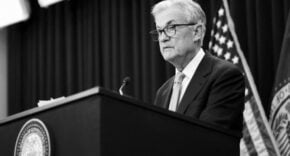

Federal Reserve Chair Jerome Powell told lawmakers on Tuesday interest rates are likely to rise more than previously expected as the central bank works to bring down inflation, which remains stubbornly above the central bank’s 2% target.

U.S. stocks were trading lower Tuesday as some analysts said the comments were more hawkish than expected. Near 2:20 p.m. ET, the benchmark S&P 500 (^GSPC) was near session lows, falling 1.5%, with the Dow Jones Industrial Average (^DJI) off 1.7%, and the Nasdaq Composite (^IXIC) falling 1.2%.

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” Powell told the Senate Banking Committee in prepared remarks. “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

“Although inflation has been moderating in recent months, the process of getting inflation back down to 2 percent has a long way to go and is likely to be bumpy,” Powell added.

The latest Consumer Price Index report released last month showed prices rose 6.4% over the prior year in January, a slowdown from last summer’s peak inflation rate of 9.1% but still well above the Fed’s 2% target.

Powell’s comments spurred traders to price in a higher chance of a 0.50% hike than a 0.25% increase later this month, according to data from CME Group.

In a note, Morgan Stanley’s chief U.S. economist Ellen Zentner said Powell’s remarks “opened the door” to a return of 0.50% hikes, “If the incoming data flow warrants it.” If there are “upside surprises” in a jobs report this Friday from the Labor Department, that could “drive a faster and longer tightening cycle,” according to Zentner’s note.

The Fed projected at its December policy meeting interest rates would need to rise to a range of 5%-5.25% this year, though Powell’s comments now suggest rates will need to eventually rise above this level. Following the Fed’s February policy decision, the central bank’s benchmark interest rate stands in a range of 4.5%-4.75%.

Some Senate Democrats challenged Powell during Tuesday’s hearing, cautioning that his rate hikes could lead to job losses. Senate Banking Chair Sherrod Brown (D-OH) said there are other ways to bring down prices, citing the strengthening of supply chains, boosting of U.S. manufacturing and the rebuilding of infrastructure.

Democratic Senator Elizabeth Warren said if the central bank raises rates as much as planned, to 5%-5.25% excluding any further rate hikes Powell has now suggested above that level, unemployment would rise to 4.6%. That, she said, would cost two million people jobs.

“Chair Powell, if you could speak directly to the two million hardworking people who have decent jobs today, who you’re planning to get fired over the next year, what would you say to them?” Warren asked.

Powell, in response, said: “I would explain to people more broadly that inflation is extremely high and it’s hurting the working people of this country badly. All of them, not just two million of them, but all of them are suffering under high inflation, and we are taking the only measures we have to bring inflation down.”

In a hat tip to these concerns, Powell said in his prepared remarks that the Fed is “acutely aware” high inflation is causing “significant hardship” for Americans while also pledging to “stay the course until the job is done.”

The Fed chair said Tuesday policymakers will continue to make decisions on a meeting by meeting basis.

Powell noted that economic data from January on inflation, job growth, consumer spending, and manufacturing production have partly reversed course from the slowdown seen back in December.

Powell attributed some of the softening to unseasonably warm weather in January, but cautioned that the “breadth of the reversal” suggests inflation is running higher than expected. He reiterated the Fed still needs to see a drop in services inflation excluding housing to bring inflation down, which is likely to require a weaker job market.