Investors love chip stocks, with many quickly realizing the vital role semiconductors play in everyday life.

Of course, many investors also target dividend-paying stocks, aiming to achieve a passive income stream and limit the impact of drawdowns in other positions.

And several stocks, including Texas Instruments (TXN – Free Report) , Broadcom (AVGO – Free Report) , and Taiwan Semiconductor Manufacturing (TSM – Free Report) , provide investors with exposure to chips and the ability to reap an income stream.

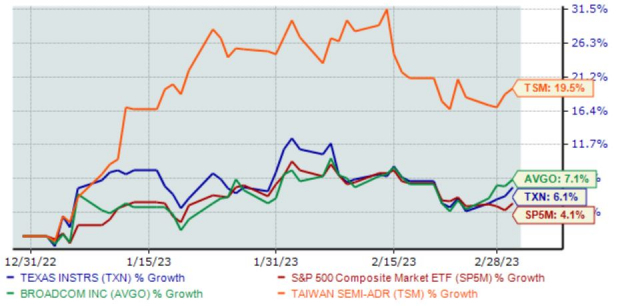

Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

For those interested in chips and reaping an income stream, let’s take a closer look at each one.

Texas Instruments

Texas Instruments is an original equipment manufacturer of analog, mixed-signal, and digital signal processing (DSP) integrated circuits.

TXN’s annual dividend yield stands tall at 2.9%, paired with a sustainable payout ratio sitting at 53% of its earnings. Impressively, 2022 marked the company’s 19th consecutive year of increased payouts.

Image Source: Zacks Investment Research

Texas Instruments posted better-than-expected results in its last quarter, exceeding bottom line expectations by nearly 9%. Quarterly revenue totaled $4.7 billion, 2% above expectations and pulling back marginally year-over-year.

Image Source: Zacks Investment Research

Broadcom

Broadcom is a premier designer, developer, and global supplier of a broad range of semiconductor devices.

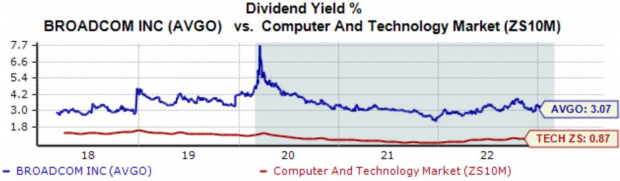

Broadcom’s dividend metrics are hard to ignore; its annual dividend presently yields 3.1%, more than triple that of the Zacks Computer and Technology sector.

And to top it off, the company’s 21% five-year annualized dividend growth rate reflects a strong commitment to increasingly rewarding shareholders.

Image Source: Zacks Investment Research

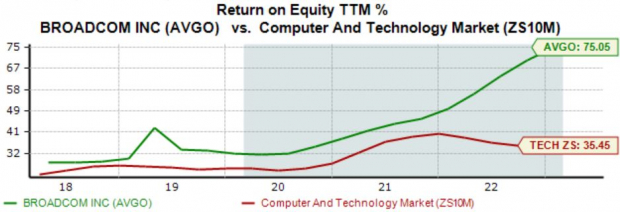

In addition, AVGO’s 75.1% TTM return on equity is undoubtedly impressive, reflecting a higher level of efficiency in generating profit from existing assets compared to peers.

Image Source: Zacks Investment Research

Taiwan Semiconductor Manufacturing

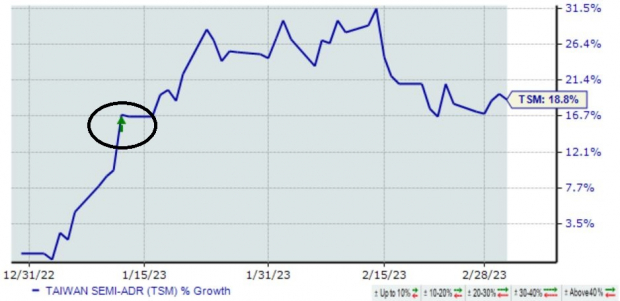

Taiwan Semiconductor Manufacturing is the world’s largest circuit foundry. The stock gained widespread attention following a purchase from the legendary Warren Buffett a few months back.

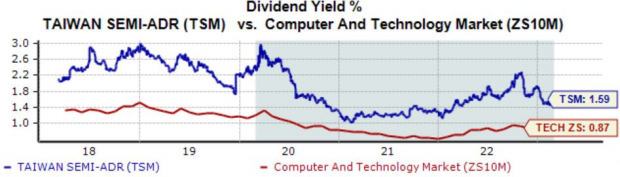

TSM’s annual dividend yield stands at 1.6%, again well above the Zacks sector average. Similar to AVGO, Taiwan Semiconductor has shown a commitment to its shareholders, upping its payout 11 times over the last five years.

Image Source: Zacks Investment Research

Shares got a nice boost following the company’s latest quarterly release, as illustrated by the green arrow in the chart below.

Image Source: Zacks Investment Research

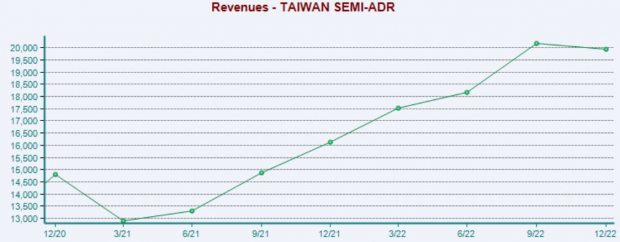

TSM exceeded the Zacks Consensus EPS Estimate by roughly 1% in its lattest quarter, reporting earnings of $1.82 per share. Quarterly revenue totaled $19.9 billion, reflecting a sizable 26% year-over-year increase.

Image Source: Zacks Investment Research

Bottom Line

Chip stocks are undoubtedly exciting investments, rewarding shareholders handsomely with gains over the last several years.

And for those interested in reaping a steady income stream paired with exposure to the semiconductor industry, all three stocks above – Texas Instruments (TXN – Free Report) , Broadcom (AVGO – Free Report) , and Taiwan Semiconductor Manufacturing (TSM – Free Report) – would provide that.