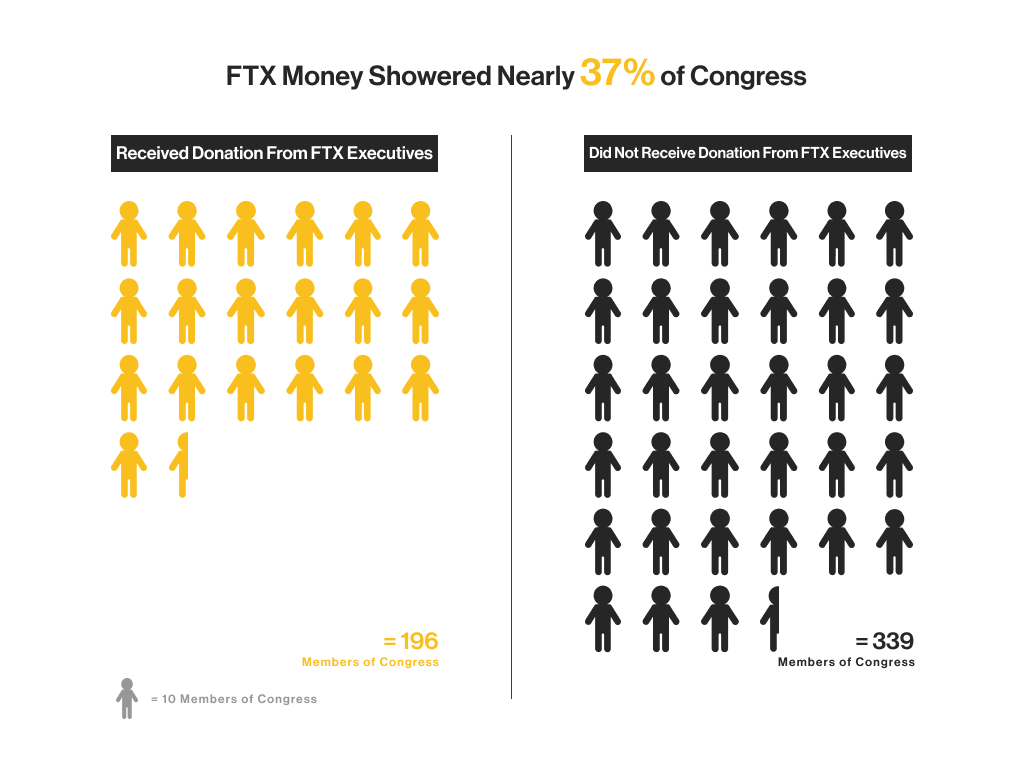

More than one in three of the 535 senators and representatives in the U.S. Congress showed up to the new session with FTX baggage, having received campaign support from one of the senior executives of the fraud-ridden crypto giant.

CoinDesk has identified 196 members of the new Congress – many of whom were just sworn in last week – who took cash from Sam Bankman-Fried or other senior executives at FTX, a crypto exchange that filed for bankruptcy in Delaware in November after CoinDesk revealed unusually close ties between FTX and Alameda Research, an affiliated hedge fund. The names in Congress range from the heights of both chambers, including new Speaker of the House Kevin McCarthy (R-Calif.) and Senate Majority Leader Chuck Schumer (D-N.Y.), down to a list of recipients new to high-level politics.

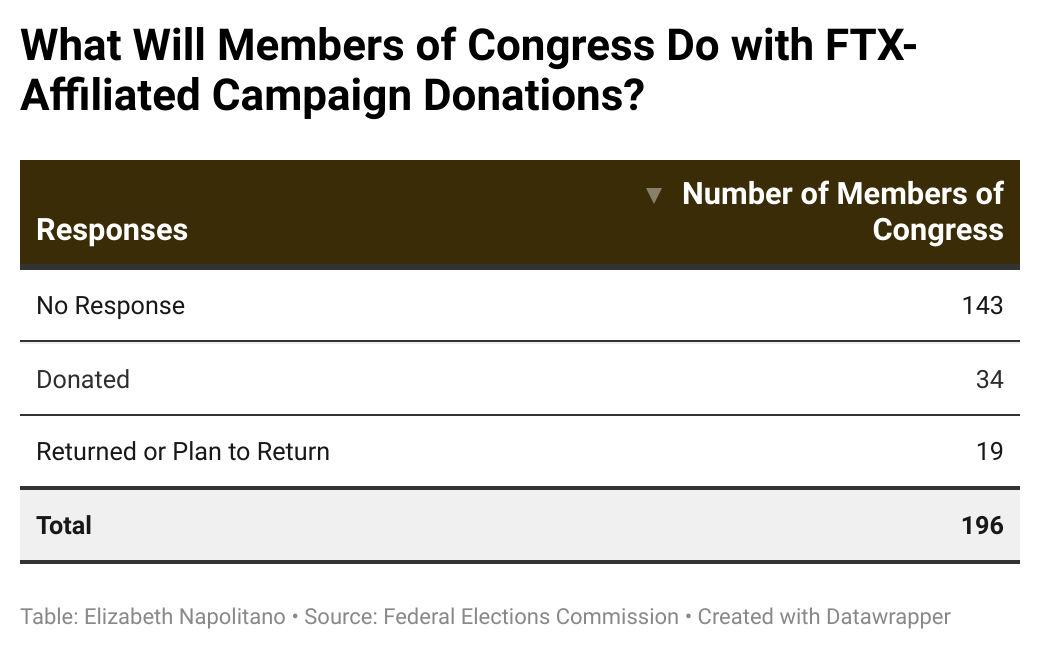

After the lawmakers received the money, it became clear – according to the work of journalists, the criminal charges and admissions of guilt from FTX insiders – that the funds sprang from this colossal financial swindle. CoinDesk reached out to all 196 lawmakers to ask what they would do with the money.

Most of the politicians who responded said they handed it over to charities to remove the taint of contributions from executives such as former FTX CEO Bankman-Fried, whose federal fraud charges also include an accusation that he violated campaign-finance laws. Others have revealed they had conversations with the U.S. Department of Justice about setting aside the money until it can be dropped into a fund to compensate FTX victims.

(Rachel Sun/CoinDesk)

Rep. Lou Correa (D-Calif.) was among dozens of current or incoming members of Congress who took FTX contributions, in his case the full limit of $2,900 directly from Bankman-Fried.

“I don’t know the gentleman – never talked to him,” Correa told CoinDesk. But Correa said he intended to donate that same amount to his alma mater, California State University, Fullerton, “to support their Dreamer education fund.”

Charitable contributions

Of the 53 campaigns that responded on the record, 64% decided to forward the donated amounts to nonprofit causes.

Incoming Rep. Greg Casar (D-Texas) planned to forward contributions from an FTX executive and Bankman-Fried’s brother to the advocacy group Fight Corporate Monopolies, while Rep. Ronny Jackson (R-Texas) said he would give to a “crisis pregnancy center” back home because, a spokeswoman said, he “believes these funds should be donated to a worthy cause, given the information that has come to light about FTX and its leaders.”

However, the campaigns channeling tainted money to favored charities may not escape the reach of FTX’s bankruptcy case. And even the organizations they give to could be roped in.

“Making a payment or donation to a third party (including a charity) in the amount of any payment received from a FTX contributor does not prevent the FTX debtors from seeking recovery,” FTX warned in a December statement. The company is now controlled by CEO John Ray III, whose primary job is to recover money for the company’s fleeced creditors, though it isn’t yet clear whether political donations – nominally made directly from the individual’s personal accounts – will be subject to clawbacks.

The company said it’s inviting any recipients of donations from FTX executives to return the money soon, according to the statement. If the money was stolen, it was never theirs to give. Several of the campaigns told CoinDesk that they’re in touch with the bankruptcy team or government authorities and are trying to determine how to give the money back.

“We have received guidance from the Department of Justice that dollars received from FTX executives should be set aside for when a victims’ compensation fund is created in the future,” said Chris Carroll, campaign manager for Rep. Rosa DeLauro (D-Conn.), whose campaign accepted a contribution from Nishad Singh, one of the executives who contributed millions last year.

The current chaos at FTX means giving the money back is easier said than done. Of the recipients who responded to CoinDesk’s inquiries, 38% said they were holding the money and waiting for guidance on how to give it back. Only five politicians said they had already successfully returned the money.

Clawbacks are coming

If, during FTX’s bankruptcy process, the money its executives gave to campaigns (as well as other causes) is deemed “fraudulent conveyances,” the recipients have to give it back to FTX’s estate.

Anthony Sabino, a bankruptcy expert and professor of law at St. John’s University, told CoinDesk that the courts will work out whether this cash is tied to fraud, though clawing it back to FTX creditors could take years. Victims of Bernie Madoff are still receiving payments 14 years after his arrest.

According to Sabino, the game of hot potato that campaigns play by giving donations to charity is a “political move” that doesn’t magically absolve them from their responsibility to pay back the money.

“The law does not care if you gave it to Mother Teresa,” Sabino said.

And if the money has already been spent? Sabino says, “tough luck.”

“If you no longer have the money, too bad,” he said. “You are still liable. You might go bankrupt yourself.”

Giving it back

Though the charity hot potato was the most common response CoinDesk received from politicians, another sizable group of respondents said they were working on giving the money back.

(Federal Election Commission)

Some, like Rep. Ro Khanna (D-Calif.) and Sen. Deb Fischer (R-Neb.), say they have already returned the donations to FTX. Others, including Reps. Joyce Beatty (D-Ohio) and Angie Craig (D-Minn.) and Sen. Debbie Stabenow (D-Mich.), say they’re holding the funds and waiting for instructions from either the courts or government agencies on what to do with them.

Still others are simply confused. Several campaign managers who spoke to CoinDesk expressed frustration with the situation, saying they don’t know how to give the funds back.

Matt Lusty, a campaign adviser for Sen. Mike Lee (R-Utah), who received money from Ryan Salame, the co-CEO of FTX Digital Markets, told CoinDesk the campaign was “looking for an appropriate place to make a donation in that amount.”

“There is nowhere to return the donation since his assets have been seized,” Lusty said.

Lee’s fellow Utah Senator, Mitt Romney (R-Utah), chose not to let the FTX founder’s dirty money linger while he waited for clear instructions on how to return what Bankman-Fried had donated. Instead, he gave the $5,800 to the U.S. Treasury.

Keeping mum

Of the 196 members of Congress who accepted campaign contributions from FTX’s former executives, 73% didn’t respond to CoinDesk’s requests for comment, and so it’s unclear what they are doing with the money.

Some of Congress’ most crypto-friendly members, including Rep. Tom Emmer (R-Minn.), who received $8,700 from Salame and Zach Dexter (the CEO of FTX US subsidiary LedgerX), have kept mum on the subject. Emmer has largely treated the FTX crash like a blip, continuing his rhetorical crusade on behalf of the industry in speeches and appearances since the exchange filed for bankruptcy in November.

Emmer, who is co-chairman of the Congressional Blockchain Congress, has argued that the FTX collapse was a “failure of character,” not of crypto, but added that the industry will keep growing. “You do not get growth without taking risk,” he told a cryptocurrency industry crowd in Washington, D.C., the week after FTX went down.

Other members of the caucus who received money from FTX executives – like Reps. Josh Gottheimer (D-N.J.) and David Schweikert (R-Ariz.), another of the co-chairs – seemed eager to distance themselves from their donors, telling CoinDesk the money has already been donated to charity or returned to FTX.

Firehose of money

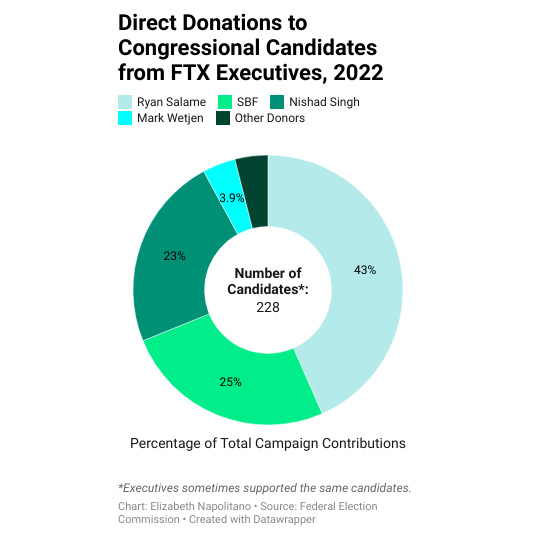

Most of the attention on Bankman-Fried’s campaign largesse has focused on the firehose of indirect money he aimed at congressional Democrats in the primary elections last year, through his own and other political action committees. He spent $40 million in the past two years – donations that are now under scrutiny by the FTX bankruptcy team and federal prosecutors – though the cash was largely spent on such things as television advertisements and political mailers.

Thad Wilson, a bankruptcy attorney at law firm King & Spalding, said that vendors could find the FTX estate knocking on their doors, taking back money that – for instance – paid television or radio stations to air political advertisements.

Wilson said that clawbacks in previous fraud cases, such as the Allen Stanford Ponzi scheme, set a legal precedent. In that case, several campaigns and politicians were hit with clawback claims, including former President Barack Obama, who had given the money to charity and balked at returning it. Even the Golf Channel, which had allegedly been paid with money from the scheme, was sued for fraudulent transfers.

The drama over FTX cash could get even messier than dragging the Golf Channel through the courts. Bankman-Fried’s family – including brother Gabe – was highly involved in his political engagement, and Wilson said it’s not uncommon for litigation to extend to family members, “particularly where the size of the donations were significant.”

While Bankman-Fried and his colleagues made a staggering number of highly visible, direct donations, those actual dollar amounts represent a sliver of their political investment. The type of PACs they favored, which don’t carry the same limits for the amount of cash individuals can shovel in, focus on what are known as “independent expenditures,” meaning political help that’s not officially tied to campaigns. The dollars that flow through such PACs can also be “dark money,” coming from unnamed donors through nonprofit intermediaries – something like the crypto mixer services of political spending.

The 30-year-old disgraced CEO said after his resignation that he had taken public credit for Democratic spending, but he had also funneled money to Republicans. That remark seems to have been echoed in his criminal proceedings in which he was charged with conspiracy to defraud the U.S. and commit campaign-finance violations, specifically accused of propping up “wealthy co-conspirators” as straw donors contributing funds that he was secretly supplying.

A spokesman for Bankman-Fried declined to comment for this story.

The bulk of FTX spending on Republican candidates came from one of Bankman-Fried’s underlings, Salame, who hasn’t been accused of criminal involvement as of press time. While Bankman-Fried’s 2022 giving had stunned national politics by raising him to a one-time rank as fourth-largest individual political donor, Salame’s spending had also lifted his name to 11th place, according to OpenSecrets.org. Salame didn’t respond to a request for comment.

(Federal Election Commission)

Salame was a fixture in the Republican congressional primaries as the companion of Michelle Bond, a crypto advocate who ran as a Republican candidate for New York’s 1st District. The two were even seen hobnobbing with Donald Trump Jr., the former president’s son. But Salame was more influential as a donor, giving about $24 million to the party’s candidates and causes.

Another major contributor was Singh, one of the inner circle of top FTX employees running the global business. He gave almost $10 million to Democratic candidates and progressive political action committees in the last cycle, according to Federal Election Commission records. A lawyer representing Singh declined to comment.

One other FTX donor was Mark Wetjen, a former commissioner and acting chairman of the U.S. Commodity Futures Trading Commission, who FTX hired in 2021 to head its policy work in Washington. The campaigns he gave to generally overlapped with Bankman-Fried donations, though Wetjen gave modest amounts and made fewer than two dozen contributions. He also declined to comment.

Personal money

All of the direct donations that politicians are scrambling to cleanse from their campaigns came from the executives’ personal money, and so until a legal determination emerges that the funds really should be considered part of the company’s bankruptcy, Sabino, the St. John’s professor, said a clawback process “does not affect donations [Bankman-Fried] made with his own money.”

“Likewise for other [executives] of FTX who donated their personal money,” Sabino added.

Bankman-Fried has been charged with campaign fraud, and prosecutors have alleged that he hid the true source of funds he donated. But the accusations are scant in detail about what exactly is being alleged. And authorities haven’t yet hinted at whether the same level of scrutiny will be applied to donations made by Salame and others.

Some additional confusion could arise over the mess Bankman-Fried made in his direct giving, often donating repeatedly and well beyond federal limits for individual contributions, according to an analysis of federal records. The maximum per election was capped at $2,900 during this cycle, which could amount to $5,800 for both a primary and general election.

For instance, in the case of Sen. Susan Collins (R-Maine), Bankman-Fried apparently contributed six times for a $17,400 total, according to federal records. A representative of the campaign said the amount over the limit was given back in September and October of 2021.

And on one date in 2021, Bankman-Fried apparently contributed to Romney six times for $31,900, though the campaign returned all but the legal limit of $5,800.

The FTX executives typically targeted candidates already in power who weren’t likely to lose it, and they only sent money to a couple of dozen candidates who lost. Despite the abundance of conspiracy theories around Bankman-Fried’s financial relationship with Democrats, he openly gave to 10 Republican lawmakers.

Some of his cash went to prominent senators who weren’t even running in last year’s election, such as Sens. Dick Durbin (D-Ill.), Romney and John Boozman (R-Ark.).

Specter of SBF

The 37% of Congress who took FTX money will now be among lawmakers deciding how the U.S. should regulate cryptocurrencies – and whether to follow the route Bankman-Fried lobbied for. This session is expected to produce at least some initial attempts at laws governing crypto assets, and the damage wrought by FTX will be in the forefront of that debate.

While Bankman-Fried sits in his parents’ Stanford, Calif., home wearing an ankle monitor and awaiting the developments of his criminal prosecution, a key figure – Sen. Sherrod Brown (D-Ohio), chairman of the Senate Banking Committee – has begun talks about the contours of a crypto bill. And despite loud crowing on social media that Bankman-Fried’s arrest heralds the death of the controversial crypto regulation bill he supported (the bipartisan Digital Commodities Consumer Protection Act, or DCCPA), experts say that and other legislative efforts will continue.

Though the discourse on Capitol Hill will remain hyper-aware of Bankman-Fried’s recent Washington ties, the fact of his widespread relationships with lawmakers won’t itself kill the work, said Jenny Lee, a partner at law firm Reed Smith’s Financial Industry Group and a former enforcement attorney at the Consumer Financial Protection Bureau.

“With the FTX bankruptcy, there is a public focus that is intense enough that we might have a chance at more thoughtful rulemaking,” Lee said. “We’ve been regulating these underlying issues for more than 100 years, and it will take some thoughtful analysis, reference back to history and deep understanding of the technical issues on the part of regulators and lawmakers to apply it to crypto in a manner that does not do more harm than good.”

Many of the lawmakers who temporarily benefited from the sudden crypto riches of FTX’s political novices are now issuing scathing comments about the recklessness of company officials – and calling for tough industry oversight. So as crypto regulation progresses, the industry may face politicians who feel they had been burned before by digital-asset advocates.

A comment from Craig – a congresswoman from Minnesota who accepted money from Bankman-Fried and Singh and who now hopes to return it to the bankruptcy effort – is typical of many of the sentiments shared with CoinDesk.

“Congress must take immediate action to regulate the crypto industry, implement strict oversight standards and shield consumers from schemes like this in the future,” she said.

A spokesperson for Romney said that the prominent lawmaker “condemns Sam Bankman-Fried’s reprehensible behavior and believes he must be held accountable for his actions – which have caused harm to many.”

Rep. Jim Himes (D-Conn.), who received a contribution from an FTX executive who wasn’t among the biggest donors, said the company’s implosion is definitely shaping how Congress is viewing the industry.

“Shields are up here,” he told CoinDesk TV on Thursday. “The industry – broadly speaking – and the players in the industry no longer have the benefit of the doubt.”

Himes said U.S. lawmakers are now looking with more suspicion at other platforms, such as Binance.

“None of us has any confidence, really, that there aren’t other FTXs brewing out there,” he said.