Airline stocks have been flying high, primarily owing to the uptick in passenger volumes. Air travel demand has bounced back very strongly from the pandemic lows and is particularly strong on the leisure front. What is more encouraging is that international demand is also bouncing back nicely.

The decline in expenses on fuel represents another tailwind for the industry. Notably, oil price declined roughly 12% in the first six months of 2023. This bodes well for the bottom-line growth of industry participants. This is because fuel expenses are a significant input cost for the aviation space.

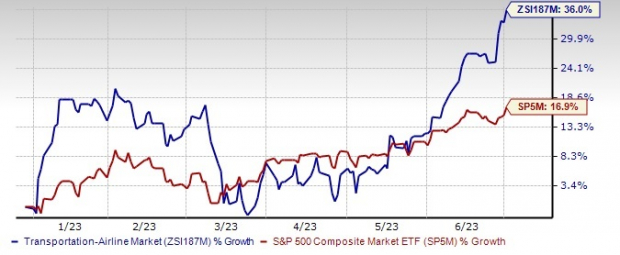

Driven by these positives, the Zacks Airline industry surged 36% in the first six months of 2023 despite economic uncertainties, way ahead of the S&P 500’s 16.9% rise in the same time period.

Image Source: Zacks Investment Research

We expect industry participants to continue their good performance in the second half of the year. Given the positivity surrounding the industry, we believe that betting on airline stocks like Copa Holdings (CPA – Free Report) , Allegiant Travel Company (ALGT – Free Report) and Ryanair Holdings (RYAAY – Free Report) is a prudent move.

Airlines Likely to Continue Flying High in 2H: Here’s Why

Multiple flight cancellations and delays due to unfavorable weather conditions have not been able to dampen the demand for travel. Per data provided by the Transportation Security Administration (TSA), nearly 2.9 million people moved through checkpoints across the United States on Jun 30, which is higher than the corresponding 2019 (pre-coronavirus) levels. TSA expects passenger volumes to hit a record in the Independence Day holiday period, with 17.7 million people likely to be screened in the Jun 29-Jul 5 time frame.

With passenger volumes anticipated to remain high throughout the year, air travel is expected to soar over the Labor Day holiday period later this year as well. It is also anticipated to be high during winter, thereby keeping airlines in good shape.

This optimism regarding air travel is not limited to the United States only. In June, the International Air Transport Association or IATA doubled its current-year profitability (net) forecast for the industry to $9.8 billion from $4.7 billion. Passenger revenues are the biggest driver of this rosy projection. Per IATA, passenger revenues in 2023 are now anticipated to be $546 billion compared with the previous estimate of $522 billion. The revised revenue forecast indicates a 27% increase from the 2022 actuals.

The anticipated decline in oil price is corroborated by the fact that average jet fuel cost is expected to be $98.5 per barrel in 2023 per IATA, much lower than the earlier forecast of $111.9 per barrel.

Given the encouraging projections, we have picked three airline stocks, which investors can bet on. These stocks carry a Zacks Rank #1 (Strong Buy) or #2 (Buy) presently and have a VGM Score of A. Moreover, the companies have witnessed favorable earnings estimate revisions for the current year. Our research shows that stocks with a VGM Score of A, when combined with a Zacks Rank #1 or 2, offer the best investment opportunities for investors.

You can see the complete list of today’s Zacks #1 Rank stocks here.

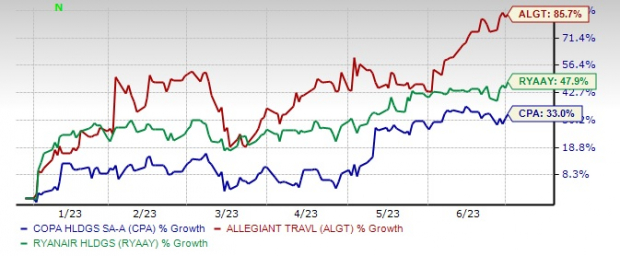

Price Performance: 1H23

Image Source: Zacks Investment Research

Our Choices

Copa Holdings, currently sporting a Zacks Rank #1, is benefiting from an improvement in air travel demand. In first-quarter 2023, passenger revenues increased 28.5% from first-quarter 2019 levels due to higher yields.

Copa Holdings’ fleet modernization and cost-management efforts are commendable. The Zacks Consensus Estimate for current-year earnings has been revised 25.1% upward over the past 60 days.

Allegiant is seeing a steady recovery in leisure air travel demand. In first-quarter 2023, this Las Vegas, NV-based company’s operating revenues grew 29.9% on a year-over-year basis. Passenger revenues, accounting for 93.7% of the top line, increased 31.3% on a year-over-year basis.

Allegiant’s fleet modernization efforts are encouraging. The Zacks Consensus Estimate for ALGT’s current-year earnings has been revised 41% upward in the past 60 days. ALGT currently carries a Zacks Rank #2.

Ryanair Holdings is based in Ireland. Passenger volume has been robust at Ryanair over the past few months owing to the rebound in air traffic from COVID-19 lows. The latest upbeat traffic result came in June when the low-cost carrier transported 17.4 million passengers, compared with 15.9 million in Jun 2022. Load factor (% of seats filled with passengers) was an impressive 95% for the month.

Ryanair’s measures to expand its fleet to cater to the improvement in travel demand are also very encouraging. The Zacks Consensus Estimate for RYAAY’s current-year earnings has been revised 7.4% upward in the past 60 days. RYAAY currently carries a Zacks Rank #2.

The New Gold Rush: How Lithium Batteries Will Make Millionaires

As the electric vehicle revolution expands, investors have a chance to target huge gains. Millions of lithium batteries are being made & demand is expected to increase 889%.

Original Article: https://www.zacks.com/stock/news/2116455/3-airline-stocks-that-appear-to-be-solid-bets-for-2h23?art_rec=home-home-investment_ideas_stocks-ID01-txt-2116455