Image: Bigstock

Many markets have been boosted higher this year. Thanks to Federal Reserve rhetoric over the last few months, market participants now believe that interest rate hiking policy is near an end. Understandably so, this has pushed investors back into stocks, as they now expect a resumption of economic growth.

Furthering this thesis is the reopening of China’s economy. After pursuing ‘Zero-Covid,’ and locking down citizens for the better part of two years, they have abandoned that policy. Having suppressed economic activity for so long, analysts and investors are anticipating China’s economic activity to resume at a break-neck pace.

Steel Market

One market that has benefited from this new narrative more than most is the Steel market. Steel is a key material in building and industrial production, so demand for the metal can be a leading indicator of economic activity. With China reopening, and lower interest rates potentially on the horizon demand for steel, and thus the price have appreciated considerably.

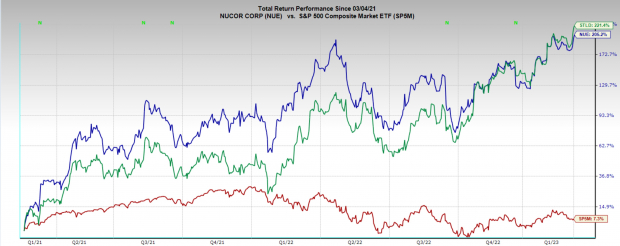

Furthermore, inflation pushed steel prices higher last year, so steel stocks also have the momentum of last year at their back. Stocks such as Nucor (NUE – Free Report) and Steel Dynamics (STLD – Free Report) are up over 200% over the last 12 months and pushing new highs this week. Both Nucor and Steel Dynamics are among many in the steel industry boasting a Zacks Rank of #1 (Strong Buy), indicating an upward trend in earnings revisions.

Image Source: Zacks Investment Research

More Steel Stocks

Steel and its sub-industries are among the highest on the Zacks Industry Rank. Steel Producers are in the top 7%, and both Steel – Specialty and Steel Pipe and Tube are in the top 4%.

Among the steel producers there is no shortage of Zacks Rank #1 stocks. In addition to Nucor and Steel Dynamics, other promising looking stocks include Olympic Steel (ZEUS – Free Report) , ArcelorMittal (MT – Free Report) , and Ternium (TX – Free Report) . These stocks are clearly benefiting from price momentum and each of them are rallying to multi-month and multi-year highs this week.

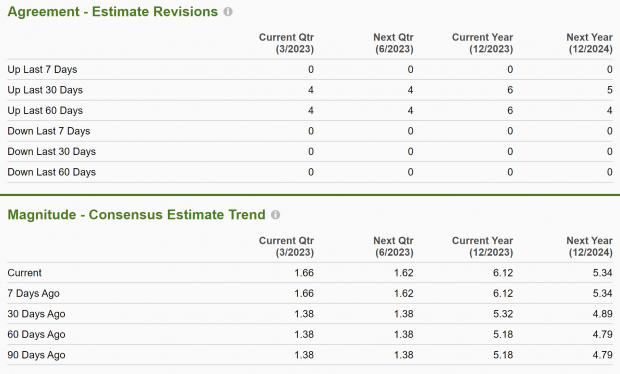

ATI Inc. (ATI – Free Report) is another steel stock with a Zacks Rank #1 (Strong Buy). ATI is a diversified specialty materials producer. ATI’s earnings estimates have been revised higher across timeframes. Current quarter sales are expected to grow 17% to $974 million and current year sales are projected to grow 6% to $4.1 billion.

ATI is another very strong performing stock pushing new highs seemingly every day.

Image Source: Zacks Investment Research

Tenaris (TS – Free Report) , a corporation organized in Luxembourg, is a leading manufacturer and supplier of seamless steel pipe products and associated services to the oil and gas, energy and other industries. Also boasting a Zacks Rank #1 (Strong Buy), analysts have unanimously raised earnings expectations.

Analysts are expecting big numbers from Tenaris, projecting current quarter sales to climb 66% to $3.9 billion. Current year sales are looking strong to with expectations 28% YoY growth bring FY revenue to $15 billion.

Image Source: Zacks Investment Research

Concerns

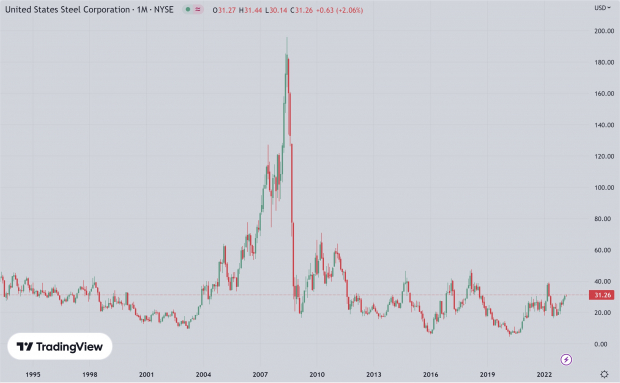

This extreme momentum, while exciting, also concerns me, rhyming with a historical pattern of past recessions. In the chart below we can see U.S. Steel (X – Free Report) experienced a parabolic move right into the 2008 financial crisis, which was followed by an equally brutal sell-off. X wasn’t alone in the move as many other steel stocks, energy, and other commodities experienced a similar move. The economic backdrop is not the same, but there are enough similarities to warrant concern.

Image Source: TradingView

Today when I look at a stock like STLD, the chart reminds me of the parabolic rally that U.S. Steel experienced. Additionally, although we are beginning to see disinflation in the economy, something like this sends warning signals. Rallying commodity prices may set off another run-on inflation. Inflation concerns are exactly what initiated the rally in 2008.

Image Source: TradingView

These historical analogs are quite speculative, but for anyone considering trading steel stocks, it should be noted how strong the momentum factor can be. So, any investors considering trading steel stocks should trade them like a momentum stock, and use trailing stop losses to manage risk.

Bottom Line

Steel stocks are pumping, and analyst expectations are continuing to be revised higher. For any bold momentum traders, the steel sector may be a great place to trade breakouts.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.