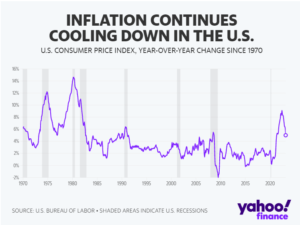

Consumer prices rose at the slowest pace since May 2021 as inflation showed further signs of easing in March, according to the latest data from the Bureau of Labor Statistics released Wednesday morning.

The Consumer Price Index (CPI) revealed headline inflation rose 0.1% over last month and 5.0% over the prior year in March, a slowdown from February’s 0.4% month-over-month increase and 6% annual gain.

Both measures were slightly better than economist forecasts of a 0.2% month-over-month increase and 5.1% annual increase, according to data from Bloomberg.

The 5% jump in inflation marks the slowest annual increase in consumer prices since May 2021 but is still significantly above the Federal Reserve’s 2% target. The Fed has been raising interest rates to try to bring down inflation, but the central bank risks sending the economy into a recession by hiking rates too high too fast.

“If I think about the economic outlook as four potential scenarios: (1) soft-landing, (2) recession, (3) continued overheating, (4) stagflation – the odds of stagflation went down while the odds of soft-landing went up. Good news for stocks,” Neil Dutta, head of economics at Renaissance Macro Research, wrote in reaction to the report on Wednesday.

On a “core” basis, which strips out the more volatile costs of food and gas, prices in March climbed 0.4% over the prior month and 5.6% over last year. Both measures were in-line with economist expectations, according to Bloomberg data.

Core inflation remained especially sticky last month amid surging rents. The index for rent and the index for owners’ equivalent rent both rose 0.5% in March following larger increases in the previous month. Owners’ equivalent rent is the hypothetical rent a homeowner would pay.

The shelter index increased 8.2% over the last year, accounting for over 60% of the total increase in core inflation.

U.S. stocks edged higher following the release of the data. Treasury yields initially moved to the upside, but then fell 7 basis points to around 3.36% at market open.

The energy index decreased 6.4% for the 12 months ending March, while the food index increased 8.5% over the last year. The energy index dropped 3.5% from February to March on a seasonally adjusted basis, led by a 4% drop in the price of fuel oil. Gas prices fell 4.6% from the prior month on a seasonally adjusted basis. They were down 17.4% annually.

Food costs saw some reprieve in March with the food index unchanged while the food at home index fell 0.3%, the BLS noted. Egg prices fell 10.9% in March.

“While headline inflation cooled as energy prices came down, we have to look at the complete picture that core inflation provides,” Gargi Chaudhuri, BlackRock’s Head of iShares Investment Strategy, wrote on Wednesday.

“What this print showed, and what we expect to continue in the next few months, is a pause in the deceleration of goods prices. All components of core goods in CPI excluding used vehicles were higher on the month,” she continued. “We also expect higher overall inflation from goods prices because of the new weighting of the CPI calculation which assigns goods a higher weighting than last year.”

The Fed is closely watching inflation data ahead of its May meeting

Wednesday’s data, a critical element in determining the Fed’s monetary policy, follows the latest jobs report, which showed a slowdown in hiring last month.

According to data from the Bureau of Labor Statistics released Friday, the U.S. economy added 236,000 jobs in March while the unemployment rate fell to 3.5%. Still, the slowdown likely won’t be enough for the Fed to pause its aggressive rate hiking campaign.

Following the release of Wednesday’s inflation data, markets were pricing in a roughly 70% chance the Federal Reserve raises rates by another 0.25% in May, according to data from the CME Group.

“Though inflation has moderated, the March consumer price data keeps a 25bps rate hike by the Fed clearly on the table for May. However, the odds of a pause in June are rising,” Ryan Sweet, chief U.S. economist at Oxford Economics, wrote in a note on Wednesday. “The Fed has made it clear that the decision to hike at the last meeting was a close one, but services inflation remains strong, and the labor market is tight, therefore their work isn’t done.”

Forecasts from the central bank released last month suggested one additional 0.25% rate increase was likely this year. Retail sales data, scheduled for release Friday, will be another economic indicator for the Fed to consider.

Original Article: https://finance.yahoo.com/news/inflation-cpi-march-april-12-2023-172921113.html