Key Insights:

- It was a bullish Friday, with BTC rising by 1.04% to end the day at $21,865.

- Fed Fear and crypto regulatory risk continued to leave BTC at sub-$22,000.

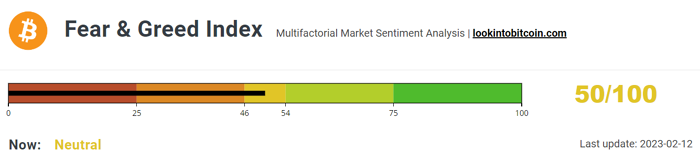

- The Fear & Greed Index remained within the Neutral zone despite rising from 49/100 to 50/100.

On Saturday, bitcoin (BTC) rose by 1.04%. Reversing a 0.73% loss from Saturday, BTC ended the day at $21,865. BTC wrapped up the day at sub-$22,000 for the third consecutive session.

A mixed start to the day saw BTC fall to an early low of $21,614. Steering clear of the First Major Support Level (S1) at $21,448, BTC rose to a final-hour high of $21,907. BTC briefly broke through the First Major Resistance Level (R1) at $21,885 before easing back to end the session at $21,865.

Regulatory Risk and Fed Fear Pinned BTC at Sub-$22,000 Levels

On Saturday, there were no external market forces to provide direction. The lack of market forces left dip buyers to deliver support ahead of another big week for the global financial markets.

Following the January US Jobs Report, hawkish Fed chatter has refueled Fed Fear, with investors considering the prospects of interest rates rising above 5% and holding at higher levels for longer. This week, the US CPI Report could support the more hawkish outlook, which would be market negative.

Regulatory risk has contributed to the bearish sentiment following the news of Kraken settling with the SEC and ceasing US crypto staking services.

With the SEC regulating by enforcement, more exchanges will likely face similar scrutiny. A US ban on crypto staking services would test investor resilience and could redefine the crypto market footprint.

The increased regulatory uncertainty, the ongoing investigation into Silvergate Bank and FTX, and Genesis bankruptcy proceedings will keep investors busy. Investors also need to consider the ongoing SEC v Ripple case. A Ripple victory would support a shift in sentiment and could lead to the CFTC having more regulatory powers to oversee the digital asset space.

The Day Ahead

Investors should continue monitoring the crypto news wires for FTX, Genesis, and Silvergate Bank updates. However, the news of more crypto exchanges coming under SEC scrutiny could bring sub-$20,000 into view.

In the final hour, the NASDAQ mini will likely influence as investors begin to consider Tuesday’s US CPI Report, which could spook investors. Following the hot US Jobs Report and hawkish Fed chatter, a pickup in inflationary pressure would support a more aggressive interest rate path to bring inflation to target.

NASDAQ – BTCUSD 120223 Daily Chart

The Fear & Greed Index Remains Neutral with BTC as Sub-$22,000

Today, the BTC Fear & Greed Index remained within the Neutral zone despite rising from 49/100 to 50/100. SEC regulatory activity and Fed Fear continued to influence crypto investor sentiment, leaving the Index in the Neutral zone.

Investors will be in wait-and-see mode today. On Tuesday, the US CPI Report could dictate the Fed interest rate path over the near term.

While Fed Fear remains a headwind, regulatory news will likely have a more material impact on BTC and the broader crypto market. A US ban on crypto staking would be a worst-case scenario that currently remains a possibility.

After returning to the Neutral zone, the Index must avoid the Fear zone to support a BTC run at $23,000. However, an Index return to the Fear zone would signal a near-term bullish trend reversal.

Fear & Greed 120223

Bitcoin (BTC) Price Action

At the time of writing, BTC was down 0.07% to $21,850. A range-bound start to the day saw BTC rise to an early high of $21,889 before falling to a low of $21,847.

BTCUSD 120223 Daily Chart

Technical Indicators

BTC needs to avoid a fall through the $21,795 pivot to target the First Major Resistance Level (R1) at $21,977. A move through the Saturday high of $21,907 would signal a breakout session. The crypto news wires need to be crypto-friendly to support an extended rally.

In the event of an extended rally, BTC would likely test the Second Major Resistance Level (R2) at $22,088. The Third Major Resistance Level (R3) sits at $22,381.

A fall through the pivot would bring the First Major Support Level (S1) at $21,684 into play. However, barring another risk-off-fueled crypto sell-off, BTC should avoid sub-$21,500. The Second Major Support Level (S2) at $21,502 should limit the downside. The Third Major Support Level (S3) sits at $21,209.

BTCUSD 120223 Hourly Chart

Looking at the EMAs and the 4-hourly candlestick chart (below), it was a bearish signal. BTC sat above the 200-day EMA ($21,705). After a bearish cross on Saturday, the 50-day EMA pulled back from the 100-day EMA, with the 100-day EMA narrowing to the 200-day EMA, delivering bearish signals.

A hold above the 200-day EMA (21,705) would give the bulls a run at R1 ($21,977) and $22,000. However, a fall through the 200-day EMA ($21,702) and S1 ($21,684) would bring S2 ($21,502) into view. A move through the 50-day EMA ($23,250) would send a bullish signal.

BTCUSD 120223 4 Hourly Chart