This year has been one of the trickiest and most challenging years that I have seen in the markets. With variables like rising interest rates, inflation, geopolitical tensions, and risk of economic slowdown there are so many factors that can shake out and unnerve investors. Nonetheless, market indexes have been very strong.

The best way to stay grounded in markets like this is to utilize a proven process. The Zacks Rank is an extremely effective way to find stocks with a high likelihood of appreciating in price over the near-term, dramatically improving investors’ odds of success.

Marriot International (MAR – Free Report) , MGM Resorts International (MGM – Free Report) , and United Airlines (UAL – Free Report) are all Zacks Rank #1 (Strong Buy) stocks, indicating upward trending earnings revisions, and near-term bullish expectations.

Upgrades across these three stocks may also indicate some interesting developments brewing. Each of these stocks were hit very hard following the Covid pandemic, and still hover around or below their pre-Covid highs. But with airlines, hotels and gaming companies expecting better earnings, we could be seeing the early stages of a full recovery and breakout in the tourism industry.

This would run counter to the narrative of a slowing economy and may suggest a contrarian trade thesis. If so, each of these stocks could be starting a major bull run.

Marriot International

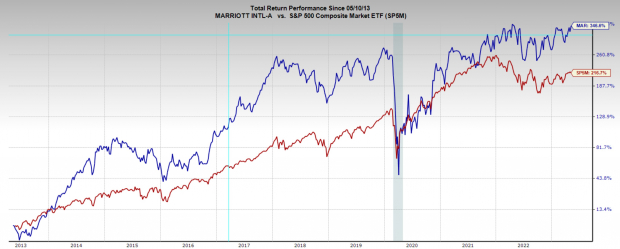

While it has been a bumpy ride, Marriot International has been an extremely strong performing stock over the last 10 years. Compounding at an annual rate of 16% over that time, it has outperformed the broad market by a significant margin.

Image Source: Zacks Investment Research

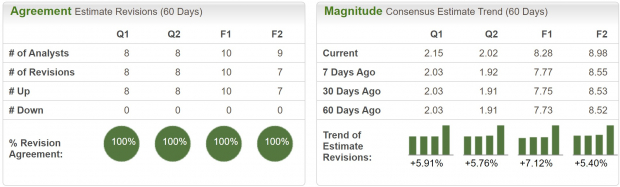

Earnings estimates for Marriot International are extremely bullish. Analysts are in unanimous agreement in upgrading expectations, revising current quarter estimates 6% higher and FY23 estimates 7% higher over the last 60 days. Additionally, during the most recent quarterly report, MAR beat earnings expectations by 12%. In response to the beat, MAR stock rallied 5%.

Image Source: Zacks Investment Research

Current quarter sales are expected to be strong as well. Analysts are projecting 11.5% growth to $5.9 billion for the quarter, and 12% growth to $23.3 billion for FY23. These are very robust growth rates for such a mature company.

MAR is trading at a one-year forward earnings multiple of 21x, which is below the industry average of 22x, and below its 10-year median of 24x. As a leading franchise in the industry, with recognizable brands across the spectrum of customers, MAR is well positioned for near and long-term stock appreciation. Earnings upgrades, and historically lows valuations make for a very bullish setup.

Image Source: Zacks Investment Research

MGM Resorts International

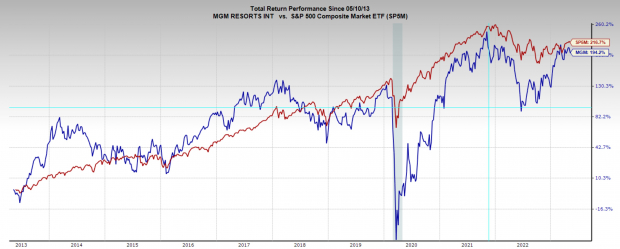

MGM Resorts International is an internationally recognized hotel and casino brand that has performed well over the last decade. MGM stock has underperformed the broad market over that period; however, it was able to make an epic comeback from its Covid pandemic lows.

Image Source: Zacks Investment Research

MGM has several very promising business developments in the pipeline that should contribute to the top and bottom line over the very long term. Online sports betting and iGaming are a secular economic mega trend that MGM should benefit massively from. With extensive experience in traditional brick and mortar gaming operations, the transition to digital should be seamless. Since its launch in 2018 this segment has done extremely well and is now operating in 24 markets boasting a growing market share.

Another major development is the acquisition of Empire City Casino in New York. Growing a footprint in a market as significant as New York will provide a new long-term source of revenue for the gaming giant.

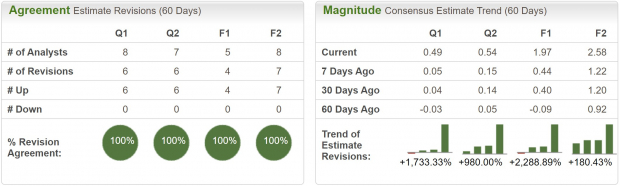

Analysts have revised earnings estimates significantly higher for MGM. After dealing with several quarters of negative earnings last year, profits have now flipped back to positive territory. This positive earnings metric was only priced in over the last two months, so estimates are now much higher.

Image Source: Zacks Investment Research

After overcoming the challenges posed by the lockdowns in the US and more recently China, MGM has proven competent management and strong staying power. MGM is currently trading at a one-year forward earnings multiple of 22x, which is above the market average of 19x, and well below its 10-year median of 33x. This historically low valuation along with the multiple bullish catalysts listed makes MGM a strong candidate for investors portfolios.

Image Source: Zacks Investment Research

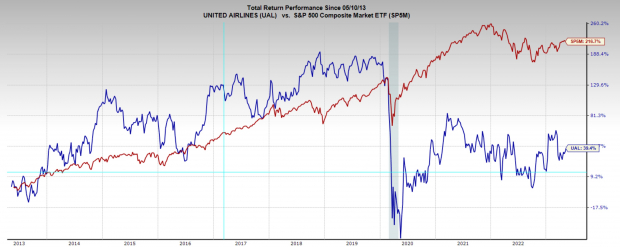

United Airlines

United Airlines stock has struggled over the past decade. The underperformance is marked by a painful drop in 2020, which the stock has yet to recover from. However, improving earnings expectations, and a resumption of international and domestic travel may be exactly what UAL needs to start trending higher again.

Image Source: Zacks Investment Research

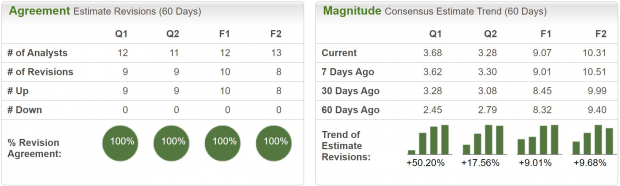

Analysts have unanimously upgraded earnings expectations for UAL. Current quarter earnings estimates have been revised higher by 50% over the past two months, and all other timeframes are expecting improved results as well. Current quarter sales are expected to grow 15% YoY to $13.9 billion and FY23 sales are expected to climb 18% YoY to $53 billion.

Image Source: Zacks Investment Research

UAL is trading at a one-year forward earnings multiple of 5x, which is below the industry average of 10x, and below its 10-year median of 9x. This is a historically cheap valuation for the airline and offers an opportunity to own an industry leading stock, that has several bullish catalysts on the horizon.

Image Source: Zacks Investment Research

Bottom Line

Market and industry dynamics have shifted at breakneck speed over the past three years. Tourism and travel were some of the sectors that took the worst of the economic pain. But these industries are clearly seeing a turn for the better. Having survived one of the worst possible scenarios these stocks should be better positioned than ever.

Zacks Reveals ChatGPT “Sleeper” Stock

One little-known company is at the heart of an especially brilliant Artificial Intelligence sector. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

As a service to readers, Zacks is providing a bonus report that names and explains this explosive growth stock and 4 other “must buys.” Plus more.

Original Link: https://www.zacks.com/commentary/2091752/3-top-ranked-stocks-investors-can-buy-now?art_rec=home-home-top_stories-ID02-txt-2091752