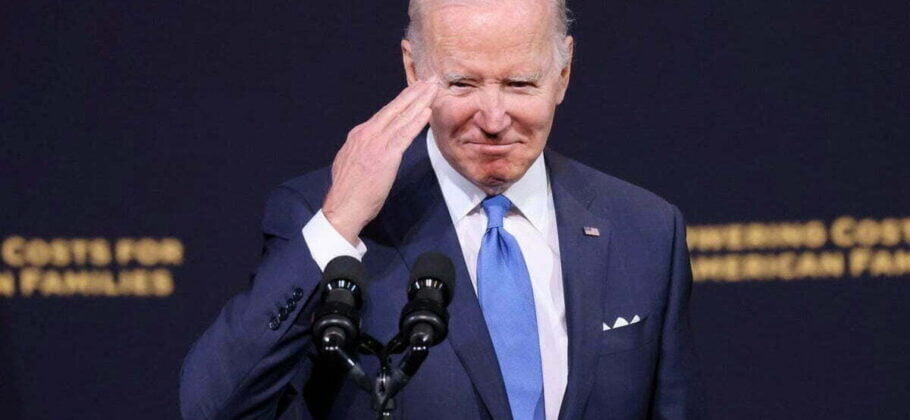

Is President Biden using student loan forgiveness to curry favor with voters, all while leveraging taxpayer money? With the timing coinciding with an election cycle, it raises eyebrows.

A quote often attributed to Thomas Jefferson (and others before him) comes to mind:

“Democracy will cease to exist when people realize they can vote themselves more money.”

Recently, Biden announced a plan to forgive up to $10,000 in federal student loan debt for individuals earning less than $125,000 annually, and up to $20,000 for Pell Grant recipients. This move stands to benefit 43 million federal student loan borrowers, with about 20 million seeing their debt wiped out completely.

That’s a significant number of voters receiving a financial windfall just in time for election season.

Historically, student loans were a transaction: people borrowed money to gain an education, which they were expected to repay. Many have worked hard, sacrificing to pay off their loans. Now, many are seeing those loans simply erased. To them, this might feel like a reward for voting in a particular way.

Critics argue this is unfair to those who diligently paid off their loans or worked multiple jobs to avoid debt in the first place. Some believe that if students were too young to understand the full implications of borrowing, perhaps they shouldn’t have been granted loans. And what about those who never went to college but now bear the burden of others’ educational costs through taxes?

But the issue goes beyond fairness—this seems to be about political gain.

This debate reflects a longer history of government subsidies and their unintended consequences. Proponents believed that subsidizing educational loans would lead to a more educated populace. However, over time, it led to skyrocketing tuition fees, as universities knew the government would back almost any loan amount students needed. The result? Students today face an educational cost that’s far more burdensome than it was decades ago when many could pay their tuition by working part-time.

Biden’s debt forgiveness plan seems to reinforce the problems that created this situation: unchecked tuition increases, massive loans, and irresponsible borrowing. It might be perceived as encouraging fiscal irresponsibility and adding inflationary pressure by pumping more “free” money into the economy, effectively shifting the debt from one group to another.

In the end, this isn’t about prudent financial management or economic fairness—it’s about political strategy. It’s about securing votes.

And once again, it appears that some voters are being enticed with the promise of “free” money.