Growth stocks have enjoyed a rebound following their dismal results in 2022. But you wouldn’t know it looking at the returns of Horizon Kinetics’ four growth funds—Kinetics Market Opportunities KMKAX, Kinetics Paradigm KNPAX, Kinetics Small Cap Opportunities KSOAX, and Kinetics Spin-Off and Corporate Restructuring LSHAX—which have slid 20% to 30% so far in 2023.

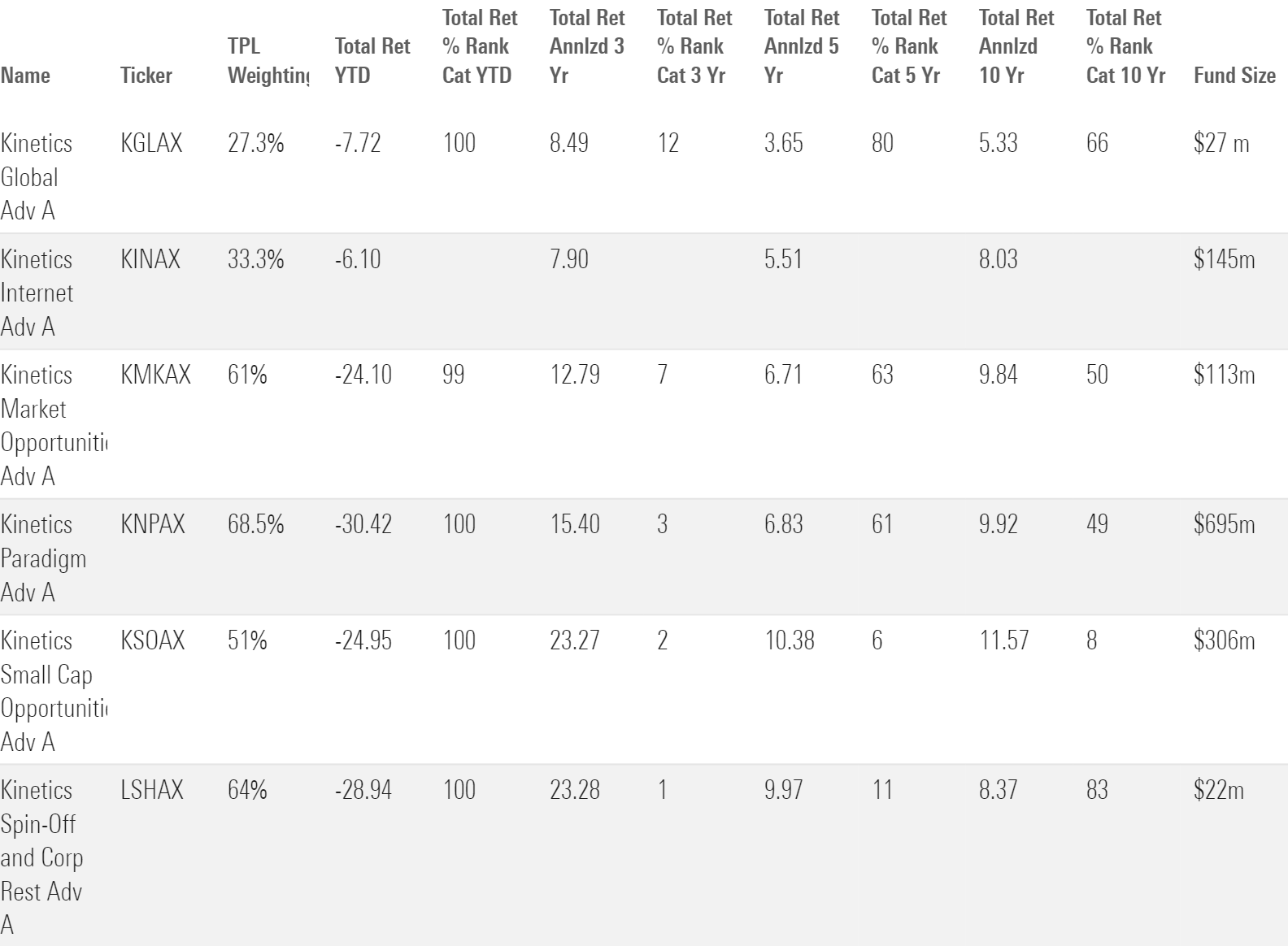

You don’t need to crunch numbers to find the source of the funds’ recent stumbles. Simply look at top holding Texas Pacific Land TPL, which takes up more than half of each portfolio’s assets and drives performance at each fund. At year-end 2022, the stock accounted for 68% of Kinetics Paradigm’s net assets under management, 64% of Kinetics Spin-Off and Corporate Restructuring, 61% of Kinetics Market Opportunities, and 51% of Kinetics Small Cap Opportunities. Other of the firm’s funds also owned big stakes, including Kinetics Internet KINAX (33%) and Kinetics Global KGLAX (27%). Horizon Kinetics Inflation Beneficiaries INFL invested 4%. Those figures have probably declined as the stock is down about 40% in 2023.

It’s not unheard of for a fund to take a big position in a stock. Horizon Kinetics’ sky-high conviction in Texas Pacific Land and the degree to which the firm is intertwined with it, however, sets it apart.

Horizon Kinetics holds around $2 billion in Texas Pacific Land stock, which amounts to one fifth of its shares and a large chunk of the firm’s $7 billion in assets under management. Horizon Kinetics’ CEO, CIO, and fund manager Murray Stahl personally owns shares worth nearly $500 million and sits on the board of Texas Pacific Land. Public filings show Stahl had been buying a small amount of Texas Pacific Land shares nearly every day for years through mid-February 2023.

Kinetics Funds’ Weights in Texas Pacific Land and Their Returns

This seems to add up to quite a challenge. First, there are very big conflicts of interest when a firm so heavily invested in a stock is led by a director who also has a huge amount riding on the stock. Second, the funds’ combined stake is massively larger than the market could easily absorb in a week or even a month. So, what’s the exit strategy?

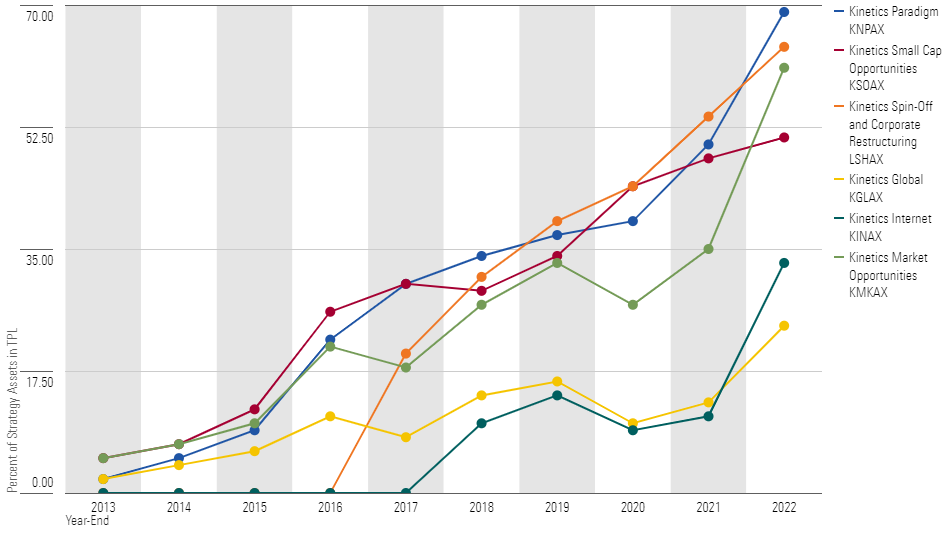

In 2019, Stahl pushed Texas Pacific Land to reincorporate in Delaware, and he became a board member and Texas Pacific Land evangelist as a result. The Kinetics funds had been buyers of the stock, and the stock surged, bringing exposure up to the extreme levels seen today.

Kinetics Funds’ Weights in Texas Pacific Land Over Time

This raises a lot of questions. First, how can a manager with so much riding on one stock make independent, unbiased decisions about it, or buy and sell shares without violating insider trading strictures? Second, because the funds own so much of the thinly traded Texas Pacific Land, how can they get out of the stock?

In 2009, I looked at funds that painted themselves in a corner with big private holdings. This company is publicly traded, but the daily trading volume is not huge, so some of these issues still apply.

Now for the latest turn. Late in 2022, Texas Pacific Land asked its shareholders to approve a sixfold increase of its authorized shares of common stock. Stahl voted against the proposal. Now, Texas Pacific Land is suing Stahl, asserting he is bound by the prior peace treaty to back the board’s recommendations. Redemptions at the funds have led them to trim their stake by about 9% this year, but the stock is still a giant position for Horizon Kinetics, which says it still believes in the stock despite the courtroom brawl.

Usually, fund companies will set up limits around trading when they have a board seat. Back in the 1990s, the Mutual Series funds had a board seat on Sunbeam Electric, and Mutual Series barred the funds from trading during blackout periods when the corporate board might have nonpublic information. We asked Horizon Kinetics if it was doing something similar. and the answer was no, the funds are free to trade. The firm claims to have a Chinese wall between Stahl and the fund managers to prevent any nonpublic information from reaching the fund managers. But Stahl himself is a manager on most of the funds, so it’s hard to see how that would work.

At most firms, compliance would have prevented this with limits on stocks that Stahl could own and prohibitions on trading in a company where the firm has a board seat. In addition, risk management would put caps on the total amount a fund could have in a stock and the total amount that could be owned firmwide.

Beyond those conflicts of interest, there is also the matter of outflows. With less liquid holdings, funds can get stuck in a doom loop in which a stock goes down causing the fund to lose money, which in turn spurs redemptions. Those redemptions then spur the fund to sell the stock, leading the cycle to repeat itself. Or it could lead them to sell more-liquid holdings and make the Texas Pacific Land bet even larger. The firm had $104 million in net outflows in the first four months of the year. That’s a manageable sum, but it could become a problem if losses increase.

We asked about an exit strategy, and Horizon Kinetics suggested some best-case scenarios such as an oil major purchasing Texas Pacific Land or Texas Pacific Land growing up to be a large cap so that its shares would be easy to sell. For sure, those results would be huge wins for Kinetics fundholders. But if that doesn’t happen, it could be ugly.

Original Article: https://www.morningstar.com/funds/fund-shop-bets-ranch-one-stock