By combining the Zacks Rank with technical analysis, investors can improve their odds of trading a winning stock. In this article I will discuss two top-ranked stocks that boast impressive earnings estimate revisions, as well as highly asymmetric technical trade setups.

Wingstop (WING – Free Report) and M.D.C. (MDC – Free Report) both have multiple bullish catalysts and make for worthwhile consideration as investments.

Wingstop

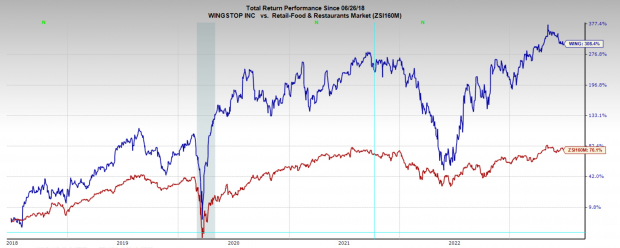

Wingstop is chicken wing franchise restaurant chain that has been growing at an incredible pace. Sales since its IPO have been growing nearly 20% annually, and the stock has compounded at an annual rate of 32.5% over the last five years.

Image Source: Zacks Investment Research

However, incredible growth rates like that bring with it premium valuations. Wingstop is trading at a one-year forward earnings multiple of 88x, which is well above the industry average of 26.4x, although just below its five-year median of 100x.

Image Source: Zacks Investment Research

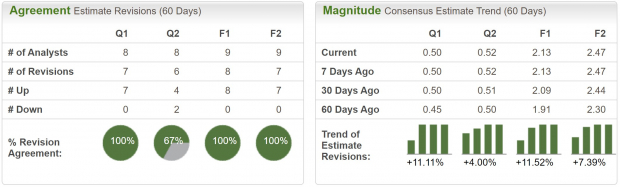

Earnings estimates continue to be revised higher nonetheless, and the stock is benefiting from strong momentum pushing it higher. WING currently has a Zacks Rank #1 (Strong Buy), indicating upward trending earnings revisions.

Current quarter earnings estimates have been increased by 11% over the last two months and are projected to climb 11% YoY. FY23 earnings have been revised higher by 11.5% and are expected to grow 15% YoY. Sales are also expected to maintain their impressive growth rate. Current quarter sales are forecast to grow 24% YoY, and FY23 sales are expected to grow 19.5% YoY.

Image Source: Zacks Investment Research

WING stock made an impressive run from $80 in June 2022 all the way to $220 less than a year later in May of this year. The price has now had almost two months to take a rest and reset for another potential move higher. WING stock has been sold now for the last seven consecutive weeks, but has clearly found support at the prior all-time high and now built out a convincing bull flag.

If the price can break out above the $192 level, it should initiate another bull run that makes an attempt at new all-time highs. Alternatively, if the stock can’t hold the level of support at $185, the setup is invalid, and investors can remain cautious.

Image Source: TradingView

M.D.C.

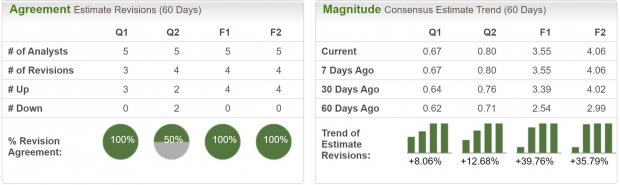

MDC is a US based new home builder that acquires and develops land, constructs homes, markets, sells, and manages customer service. Not only is MDC a Zacks Rank #1 (Strong Buy) stock but it also earns an “A” grade across the Zacks Style Scores.

Additionally, it sits in the top 7% of the Industry Rank, and the #1 position in the Sector Rank. MDC also pays a 4.5% dividend yield, which has increased by 19.5% annually over the last five years.

Image Source: Zacks Investment Research

Current quarter earnings have been revised higher by 8%, while FY23 earnings have been upgraded by nearly 40% and FY24 by 36% over the last two months.

Image Source: Zacks Investment Research

MDC has been building out a convincing technical setup over the last two weeks. If MDC stock can breakout above the $45 level, it should continue its strong run higher. However, if the price can’t hold above $43.75, the setup is invalid, and investors can wait for another setup to form.

Bottom Line

Both Wingstop and M.D.C. make for exciting investment opportunities. They have clearly built out strong business models and are gaining from the strong momentum pulling up many segments of the broad market. When trading from chart patterns like these it is critical for investors to respect their trading plan and know exactly how much money they may lose on any given trade. Picking stocks, and marking up charts is important, but risk management is absolutely key for long-term success.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Original Article: https://www.zacks.com/commentary/2113230/2-stocks-with-compelling-technical-setups-and-top-ranks?art_rec=home-home-investment_ideas_stocks-ID01-txt-2113230