It is hard to go wrong buying stock in high quality businesses that have consistently grown sales and earnings year after year. Even better if you can buy them when they have improving earnings estimates and high Zacks Ranks, as this further improves the near-term odds of the stock trading higher.

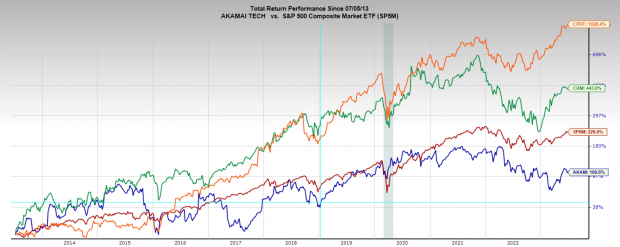

By scanning the Zacks Rank, I have identified three top-ranked stocks with exactly these characteristics. Copart (CPRT – Free Report) , Akami Technologies (AKAM – Free Report) , and Salesforce (CRM – Free Report) all have numerous bullish catalysts acting in their favor.

Image Source: Zacks Investment Research

Copart

Copart is a global online vehicle auction and remarketing platform founded in 1982. It facilitates the buying and selling of vehicles through its digital marketplace, serving individuals, dealerships, and insurance companies. With operations at over 200 locations in 11 countries, Copart has more than 250,000 vehicles available online every day.

The company focuses on advanced technologies and data analytics to enhance the auction experience. Copart’s efficient processes and extensive network have established its position as a leading player in the automotive industry with an estimated 40% market share in the auction market.

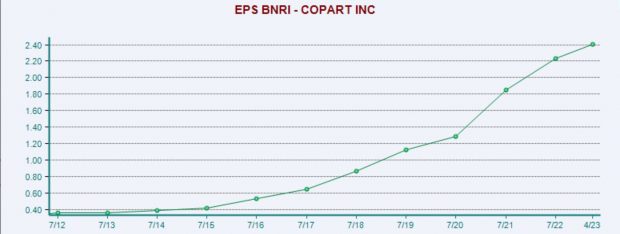

CPRT stock has been an exceptional performer over the last 10 years compounding at an annual rate of 27.4% and returning 1,026% over that time. Also, over that period annual sales have steadily increased from $1.1 billion to $3.7 billion, and EPS have grown from $0.39 to $2.41 per share.

Image Source: Zacks Investment Research

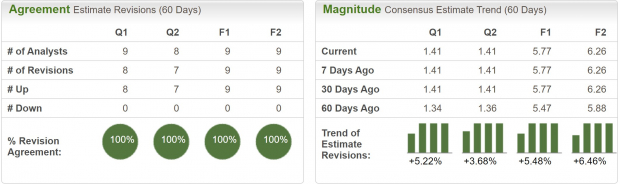

Copart enjoys a Zacks Rank #1 (Strong Buy), indicating upward trending earnings revisions. Analysts have unanimously upgraded earnings expectations across timeframes, with current quarter earnings estimates revised 3.5% higher and FY23 earnings estimates revised nearly 4% higher. Additionally, current quarter earnings are projected to grow 5.3% YoY and FY23 earnings are expected to climb 9% YoY.

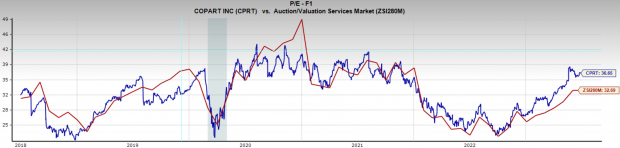

Image Source: Zacks Investment Research

CPRT is trading at a one-year forward earnings multiple 36.7x, which is above the industry average of 32.7x and above its five-year median of 32x. However, as the leading auction platform in the industry, it is understandable that Copart earns a premium valuation.

Image Source: Zacks Investment Research

Akami Technologies

Akamai Technologies is a global content delivery network (CDN) and cloud services provider founded in 1998. The company offers solutions to accelerate and secure the delivery of online content, applications, and media. With a robust network infrastructure and advanced CDN technology, Akamai serves clients across various industries, optimizing website performance and providing cloud security against cybersecurity threats. Akamai remains a leading player in the digital content space, continuously adapting to meet evolving industry demands.

AKAM has experienced strong upgrades in its earnings estimates, demonstrated by its Zacks Rank #1 (Strong Buy). Current quarter earnings estimates have been revised higher by 5.2% and are projected to grow 4.5% YoY. FY23 earnings have increased by 5.5% over the last two months and are forecast to climb 7.5% YoY.

Image Source: Zacks Investment Research

Akami Technologies is trading at a one-year forward earnings multiple of 19.8x, which is below the industry average of 23.9x, and below its 10-year median of 26.3x. With a valuation below its historic average and continued earnings growth, AKAM looks quite appealing.

Image Source: Zacks Investment Research

Salesforce

Salesforce is a cloud-based customer relationship management (CRM – Free Report) platform that offers a suite of tools and services to manage sales, marketing, customer service, and analytics. Founded in 1999, Salesforce has become a global leader in CRM solutions, providing businesses with a centralized hub for storing and managing customer data.

The platform offers customization options and integrations to meet specific business needs. With its user-friendly interface and scalability, Salesforce enables organizations to strengthen customer relationships and drive growth through efficient CRM management.

After a major restructuring earlier this year which involved laying off some 12,000 employees to increase profits, CRM has been one of the leading stocks in the market. The stock is up an impressive 59% YTD.

Momentum seems to have taken ahold of Salesforce stock as the chart looks like it is ready for its next leg higher. The technical pattern below indicates that if CRM can clear the $214 level, it may very well initiate another bull run to new YTD highs. But, if the stock can’t hold above the $205 level, the pattern is invalid, and investors can wait for another trade setup.

Image Source: TradingView

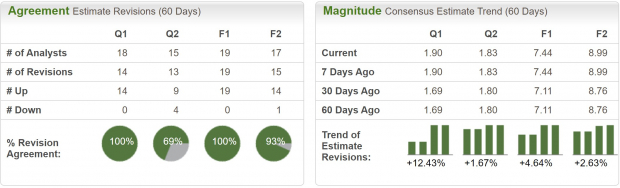

Further improving the odds that CRM rallies again are its upward trending earnings revisions. Salesforce currently boasts a Zacks Rank #1 (Strong Buy). Current quarter earnings estimates have been revised higher by 12.4% and are expected to climb a whopping 60% YoY. FY23 earnings estimates have been upgraded by 4.6% and are projected to increase 42% YoY.

Sales for the software giant are expected to grow ~10% YoY across timeframes, so clearly the restructuring has been successful in boosting the bottom line.

Image Source: Zacks Investment Research

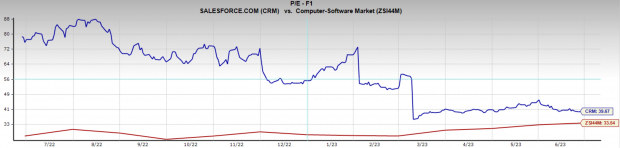

Salesforce has managed to engineer something rather unique. Despite considerable stock appreciation over the last year, its earnings multiple has more than halved thanks to the massive increase in profits. CRM is trading at a one-year forward multiple of 39.7x, which is above the industry average of 33.5x, and below its five-year median of 122x.

Image Source: Zacks Investment Research

Bottom Line

Investors using Zacks proprietary research don’t need to look far to find high quality investment ideas. While timing the market is an incredibly difficult activity, investors’ odds of success can be greatly increased by trading only stocks on the Zacks Rank #1 list, which regularly outperform the market.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Original Article: https://www.zacks.com/commentary/2114404/3-top-ranked-stocks-investors-can-buy-today?art_rec=home-home-top_stories-ID02-txt-2114404