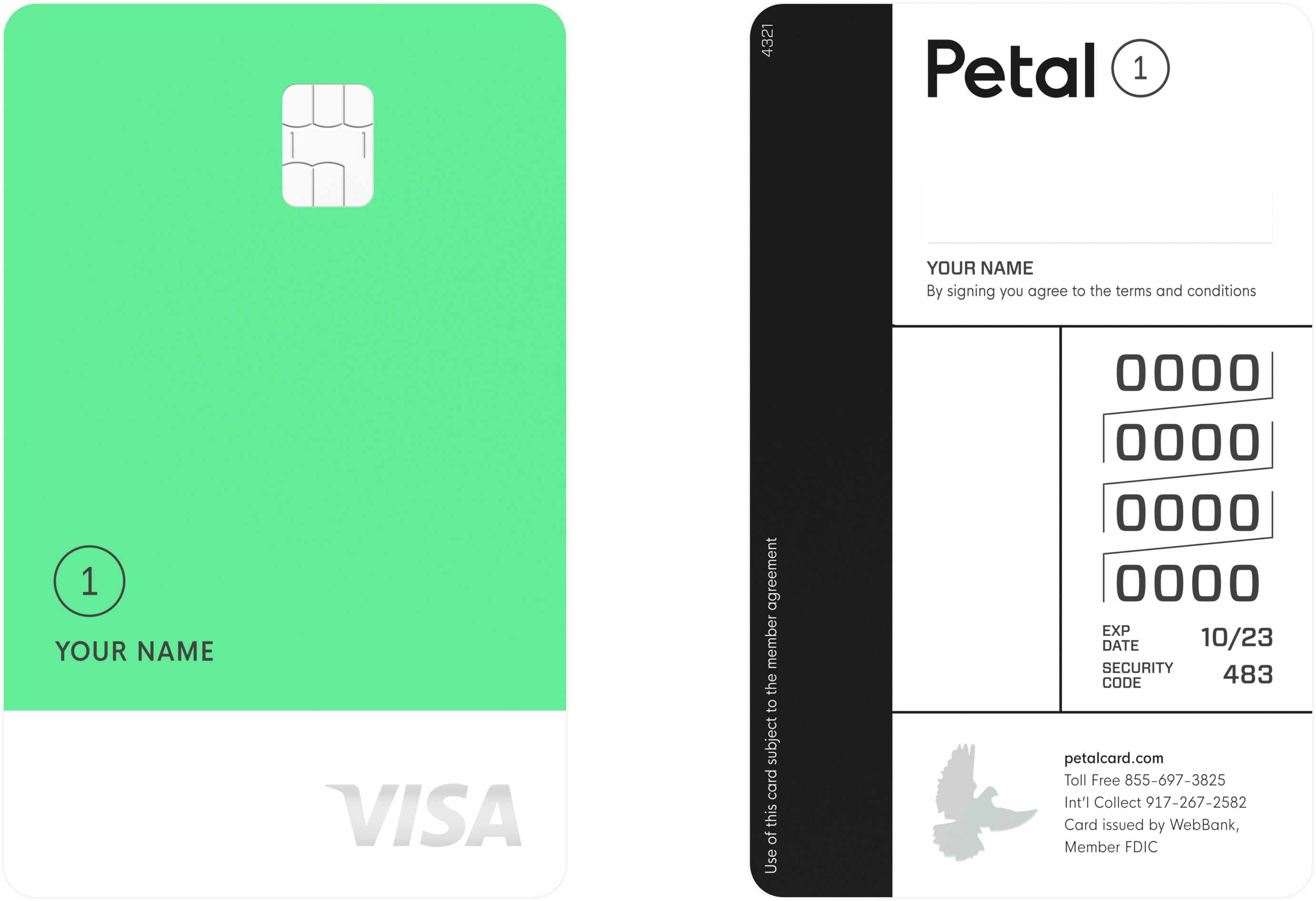

Petal® 1 “No Annual Fee” Visa® Credit Card

In A Nutshell

The Petal® 1 “No Annual Fee” Visa® Credit Card is a great no-annual-fee card with a solid rewards system for people with limited or no credit. It reports to all three major credit card bureaus and you can score a higher credit limit between $300- $5,000 — just make sure to use your card responsibly. The Petal® 1 “No Annual Fee” Visa® Credit Card is issued by WebBank, Member FDIC.

What We Like:

- No credit history required, making it perfect for beginners.

- No annual fee, and no over-limit or foreign transaction fees, either.

- 2% – 10% cash back at select merchants.

Best for students: Capital One QuickSilver Student Cash Rewards Credit Card

Capital One Quicksilver Student Cash Rewards Credit Card

In A Nutshell

Students will love the simplicity of this cash back credit card from Capital One. Earn an unlimited 1.5% cash back on every purchase, every day, and your rewards won’t expire for the life of the account. Plus there’s no annual fee, foreign transaction fees, or other hidden fees to worry about.

What We Like:

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn unlimited 1.5% cash back on every purchase, every day

- Enjoy no annual fee, foreign transaction fees, or hidden fees

Best for buying groceries: Capital One SavorOne Student Cash Rewards Credit Card

Capital One SavorOne Student Cash Rewards Credit Card

In A Nutshell

Students will love earning an unlimited 3% cash back on popular everyday purchases and 1% cash back on all other purchases, all with no annual fee. Plus, student cardholders will also earn 8% cash back on entertainment purchases when booked through the Capital One Entertainment Portal.

What We Like:

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®)

- 8% cash back on entertainment when booked through the Capital One Entertainment Portal

Best for automatic credit limit increase: Capital One QuicksilverOne Cash Rewards Credit Card

Capital One QuicksilverOne Cash Rewards Credit Card

In A Nutshell

If you don’t have the excellent credit needed to score some of the bonuses other Capital One credit cards offer, consider the Capital One QuicksilverOne Cash Rewards Credit Card. It’s a terrific card for average credit and you can still earn 1.5% cash back on all purchases with a modest $39 annual fee.

What We Like:

- 1.5% cash back on all purchases.

- Be automatically considered for a higher credit line in as little as six months.

- No foreign transaction fees and a modest $39 annual fee.

Best for keeping tabs on your credit score: Capital One Platinum Credit Card

Capital One Platinum Credit Card

In A Nutshell

Finding an unsecured credit card with average credit can be difficult, but the Capital One Platinum Credit Card is happy to have your business. You won’t find many perks to owning this credit card, but it’s a great first card for young people looking to build a strong credit history and there’s no annual fee.

What We Like:

- Only average / fair / limited credit is required for approval

- Be automatically considered for a higher credit line in as little as 6 months

- No annual fee or foreign transaction fees

Best for prequalification: Milestone Mastercard

Milestone Mastercard®

In A Nutshell

If you have lousy credit and are looking for a way to build it back; the Milestone Mastercard® is a strong option. There’s a quick pre-qualification process with no impact to your credit score, modest interest rate and an annual fee of $35 – $99.

What We Like:

- $35 – $99 annual fee

- Easy pre-qualification process

- Previous bankruptcy is OK

Best for very poor credit: Indigo Platinum Mastercard Credit Card

Indigo® Mastercard® Credit Card

In A Nutshell

The Indigo® Mastercard® Credit Card offers consumers with poor credit the opportunity to use a credit card for everyday spending. Pre-qualification is quick and easy and if you have the credit profile needed, you might be able to secure a credit card with no annual fee. ($0 – $99 annual fee).

What We Like:

- $0 – $99 annual fee

- Easy pre-qualification process

- Previous bankruptcy is OK

What’s Ahead:

Bad credit vs fair credit

Petal 2 Visa Credit Card: Best overall

Pros

- Uses your income and banking habits to qualify you rather than a credit score

- No fees, including an annual fee or late payment fees

- Up to $10,000 credit limit

Cons

- You won’t unlock the card’s full potential until after 12 months

- No sign-up bonus

The beauty of the Petal® 2 “Cash Back, No Fees” Visa® Credit Card is that it doesn’t rely only on your credit score to qualify you. This is perfect for those who are either just getting started or looking to rebuild credit. On the card’s application, you can connect your checking and savings accounts so they can look at your banking habits. Things like account balances and how often you overdraft will help them generate a “CashScore.” In other words, if you’re lacking credit history, the issuer will look at your bank history to see if you’re a responsible candidate.

As its name suggests, light on fees. You won’t pay an annual fee, foreign transaction fees, late payment fees, or fees for returned payments. It’s a great card for someone just learning to use credit.

This card earns a respectable 1.5% cash back on all purchases — but it’s a journey to get there. You’ll earn:

- 1% cash back on eligible purchases after opening your account

- 1.25% cash back after six months of on-time monthly payments

- 1.5% cash back after 12 months of on-time monthly payments

You’ll also earn between 2% and 10% cash back at select merchants.

This gradual increase in rewards earnings is another potential win for younger adults beginning in credit who are just learning to wield credit effectively. The card sort of “gamifies” responsible use of credit and rewards you for good habits.

The card also offers similar benefits to other cards on this list, such as the ability to prequalify without enduring a hard inquiry on your credit and the ability to potentially receive a credit line increase in as little as six months (after meeting very specific requirements).

This card doesn’t have a sign up bonus and you’ll pay APR Range: 17.49% – 31.49% Variable APR.

If you don’t qualify for the Petal 2, you may be approved for it’s sister card, Petal 1. Petal 1 is also a great card but it has fewer bells and whistles.

Here’s our full review of the Petal 2 card.

Capital One Quicksilver Student Cash Rewards Credit Card: Best for students

Pros

- No annual fee

- Welcome offer of $50 when you spend $100 on purchases within 3 months from account opening

- Solid cash back rewards program

Cons

- No 0% intro offer

- Must be an enrolled student to qualify

If you are a student this is a definitely a card to consider. It has a welcome offer of $50 when you spend $100 on purchases within 3 months from account opening. Which is pretty easy to do.

It also has no annual fee and earns decent cash back. You can earn 1.5% cash back on all purchases. Additionally, any hotels and rental cars booked through Capital One Travel will earn 5% cash back.

Also, Uber and Uber Eats transactions will actually earn 10% cash back plus a statement credit for your Uber One membership each month through 11/14/2024. So, if you spend a lot on Uber, this is a very attractive bonus.

You can redeem your rewards as a statement credit, paper check, gift card, or even when you check out through Amazon or PayPal.

This card does not come with a 0% intro offer on purchases or balance transfers. The regular rate of 19.24% – 29.24% (Variable) will kick in right away. So, if you carry a balance on your card, you won’t be saving interest here.

Here’s our full review of the Capital One Quicksliver Student Cash Rewards Credit Card.

Capital One SavorOne Student Cash Rewards Credit Card: Best for buying groceries

Apply NowOn the Secure Website

Pros

- $0 annual fee

- Welcome offer of $50 bonus when you spend $100 on purchases within 3 months from account opening

- 3% cash back on dining and at grocery stores, 1% on almost everything else

Cons

- No 0% intro offer

- Must be an enrolled student to qualify

The biggest draw of student credit cards is that they are easy to get for someone with very little (or poor) credit history.

It’s hard to believe the Capital One SavorOne Student card is just that — a student card. The return rate this card offers is ridiculously high, outpacing even most non-student cashback credit cards.

First, you’ll receive a $50 bonus when you spend $100 on purchases within 3 months from account opening. It’s easy to earn, and it’s a solid offer. The real value of this card lives in its ongoing earning rates, though. You’ll get:

- 10% back on Uber & Uber Eats purchases through November 14, 2024

- 8% back on entertainment purchases when booked through Capital One Entertainment

- 5% back on hotels and car rentals reserved with Capital One Travel

- 3% back on dining, entertainment, popular streaming services, and grocery stores (not including Walmart and Target)

- 1% back on all other purchases

Additionally, this card comes with statement credits to offset an Uber One membership through November 14, 2024. That’s a monthly value of $9.99. Couple this with the 10% return on Uber and Uber Eats purchases, and this is one of the best cards for rideshare expenses on the market.

This card doesn’t have a 0% intro offer on purchases or balance transfers and the regular rate is 19.24% – 29.24% (Variable).

The biggest downside to this card is that you must prove that you’re an enrolled student — or at least admitted and intending to enroll within the next three months — at any accredited higher education institution (such as a community college or university).

Related: Best credit cards for college students

Capital One QuicksilverOne Cash Rewards Credit Card: Best for automatic credit limit increase:

Apply NowOn The Secure Capital One Website

Pros

- Solid cash back rewards program

- Automatic review your credit limit after six months

Cons

- $39 annual fee

- No welcome bonus or 0% intro offer

The best thing about the Capital One QuicksilverOne Cash Rewards Credit Card is the fact that you can earn cash back. You’ll earn 1.5% unlimited cash back on all your purchases. In addition, you’ll earn 5% cash back on hotel and rental cars booked through Capital One Travel.

There is no welcome offer and no intro offer, so the 29.74% (Variable) APR will apply right away. This APR is also higher than other cards on this list so keep that in mind if you plan on carrying a balance.

Capital One will review your credit limit after six months to see if you qualify for a credit limit increase.

Here’s our full review of the Capital One QuicksilverOne Cash Rewards Credit Card.

Capital One Platinum Credit Card: Best for keeping tabs on your credit score

Apply NowOn the Secure Website

Pros

- $0 annual fee

- Automatic review of credit limit after six months

Cons

- No welcome bonus or 0% intro offer

- No rewards

The Capital One Platinum Credit Card will consider applicants with credit as low as 580. They will also give you an automatic review of your credit limit after six months. So you have the chance at a higher limit if you’ve been using your card responsibly.

Another bonus of this card is the $0 annual fee. However, there is no welcome offer or 0% intro period, so you’ll be paying the 29.74% (Variable) APR right off the bat.

You do get access to CreditWise. This is Capital One’s credit tool which will give you access to your credit score, notify you if there are changes to your credit score, and help you understand why your credit score has moved up or down.

Milestone Mastercard®: Best for prequalification

Apply NowOn the Secure Website

Pros

- Eligible even if you’ve filed for bankruptcy

- Know if you’re approved before you apply

Cons

- Annual fee between $35 – $99*

- No rewards for spending

A bad credit score can be the result of any number of financial situations. No matter how your credit score is now, the Milestone Mastercard® is a good option to help you rebuild.

Before you apply, you’ll be able to see if you prequalify. This means that your credit won’t receive a “hard inquiry,” which can temporarily ding your credit score, causing it to drop a few points. If you’re not approved, you’ve essentially lowered your credit score (again, temporarily) for nothing.

That’s why it’s so handy to see if you’ll be approved before you submit an application to officially obtain the card. After you’ve got it, you’ll be able to rebuild your credit through on-time payments that will be reported to three credit bureaus.

Depending on your application, you’ll pay an annual fee between $35 – $99* and you’ll pay an APR of 24.9%.

Other features do include extended warranty coverage, price protection, and custom card designs. Other than that, this card has very few features that justify an annual fee; the card serves one purpose alone, and that’s to help those with poor credit to have a shot at redeeming themselves. If you’re not rebuilding credit, look elsewhere.

Here’s our full review of Milestone Mastercard®.

Indigo® Mastercard® Credit Card: Best for very poor credit

Apply NowOn the Secure Website

Pros

- Can qualify even if you’ve had a bankruptcy

- No cash advance fee for the first year

Cons

- Maximum $300 credit limit

- Annual fee of $0 – $99

- No welcome offer or 0% intro rate

- No rewards

This card very few perks, but if you are having trouble qualifying for other cards the Indigo® Mastercard® Credit Card might be for you as they may accept applicants with credit scores as low as 300. The good news is that they only do a soft credit check (rather than a hard credit check) so the if you aren’t approved there is no impact to your score.

While it will have a very low credit limit, max of just $300, you can qualify even if you have a bankruptcy. Which typically will disqualify you from having an unsecured credit card.

This card may come with an annual fee, depending on your credit you may have an annual fee of $0 – $99. It doesn’t have a welcome bonus or a 0% intro rate so the regular APR of 24.9% will apply right away.

Here’s our full review of the Indigo® Mastercard® .

Mission Lane Visa Credit Card: Best as a secured card alternative

Pros

- Be approved with poor (or no) credit history

- Potential credit line increase after six months

Cons

- No rewards for spending

- No sign-up bonus

- Low credit limit, up to just $300

- Potential $59 annual fee

The Mission Lane Visa Credit Card is a very one-dimensional credit card with the sole purpose of helping you to improve your credit score. It’s got one of the most credit score-inclusive approaches, making it a good choice for those with credit scores even in the 300s.

Depending on your creditworthiness, you could get a credit line of just $300. However, by using your newfound credit responsibly (e.g. making on-time payments), you’ll be eligible for an increase in your credit limit after just six months.

Depending on your creditworthiness, you’ll pay between $0 and $59 in annual fees. If it turns out you’ll pay an annual fee, jettison this card as quickly as possible. Its ongoing benefits are not good when compared to other cards. It serves a similar function to the Milestone Mastercard®: Get access to a credit line, use it responsibly to improve your credit score, and move on to other more appealing cards.

Secured vs. unsecured credit cards

Secured credit cards require you make a cash deposit (as a form of collateral) to the card issuer. You’ll receive this deposit back when you either graduate to an unsecured card or close the secured card. Often, you’ll only receive a credit line equal to your cash deposit. If you’re unable to pay your card, the bank will simply use your cash deposit to pay it.

An unsecured credit card is a credit line given to you with no deposit. The bank trusts you to pay what you owe.

In many cases, people with poor credit use secured credit cards since they are easy to qualify for. But if you can qualify for an unsecured credit card with your current credit score, an unsecured card is typically going to be better than a secured one.

Unsecured cards usually come with better interest rates and perks, like rewards and fraud protection.

Secured credit cards are a good place to start when you can’t get any other kind of card. You typically don’t need them for long, just keep an eye on your credit and apply for unsecured credit cards as soon as you qualify. If you have a low credit score, a secured credit card is a great place to start. No shame in it whatsoever.

Learn more: Secured vs unsecured credit cards

What to look for in unsecured credit cards

Cards that work with low credit scores

If you’re debating between a secured and an unsecured credit card, you’re probably at least teetering on poor credit. You should be looking specifically for an unsecured card that approves applicants with a low credit score.

Cards that report to major credit bureaus

If you have bad credit, you’re going to want a credit card that shouts your good credit habits from the rooftops.

Be sure to find cards that report to the three major credit bureaus (namely, Equifax, Experian, and TransUnion). These are the major players in determining your FICO credit score — the score most often used by lenders to determine if you’re a financially responsible person.

Annual fee

A high annual fee could be a big issue for your budget. Make sure that you are able to comfortably afford a card’s annual fee before applying. Fortunately, there are plenty of unsecured credit cards that don’t charge an annual fee.

If you do end up with an annual fee, keep a close eye on your credit and apply for a no-annual fee card as soon as you are sure you’ll qualify.

APR

The APR of a credit card is an important factor to consider. A lower APR can mean fewer interest charges. But if you are planning to pay off your balance in full every month by the due date then the APR may not be as big of an issue. You won’t be paying any interest in this case anyways.

If you DON’T pay your full statement balance each month, you could find yourself racking up credit card debt in no time. Not only will you be charged interest on your balance, but if you don’t meet the minimum payment, you could find yourself being charged late fees.

Let me be clear: not paying your balance in full is not good, and will cause you to waste money with interest charges. But not meeting your minimum payment each month is devastating to your credit health. If you aren’t confident that you can meet minimum monthly payments, you should absolutely not open a credit card. Miss a payment or two and your credit score will get worse, not better.

Grace period

Mainstream banks all offer a grace period on interest. This means that if you pay your entire purchase balance off in full every month you will not be charged interest. This is a major perk for those who use credit cards but pay their balance off in full each month.

If the card doesn’t offer a grace period, you could get stuck paying more interest charges than you anticipate.

Extra perks

After you consider the features above, other perks like cash back and protections can come into play. Although extra perks shouldn’t necessarily be the deciding factor, it is worth choosing a credit card that has perks that you can actually use.

When choosing an unsecured credit card for bad credit perks shouldn’t be your primary concern. Nice if you can get them but your main goal should be getting a card that will help you improve your credit and then upgrading to a premium credit card when you can.

Should you get an unsecured credit card?

If you’ve got bad credit, unsecured credit cards can help you build or rebuild your credit score. An unsecured credit card is a great choice if you are able to manage your spending responsibly and make on-time payments.

Unsecured credit cards might not be a good idea if you are easily tempted by higher credit limits. If you overspend with an unsecured credit card, it could end up hurting your credit score instead of helping.

You may also want to choose a secured credit card if you tend to make expensive purchases. Secured credit cards will usually give you a credit line as large as your initial deposit. You could give the bank $5,000 in cash to receive a $5,000 credit line. Meanwhile, you might receive a credit line of just $300 from an unsecured credit card.

How to build your credit

To build your credit, you’re going to need to convince a bank to trust you with a credit line. You can only build credit if you’ve got credit. You can do this in a few ways, such as:

- Ride the coattails of someone who already has good credit by becoming an authorized user on their credit card.

- Ask for someone with established credit to cosign for you on a loan of some sort (it doesn’t have to be a credit card).

- Open a credit card that accepts poor (or no) credit history.

The above are the most effective ways to reach a point where you can open any credit card you want. And if you use a credit card responsibly and make on-time payments, a credit card can be a powerful tool to improve your credit score. However, if you miss payments and overspend, you can do serious damage to your credit. Consider your spending habits and temptations before diving into a credit card.

Related: How to build credit the right way

Bad credit vs fair credit

FICO, the most popular arbiter of credit scores, has scores ranging between 300 and 850. According to Equifax, a major credit bureau, fair credit is generally 580 – 699 and anything under 580 is considered bad credit.

How do unsecured credit cards help improve credit scores?

Credit cards are a great way to show potential creditors that you are responsible with credit. Your credit score is broken down into a few main areas.

- Payment history

- Credit utilization

- Length of credit history

- Credit mix

Your payment history is a big deal. Be sure to make at least the minimum payment on time every single month. If you don’t have a balance to pay, that is ok. You don’t need to charge something to your credit card just so you can make an on time payment. The important part here is to make late payments.

Credit utilization is how much of your credit limit is used up. Experts say to keep your balances under 30% of your credit limit. For example, if you have a $1,000 credit limit you’ll want to keep your balance under $300.

This is why having a low credit limit on some of the unsecured cards on this list is something to keep an eye on. If your credit limit is $300 you should only charge up to $100 on the card. This is great for keeping you out of debt, but limits the usability of the credit card.

Length of credit is another important factor to your credit score. This looks at how long have you had your open credit accounts and the longer the better. Because of this, the annual fee is important.

Since many unsecured cards for bad credit don’t have rewards, or at least don’t have the best rewards on the market, paying an annual fee for limited rewards isn’t ideal. If you are going to keep this card for a long time to increase your length of credit history it’s best to get a card that doesn’t have an annual fee.

Finally, credit mix. Credit mix is how many different types of credit do you have on your report. Credit cards are considered “revolving credit” and are one type. The other type is “installment credit”, which are loans that have set end dates, such as your car loan. Here’s more about credit types.

Summary

It is possible to find an unsecured credit card that works for your bad credit history. Take some time to consider your options and then apply for a credit card that will help you rebuild your credit. For the sake of future milestones like an auto loan, mortgage, etc., it’s extremely important to nurture your score back up to a respectable number — ideally above 700.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.