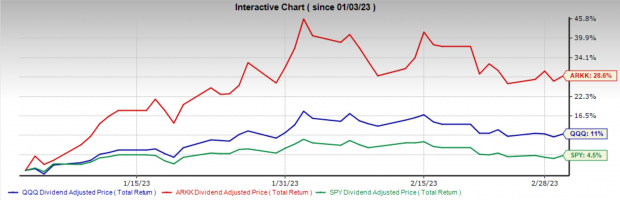

Without a doubt, growth and technology stocks are back on top this year. The Nasdaq is outperforming the S&P 500, and the (ARKK – Free Report) Innovation fund has nearly tripled the Nasdaq returns YTD.

After a brutal 2022, many stocks experienced the worst drawdowns since the financial crisis. Those hit the worst were technology stocks with high sales growth and equally high earnings multiples. Because of the dramatic increase in interest rates, these high multiple growth stocks had to readjust to the new economic regime.

Although times are tough in the tech sector, things have clearly turned around. Discerning investors can find very promising technology stocks trading at just a fraction of what they traded 12-18 months earlier. Even more encouraging is this new interest rate policy pushes tech companies to prioritize profits rather than growth. After years of negative earnings, with the promise of future profits, many of these companies are now making good on those words.

Image Source: Zacks Investment Research

Okta

Okta (OKTA – Free Report) is one of these technology companies that will finally be flipping to a positive EPS stock. Okta is a cloud-based identity solutions company that provides services for large enterprises, small and medium businesses, universities, non-profits, and government agencies. Okta’s products ensure secure usage of internal software and data through authentication technology.

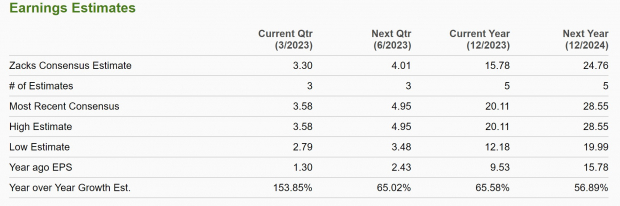

OKTA has a Zacks Rank #2 (Buy), indicating a positive earnings revision trend. The current quarter earnings are now expected to be positive and so are all future EPS estimates.

Current quarter sales estimates are expected to grow 22% to $506 million. Current year sales estimates are also expected to grow by 16% to $2.2 billion.

Image Source: Zacks Investment Research

After trading as high as 45x one-year forward sales, OKTA’s valuation has come back to reality. Currently trading at 6x one-year forward sales it is well below its three-year median of 27x, and just off its low of 4x.

Image Source: Zacks Investment Research

Mercado Libre

Mercado Libre (MELI – Free Report) is an Argentina-based e-commerce company. MELI functions kind of like the Amazon AMZN of South America. It has a very broad array of products for consumers to purchase and acts as a platform for third-party sellers to conduct business.

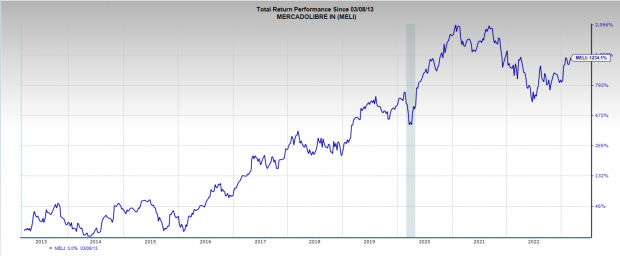

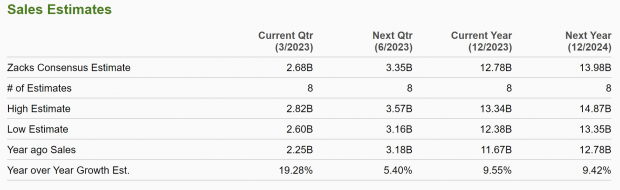

MELI is a Zacks Rank #1 (Strong Buy) stock, indicating strong earnings revisions. Mercado Libre has been ahead of the curve in terms of showing a profit, which it has done so since early 2020. Nonetheless earnings are projected to rocket higher over the next few quarters.

Image Source: Zacks Investment Research

From 2021 high to 2022 low MELI experienced a very painful -70% correction, but the stock still shows stellar long-term performance. Over the last ten years MELI stock has appreciated over 1200%, which comes out to a whopping 30% annualized.

Image Source: Zacks Investment Research

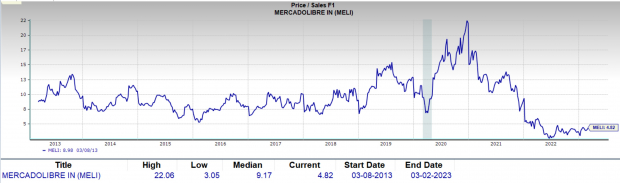

Trading just below 5x one-year forward sales, MELI’s valuation is well below its 10-year median of 9x, and just above its recent low of 3x. In terms of an earnings multiple, rather than sales, MELI is still quite high. A one-year forward P/E of 81x is very rich and will dissuade any value-oriented investors.

Key to Mercado Libre’s future is going to be interest rate policy and economic growth expectations in South America.

Image Source: Zacks Investment Research

Expedia Group

Expedia Group (EXPE – Free Report) is one of the largest travel companies in the world and operator of Expedia.com, Hotels.com, Tripadvisor.com, VRBO.com among several others. Along with destination and flight plan choices, the websites also provide details of the places to be visited, maps, local restaurants, and things to do.

Expedia is a much more established company than the other two and far more reasonably valued. Currently trading at a one-year forward earnings multiple of 15x, it is well below its 10-year median of 25.5x, and just off the lows of 13x. This is an extremely appealing valuation for such an established technology company.

Image Source: Zacks Investment Research

EXPE also currently earns a Zacks Rank #1 (Strong Buy), indicating a positive trend in earnings revisions. Furthermore, with the reacceleration in the economy and people’s willingness to travel sales growth expectations for Expedia are high.

Image Source: Zacks Investment Research

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.