I can’t tell you how many people I run into that have no idea what their retirement savings is invested in. Not a big deal, right? It’s only….all your money in the world when you stop working!

The typical response is something like, “It’s in the market, I think,” or “I’m not sure.” Wow. It makes a huge difference, people! Anecdotally, a young friend of mine has worked his entire ten-year career since high school at Dominion Energy.

Just like his father, he has his entire 401k in Dominion Energy stock.

The upside is that he knew what his retirement money was invested in. The downside is that he wasn’t diversified and never got accurate information from a financial advisor.

If you look at the following chart of Dominion Energy (red and green candles) over the last decade compared to the S&P 500 (purple line), you’ll see that being the market and diversified was incredibly more profitable than being in just one stock, Dominion Energy, by the tune of 165% returns vs. 16% in the S&P 500.

Retirement planning isn’t the only area where you need to be cognizant of how your money is being handled. Like everything else in life, all financial planners are not created equal. Take financial broker Dana Vietor, for instance. In 2020, Mr. Vietor was barred for life by the Financial Industry Regulatory Authority, which oversees how brokers do business.

What was his crime?

He told investors, including one Jeff Temeyer, a 64-year-old farmer, that investing in a Texas cancer treatment center would yield at least 8% annual returns. So Mr. Temeyer invested more than $900,000 in all—only to learn that the securities were near worthless. One could say that this was a bad investment decision for Mr. Temeyer. It was.

He relied on the broker to do the due diligence for him, which in this case, was fraudulent. According to Andrea Seidt, securities commissioner for the state of Ohio, “The power and prowess of a good sales pitch will win the day every day.”

The stories are myriad, but I think you get the point. The time to do your due diligence is before you invest your money.

You need to find a reputable financial planner.

Easier said than done if you don’t know someone in the business, but there are certainly ways to find them so that you can mitigate financial stress down the road.

Let’s take a look at four quick steps to go through to see what’s right for you.

- Figure out what services you need: After all, this should be the reason why you thought of hiring a financial advisor in the first place. Ask yourself:

- Do you need help with a budget?

- Do you want help investing?

- Would you like to create a financial plan?

- Do you need to get your estate plan in order or create a trust?

- Do you need tax help?Depending upon your needs, you can decide on a range of help from robo advisors to full-service brokers.

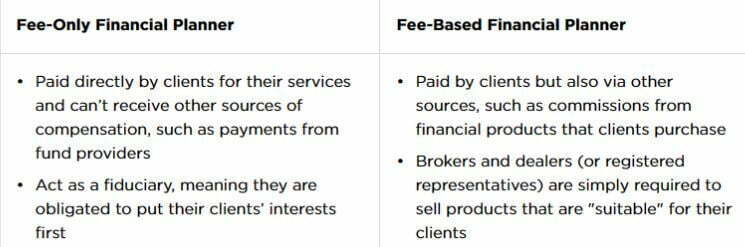

- Figure out how you will pay a financial advisor: Some financial advisors have a fiduciary duty to their clients, meaning they are obligated to act in their client’s best interest rather than their own. As one might imagine, the other side of the coin is those that put their interest either alongside or above yours. The following chart depicts the two styles.

- Select Which Type of Advisor You Want: There are many different types of advisors with whom you could work, from traditional financial advisors you meet with in person to online advisors or robo advisors. The type of financial advisor best suited for you depends on the complexity of your situation and whether or not you have a desire to have a more personal relationship with the advisor.

- Traditional Financial Advisors: Traditional financial advisors can meet with you in person and will be able to help you with all of your financial planning needs. The personal touch comes with a cost. Many traditional advisors charge around 1% of your assets under management. Some advisors also require a high minimum balance, such as $250,000 in assets. Best if you want specialized services, your situation is complex, you want to meet your financial advisor in person and develop a long term relationship with them.

- Robo Advisors: A robo advisor is a digital service offering simplified, low-cost investment management. You answer questions online, then computer algorithms build an investment portfolio according to your goals and risk tolerance. Fees start as low as 0.25% of your balance, and many services have no or low account minimums, so you can start investing with a small amount of money.

- Vet the financial advisor’s background: Perhaps the most important step of all if you decide to go with a traditional advisor Verify any credentials they claim to have and check to see if they’ve had any disciplinary problems such as fraud. You can verify your advisor’s credentials on BrokerCheck.finra.org or AdviserInfo.sec.gov. Both are free tools that provide the background and experience of individual advisors and firms, including robo advisors.

Source: https://investingand.money/2023/02/selecting-a-financial-advisor-in-2023/