For many, U.S. Treasury bond funds are safe investments. Thanks to the U.S. government’s backing of the underlying bonds, these funds can cushion a portfolio against market turmoil.

Now these funds come with an added benefit: higher yields without the kind of credit risk that could become a problem during a recession when bond issuers have a hard time paying back the money they have borrowed. That’s especially the case for short-term bond funds, where yields are well above those on intermediate- and longer-term funds.

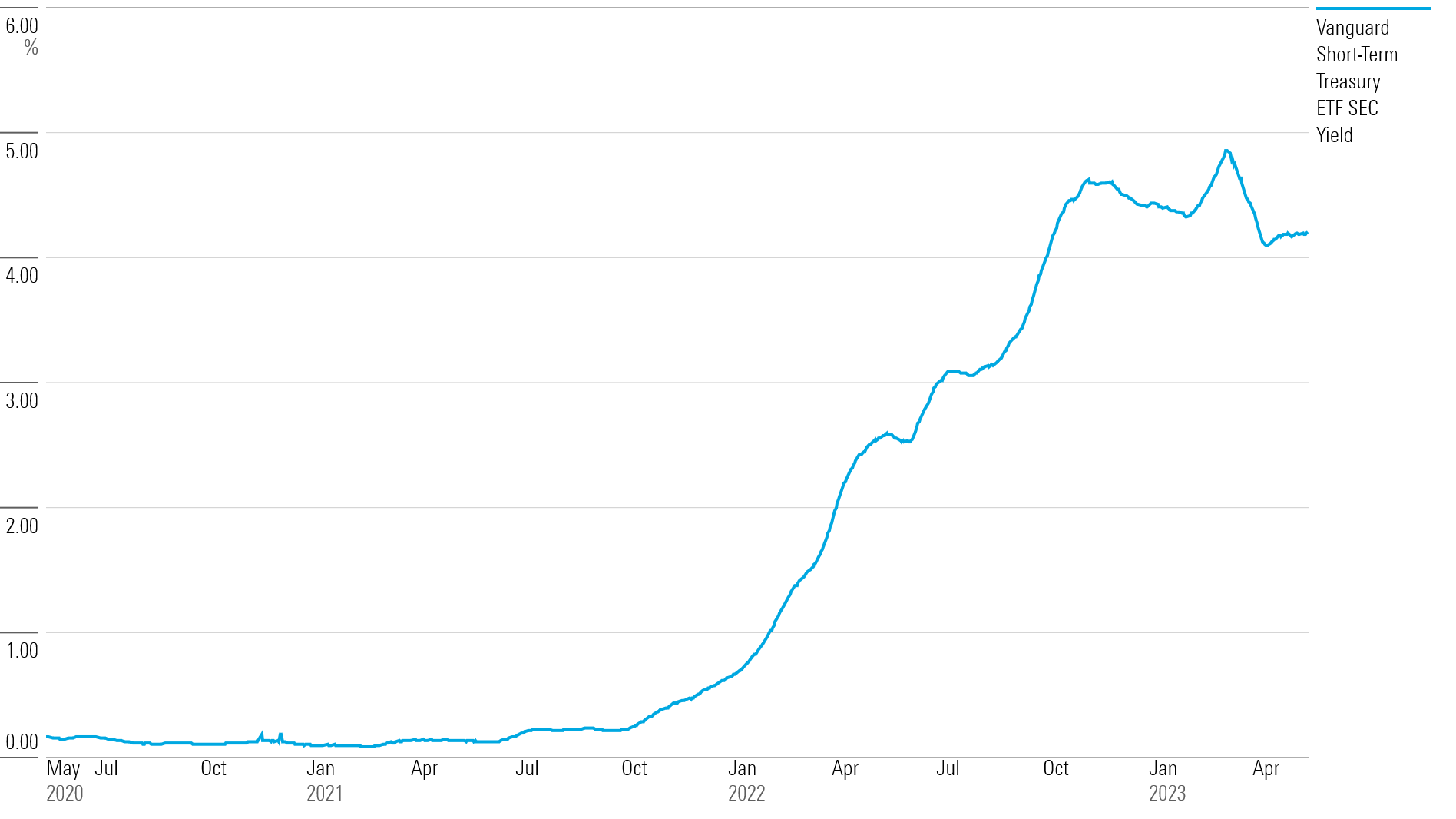

The average yield on the short-term government bond funds that Morningstar tracks is 3.8%—up from 1.8% one year ago. And many funds in the group, which have top ratings from Morningstar, are paying even higher yields. For example, the yield on the $22.5 billion Vanguard Short-Term Treasury ETF VGSH is 4.20%, up from 2.58% one year ago and 0.12% two years ago.

“You don’t have to take on a lot of risk to get yield,” explains Morningstar associate analyst Zachary Evens.

Investors have the Federal Reserve’s aggressive interest-rate increases to thank for the higher yields on short-term government bond funds. The Fed has raised the federal-funds rate target to 5%-5.25% from effectively zero at the start of 2022. Of course, as bond investors know, this inflicted losses on fixed-income funds last year, including those that invest in short-term Treasury bonds. Vanguard posted a loss of 3.9% in 2022.

While Treasury bonds aren’t immune to losses, they have limited credit exposure, unlike investment corporate bonds, high-yield bonds, or bonds backed by other kinds of assets. “Even the safest corporate bonds have credit risk,” says Evens.

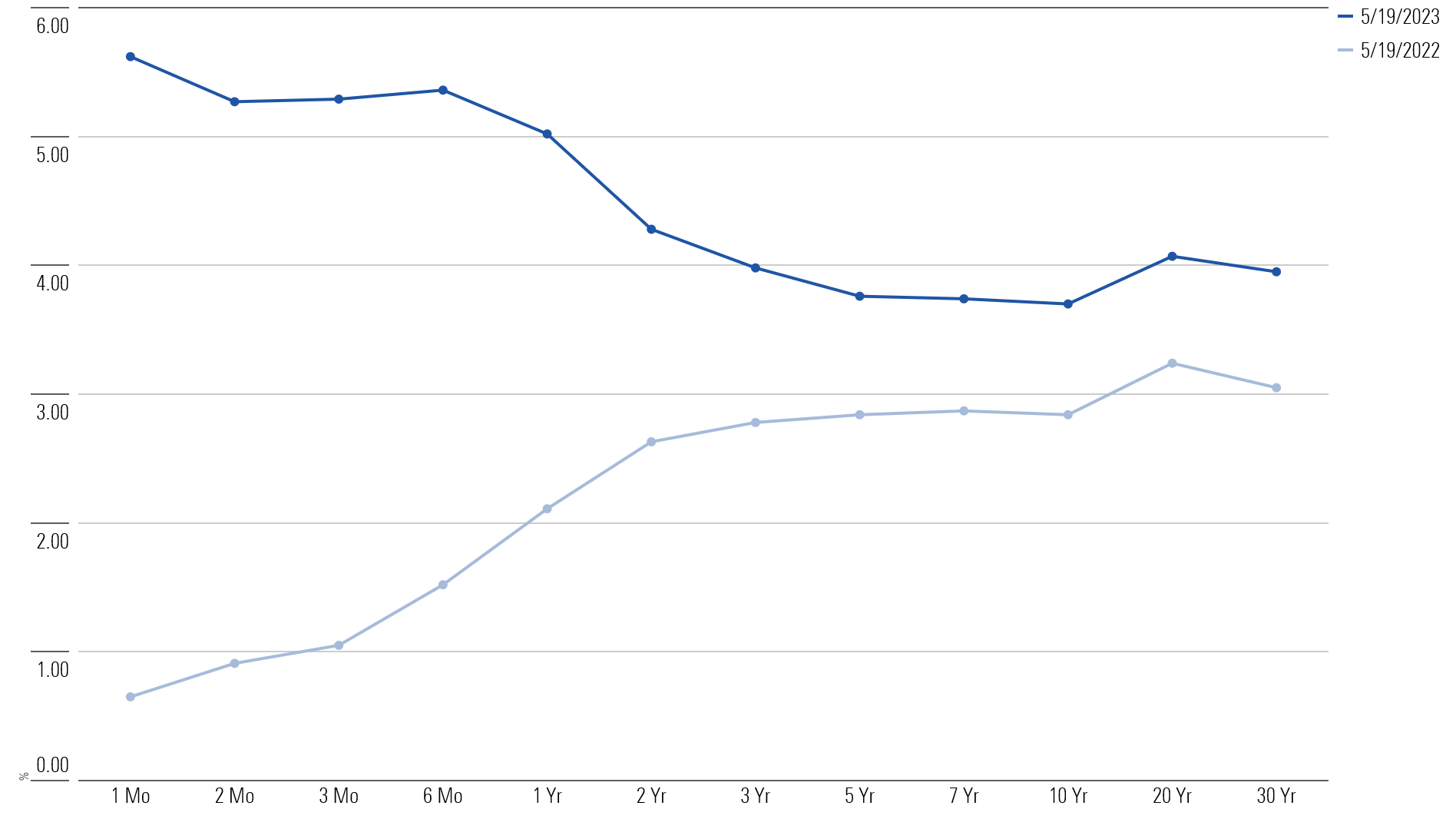

Another dynamic working in favor of short-term bond funds is that short-term exchange-traded funds currently offer higher yields than intermediate-term ETFs. This is thanks to what is known on Wall Street as an inverted yield curve, where longer-term interest rates are lower than short-term rates—a reversal of the usual pattern.

U.S. Treasury Yield Curve

One potential near-term wrinkle is the deadlock in Washington over the U.S. government debt ceiling. Should Congress not approve an increase in the debt limit before the Treasury runs out of money, there is the unlikely scenario that there could be a default where some holders of Treasury debt aren’t paid. Most analysts expect Congress and the White House to reach a deal before that happens. This also isn’t a pressing issue for most funds because they sample a large basket of Treasuries that all have different maturities, according to Evens.

For investors buying short-term bond funds, it’s important to understand that because the funds hold bonds that mature in just a few months, those yields could also come down quickly should the Fed start to cut interest rates, as is currently expected in the market. That would mean the funds would have to buy new bonds at lower yields.

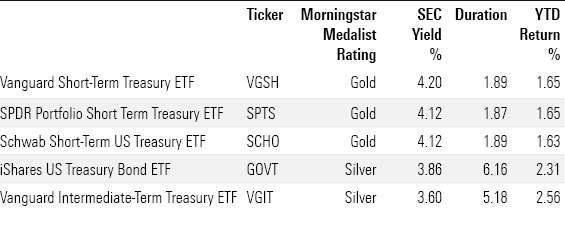

One of the key measures for comparing fund yields is the SEC yield, an annualized measure of what a fund has paid to investors over the past 30 days. That figure doesn’t reflect the yield investors would receive going forward.

Evens explains how another important consideration for investors is that since Treasury funds all have similar credit quality, the main difference between them is their duration—a measure of how sensitive an investment is to changes in interest rates. As interest rates rose in 2022, funds with longer durations suffered the most, but when interest rates start to fall, longer-duration assets become more attractive because they pay higher interest rates than what is being offered.

Treasury ETFs With High Yields

Among short-term funds, which invest in bonds that mature in one to three years, Gold-rated Vanguard Short-Term Treasury ETF offers the highest yield at 4.20% as of May 19. SPDR Portfolio Short Term Treasury ETF SPTS and Schwab Short-Term US Treasury ETF SCHO offer similar yields.