Image: Bigstock

Reflecting on Coal Industry Woes

In 2016, then-presidential candidate and front-runner Hillary Clinton made headlines during a town hall when she promised, “We’re going to put a lot of coal miners and coal companies out of business.” While Clinton never made it to office, more than 50 coal companies have gone out of business in the past decade as more politicians and financial giants have pushed a clean energy agenda to fight climate change. Interest in coal stocks waned so much that the VanEck Vectors coal ETF (KOL), the only coal ETF in the U.S., stopped trading after more than a decade of being active.

Investment giants like Blackrock (BLK – Free Report) have pushed for Environmental, Social, and Governance (ESG) policies and have promised to reduce investments in companies that produce emissions. Meanwhile, clean energy has taken a bigger slice of the pie, and energy solutions such as solar have become more efficient in recent years.

Expect the Unexpected

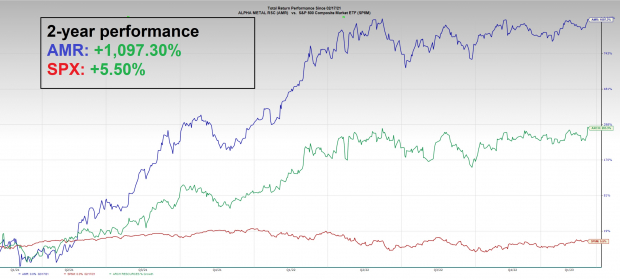

Wall Street is never obvious. Knowing what occurred over the past decade, one would think that very few if any coal stocks would be in business, let alone performing well. However, that is exactly what is happening. Over the past two years, coal stocks have remained in business and quietly became market leaders and some of the top performing stocks in the entire market. For example, since 2021, public coal producers such as Arch Resources Inc (ARCH – Free Report) have gained 283%, while Alpha Metallurgical Resources (AMR – Free Report) is up a mind-blowing 1,097%!

Image Source: Zacks Investment Research

What is Driving the Stellar Performance?

Coal stocks not only have scorching hot performance but are also highly ranked. The coal industry ranks 19 out of the 251 industries tracked by Zacks, putting it in the top 8%. Arch Resources, Alliance Resource Partners (ARLP – Free Report) , and Warrior Met Coal (HCC – Free Report) hold a best possible Zacks Rank of #1 (Strong Buy), while a handful of peers such as Peabody Energy (BTU – Free Report) earn #2 (Buy) ranks. Coal stocks are benefitting from a variety of factors, including:

- Clean Energy is not Enough to Meet Supply Void:Despite the advent of the green energy revolution, the increase in alternative energy has not been enough to stave off increasing energy demand in recent years.

- Industry Consolidation: Because many weaker coal companies went out of business a few years ago, the remaining coal companies are benefiting from soaring demand.

- ESG:There’s a big difference between what many of the ESG proponents are saying versus doing. Contrary to the rhetoric around decreasing emissions, firms such as Blackrock, Bank of America (BAC – Free Report) , Morgan Stanley (MS – Free Report) , and J.P Morgan (JPM – Free Report) , continue to invest billions of dollars in coal and other “dirty” energy.

Fundamentals

The soaring stock prices in the coal industry are not without merit. For example, Arch Resources grew EPS by 94% year-over-year in its latest quarter, while Alliance Resource Partners’ EPS vaulted more than 300%. SunCoke Energy (SXC – Free Report) is yet another strong coal performer. Last quarter, earnings surprised by 133.33%, and the Consensus Estimate Trend has been positive over the past 90 days.

Image Source: Zacks Investment Research

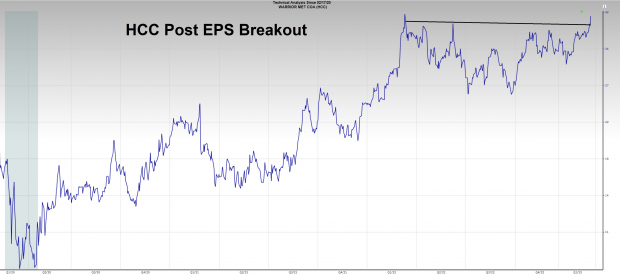

Technical Picture: Breakouts Galore

While the coal industry has seen a meteoric rise over the past two years, most names in the group have consolidated and digested in recent months. However, following recent blowout earnings, and firm EPS estimates moving forward, the coal leaders such as ARCH and HCC look poised to continue their uptrends. Both names are examples of just some of the coal stocks breaking out. On Thursday, ARCH rocketed higher by nearly 10% on volume more than double the norm. HCC is also breaking out from a multi-month base after a strong earnings report.

Image Source: Zacks Investment Research

Takeaway

Industry consolidation, strong demand, and a lack of ESG adherence is leading to strength in the coal industry. Recent earnings have been strong, expectations moving forward are robust, and multiple stocks are staging breakouts simultaneously – a confirmation signal for technicians. For these reasons, investors should remain bullish on coal leaders such as Warrior Met Coal and Arch Resources.

4 Oil Stocks with Massive Upsides

Global demand for oil is through the roof… and oil producers are struggling to keep up. So even though oil prices are well off their recent highs, you can expect big profits from the companies that supply the world with “black gold.”

Zacks Investment Research has just released an urgent special report to help you bank on this trend.

In Oil Market on Fire, you’ll discover 4 unexpected oil and gas stocks positioned for big gains in the coming weeks and months. You don’t want to miss these recommendations.