Image: Bigstock

Warren Buffett, also commonly called the Oracle of Omaha, is a name that jumps to the forefront of many minds when thinking of the financial world.

As we’re all aware, many mimic his portfolio moves.

And just over the weekend, Berkshire Hathaway hosted its annual shareholder meeting, putting the Oracle of Omaha and his go-to man, Charlie Munger, in full focus.

With the legendary investing icon making headlines following the meeting, let’s take a look at three companies that Buffett has placed big bets on.

Apple ((AAPL – Free Report) )

Apple is a long-time favorite of Buffett, reflecting the largest holding of Berkshire. Over the weekend, the icon spoke positively about the iPhone’s rock-solid status among consumers, a big reason why he believes in the company.

Apple’s quarterly results took the spotlight last week, with the tech titan delivering a positive 5.6% EPS surprise and reporting revenue nearly 2% above expectations. The company also announced a 4% increase to its quarterly cash dividend, payable on May 18th.

Image Source: Zacks Investment Research

In addition, the company posted solid iPhone results; iPhone revenue throughout the reported quarter totaled $51.3 billion, 4% above the Zacks Consensus Estimate and improving 1.5% from the year-ago period.

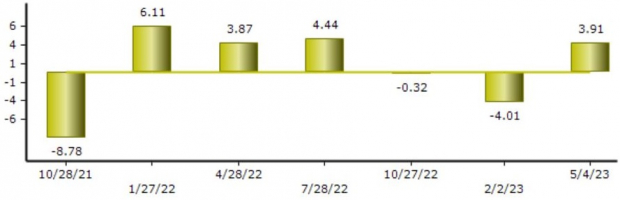

As we can see from the chart below, the better-than-expected iPhone results snapped a streak of back-to-back negative surprises.

Suprise (%) – iPhone Revenue

Image Source: Zacks Investment Research

Bank of America ((BAC – Free Report) )

Despite the recent turmoil within banking, Buffett still remains optimistic about BAC. The legendary investor is well-known for his purchase of BAC shares back in 2011.

Similar to AAPL, Bank of America posted results that came in nicely above expectations in its latest release, exceeding the Zacks Consensus EPS Estimate by nearly 20% and delivering a positive 4.7% revenue surprise.

The market didn’t have a great reaction to the results post-earnings, as we can see by the green arrow in the chart below.

Image Source: Zacks Investment Research

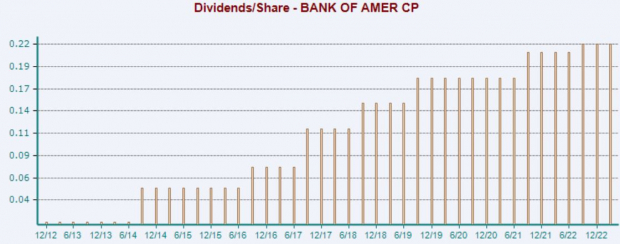

Still, the company has consistently shown a shareholder-friendly nature, carrying a solid 10.8% five-year annualized dividend growth rate. Currently, BAC shares yield 3.2% annually, well above the Zacks Finance sector average.

Image Source: Zacks Investment Research

Occidental Petroleum ((OXY – Free Report) )

Buffett’s been in the headlines many times over the last year regarding his OXY purchases. At the annual shareholder meeting, the Oracle of Omaha said that there were no plans to fully acquire the company despite the rapid buying of shares.

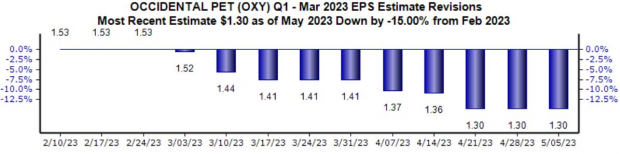

Keep an eye out for OXY’s upcoming quarterly release expected on May 9th after the market’s close; the Zacks Consensus EPS Estimate of $1.30 reflects a pullback of roughly 40% from the year-ago period.

Analysts haven’t been bullish for the quarter to be reported, with the quarterly EPS estimate being revised 15% lower since February of this year.

Image Source: Zacks Investment Research

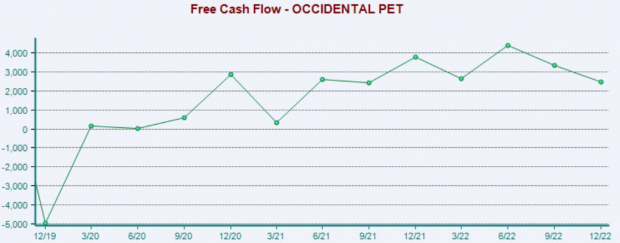

A favorable operating environment has allowed OXY to generate substantial cash over the last year, helping it increase its dividend payout by nearly 40% during the period. The company generated $2.4 billion of free cash flow in its latest quarter, down year-over-year but well above pre-pandemic levels.

Image Source: Zacks Investment Research

Bottom Line

With the Oracle of Omaha making headlines over the weekend following the annual Berkshire Hathaway shareholder meeting, revisiting some of his favorite holdings is beneficial.

And all three stocks above – Apple (AAPL – Free Report) , Bank of America (BAC – Free Report) , and Occidental Petroleum (OXY – Free Report) – are all examples of companies that the legendary investor has placed sizable bets on.

Zacks Reveals ChatGPT “Sleeper” Stock

One little-known company is at the heart of an especially brilliant Artificial Intelligence sector. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

As a service to readers, Zacks is providing a bonus report that names and explains this explosive growth stock and 4 other “must buys.” Plus more.