It’s likely that the thoughts of moving or relocating to Florida arise in the dead of winter when shoveling snow and freezing cold make you long for warmer climates. You think about your job holding you to the frozen north with little chance of escape. The week vacation to the tropics only enforces your desire that things must change.

In the sun-soaked words of Jimmy Buffett, “The weather is here, I wish you were beautiful.” Detachment from Illinois by hedge fund founder Ken Griffin this week punctuates what others have been feeling. However, Griffin is fleeing his home of some thirty years for more than the weather. Fear and loathing crime and usurious taxes are at the crux of the flight. You don’t need to be peppered with the crime statistics from Chicago, New York, Minneapolis, etc. You know they’re outrageous.

Griffin suggests, “If people aren’t safe here, they’re not going to live here. I’ve had multiple colleagues mugged at gunpoint. I’ve had a colleague stabbed on the way to work. Countless issues of burglary. I mean, that’s a really difficult backdrop from which to draw talent to your city from.”

The trend did not start with Griffin and likely will not end with him. A recent study by Forbes showed that at least 20% of Wall Street banks and financial services firms have thought about relocating workers to other locations outside of New York. Data from United Van Lines shows empirical evidence of movement from New York and other large cities to locations in the south and west.

Eily Cummings, director of corporate communications at United Van Lines said, “Concerns for personal and family health and wellbeing and changes in employment status or work arrangement, along with a desired lifestyle change or improvement of quality of life,” are dictating why people are relocating.

Griffin’s fund, Citadel, has over 1,000 employees in the Chicago area, and most are expected to remain there. However, other New York firms like Virtu Financial Inc., a highly successful electronic trading firm that made some $9.6 million a day during the third quarter of 2020, is the most recent Wall Street player to set-up shop in Palm Beach Gardens, Florida.

In addition to the Florida sunshine, the move for Virtu has had a significant financial upside for employees. According to Chief Executive Officer Doug Cifu, “Employees will see a lateral pay move, which amounts to around an 11% increase in salary because Florida has zero income tax.”

Let’s take a look at who is putting their words to action in the financial community and relocating to a friendlier environment. Some of the larger names include Carl Icahn and Dan Sundheim, as well as some of Wall Street’s bigger firms like Goldman Sachs Group, Apollo Global Management, and Point72 Asset Management.

The $42 billion Elliott Management Corp. has seen several of its highest-paid executives leave Manhattan. Jesse Cohn, managing partner at the firm, and Jon Pollock, the company’s co-chief investment officer, have moved near its new headquarters in West Palm Beach. Other hedge fund titans are also moving to Florida permanently. Scott Shleifer, the co-founder of the private equity unit at the $40 billion Tiger Global Management, bought a $132 million house in Palm Beach, where he plans to relocate. Sundheim, who runs the $20 billion D1 Capital Partners, is relocating near his new office in Miami.

The number of active hedge fund managers headquartered in Florida grew from 193 at the end of 2019 to 290 this year, with those managers accounting for $94.2 billion in assets under management, according to data from Preqin. These funds account for a total of $94.2 billion under management. Instead of regulating the industry to death and penalizing it for performance like New York, New Jersey, California et al, Florida has a supportive business environment with the zero state tax certainly being a helper at both the individual and company level.

Florida, and in particular Miami-Dade, has been on the forefront of recruiting financial service firms for a long time. James Kohnstamm, executive vice president for economic development at the Miami-Dade Beacon Council, noted, “The federal tax changes in 2017 that limited deductions for state and local income and property taxes allowed Miami to position itself better to attract more firms.” Continuing with the theme, Kohnstamm goes on to say, “Once Covid hit and New York locked down, there was a big shift in talent, followed by company migration.

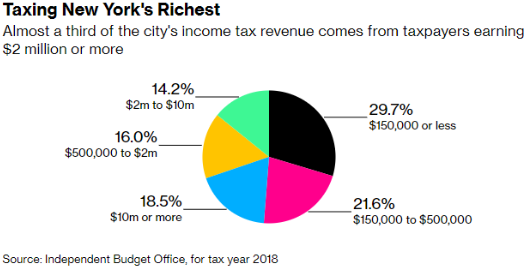

What was a trend that went gangbusters? We are still receiving inquiries almost daily from financial services… companies.” The following chart shows you the finances behind the withdrawal from New York City, noting that almost a third of its tax revenue comes from those earning $2 million or more.

As mentioned, it isn’t all about money though. Griffin of Citadel cites crime as another top motivator, as well as his clashes with Illinois Gov. J.B. Pritzker over violence in the state.

I’ll coin the three C’s of woe for New York, California, and the other leading outbound states. Cold, crime, and communism (well, at least socialist tax rates) will continue to be the dirge that keeps our financial friends always on the lookout for the next, best place to live and work.