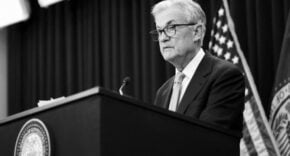

Fed Chairman Jerome Powell and central bankers around the world aren’t done fighting inflation yet.

Market euphoria in early June, spurred on by a pause in interest rate hikes by the Federal Reserve, is well behind us now. Central Bank leaders in the US and across the globe delivered a clear message to markets this week: We’re not done hiking.

Wall Street didn’t take the message well. US stocks are on track to notch a losing week and the Nasdaq is on pace to end an eight-week winning streak.

What’s happening: It’s been just over a week since the Federal Reserve paused its 14-month regimen of interest rate hikes to fight inflation. Now, it appears that pause will be very short lived.

Fed Chair Jerome Powell testified before the House and Senate this week that the central bank is far from reaching its 2% inflation target and expects to hike rates further.

“The strong majority of the committee believes that it will be appropriate to raise the federal funds rate again once or twice by the end of the year,” Powell told the Senate Banking Committee on Thursday. He made similar comments on Wednesday to the House Financial Services Committee.

The Bank of England, meanwhile, surprised investors by raising interest rates in the UK by an outsized half of a percentage point. Analysts had expected a smaller move.

In a statement, Bank of England policymakers said that economic data showed that inflation was proving persistent as the labor market remained tight and consumer demand strong.

Central banks had been making smaller interest rate moves as inflation began to ease off of recent highs. However, that no longer seems to be the case.

Elsewhere in Europe, central banks in Norway and Switzerland also hiked rates to decade-high levels on Thursday.

Officials in Norway said rates will “most likely be raised further in August.” Switzerland also indicated that more tightening is coming.

Why it matters: In the United States, markets have been enjoying a bull run — largely fueled by a boom in tech stocks, which are particularly sensitive to inflation and interest rates. News of a return to hawkish monetary policy could put an end to all of that.

Stocks rebounded slightly on Thursday, but “investors seem to be slow to come to grips” with the likelihood that rates will be higher for longer, said Scott Wren, senior global market strategist at Wells Fargo.

“Rising rates weigh on both economic growth — the Fed wants and needs to see slower growth in demand — and financial markets,” wrote analysts at financial firm Commonwealth. “This potential headwind will be something to watch closely for the rest of the year.”

3M settles for $10.3 billion in ‘forever chemicals’ drinking water lawsuits

3M (MMM) announced Thursday that it had reached an agreement to settle lawsuits that claimed that toxic “forever chemicals” had contaminated water supplies in the United States, reports my colleague Samantha Delouya.

The company — which produces Post-It notes, Scotch Tape, and n95 masks, among other industrial products — said it would pay up to $10.3 billion over 13 years to fund public water suppliers that have detected these chemicals in drinking water.

Polyfluoroalkyl and perfluoroalkyl substances (PFAS), known as “forever chemicals,” have been found in hundreds of household items, including makeup and carpeting, and are used to make coatings that repel water, grease, and oil.

The settlement comes after 3M faced thousands of lawsuits for the last two decades over its manufacturing of products containing PFAS. These lawsuits allege that 3M knew PFAS caused cancer, developmental defects and other health problems, and that the chemicals contaminated US drinking water systems.

News of the deal bumped shares of 3M stock up nearly 5% in after-hours trading — likely because the settlement would eliminate the need for further litigation and save the company from making an appearance in federal court.

3M said its settlement is not an admission of liability. If the settlement agreement is not approved by a court, the company said it would be prepared to continue defending itself against litigation.

Shares of 3M are still down by about 16.3% so far this year.

Elon Musk and Mark Zuckerberg face off

Sometimes America’s top executives act like leaders, and sometimes they act like members of the WWE.

Tech billionaires Elon Musk and Mark Zuckerberg have said that they want to settle their ongoing rivalry in a cage fight.

Twitter owner and Tesla (TSLA) CEO Musk recently tweeted that he would be “up for a cage fight” with Zuckerberg, the CEO of Meta. In an Instagram story Wednesday, Zuckerberg fired back by posting a screenshot of Musk’s tweet overlaid with the caption: “Send Me Location,” reports my colleague Hanna Ziady.

Musk then responded to a tweet about the fight by Alex Heath, editor of tech news website Verge, with “Vegas Octagon” — a reference to the Las Vegas arena that hosts the Ultimate Fighting Championship.

“I have this great move that I call ‘The Walrus,’ where I just lie on top of my opponent & do nothing,” he added in a separate tweet.

Meanwhile, bookmaker Paddy Power is betting the match never happens, but that if it does, both men have an equal chance of winning.

“If this fight does actually go ahead, with a bit of luck, they’ll both knock some sense into each other,” a spokesperson for the Irish company said in a statement.