The grumbling comes around each year at this time as Americans have to settle up with Uncle Sam. I always got a kick out of those who relish the time because they say they get money back.

Well, actually, they don’t.

By utilizing deductions they have backed into a planned savings account, albeit with no interest, they are just getting back their own money which they overpaid the government in the course of the year. In past years or decades, for that matter, it didn’t really matter because your bank was giving you zero interest anyway. Times have changed, and online banks can yield around 5% annually on savings now. Do the math and see if it makes sense to change those deductions.

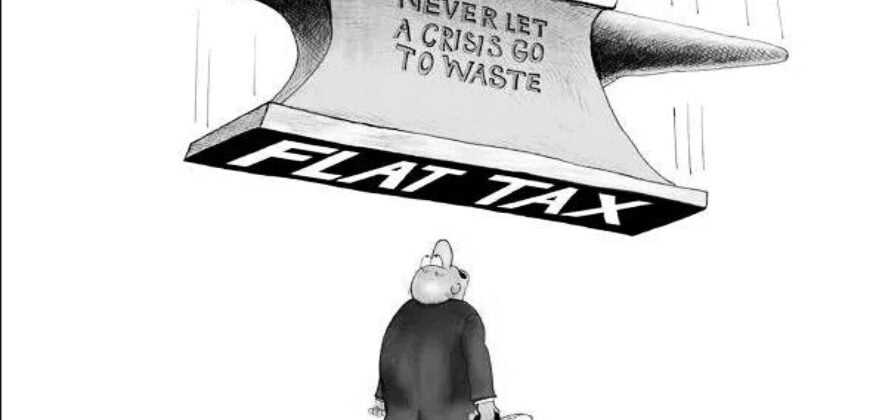

Speaking of deductions, itemizations, and other things that only fill your mind at this time of year, isn’t it time to look at the flat tax again? For no other reason than with one stroke of the pen we could save $80 billion on IRS agents that will hunt you down for illegally declaring that Brazilian steak house business meal when you should have ordered a vegan entrée that was more carbon neutral.

Yes, they are armed with the very guns they want to take away from you. But I digress.

The only guarantees in life are death and taxes. But one of those two is infinitely more complex than the other. In the U.S., like most of the world’s major economies, there is a gradual tax system that charges different rates for various income levels.

In most cases, those who make the most money pay a higher percentage in taxes compared to lower-income brackets. The idea of a flat rate tax system is not new but has ebbed and flowed as a topic for a generation, most notably with Steve Forbes, who ran a presidential campaign on the issue.

A flat tax is a system where everyone pays the same tax rate, regardless of their income. There are case studies for a flat tax. The lion’s share of economies utilizing a flat tax are those of former Soviet Union countries. And many of these countries that instituted a flat tax saw their economies grow dramatically.

The reason why the flat tax works, according to proponents, is that the system is incredibly simple. In many cases, not just individuals enjoy the benefits of an easy-to-understand tax code. Some nations grant flat taxes to businesses as an incentive to lure corporations and other employers.

A flat tax is unlikely to get anywhere in today’s politically charged America. With DEI policy shoved into every crevice possible, the thought of actually making things equal and fair seems off the table. Or is it? While a flat tax on income in the U.S. is unlikely anytime soon, some Republicans in Congress are taking a different approach.

Here are the key points in a nutshell:

- A group of House Republicans is supporting the Fair Tax Act, which would eliminate income, payroll, estate, and gift taxes to be replaced with a 23% national sales tax.

- The plan would also decentralize the IRS by slashing funding by the fiscal year 2027, relying on states to administer the levy.

- Policy experts say the plan would make the tax system more regressive, meaning the burden decreases as income increases.

H.R.25 – Fair Tax Act of 2023 was introduced in January and has yet to be brought up for a vote in the House. As mentioned, the proposal would eliminate the federal income tax, payroll, estate, and gift taxes and be replaced them with a 23% national sales tax.

The legislation would take a sledgehammer to the IRS, reducing it to essentially nothing and allowing the states to administer the new levy. House Speaker Kevin McCarthy has promised to bring it before the chamber for a vote, although he has not specified when or under what conditions.

One would think, and rightly so, that this, too, has no likelihood of becoming law. Interestingly, such legislation would even be introduced into this woke economic and political environment. In addition, no major economy relies exclusively on sales taxes for revenue.

While a handful of small or petroleum-fueled economies have no income tax, the main exceptions to this rule are sub-jurisdictions like American states or cities. Of course, the first thing you hear from policymakers is that this is a regressive tax. According to John Buhl, senior communications manager at the Tax Policy Center, “The plan would make the tax system more regressive, despite the built-in monthly rebates for families below a certain income level, especially since the 23% rate is “tax-inclusive” and will actually cost consumers about 30%.”

The average price for a loaf of bread is approximately $1.87. Under the new law proposed by House Republicans, that price would go up to more than $2.50. There you have it. Virtually all tax experts to study the issue agree that it would complicate the tax code and act as a massive tax cut for the wealthy. I guess we will always be stuck with death and taxes.