A leading analytics firm says that Bitcoin (BTC) is flashing a key on-chain signal that also surfaced in the first half of 2021 when the king crypto rallied above $60,000.

Santiment says the number of Bitcoin hodlers, or entities that have little history of selling BTC, is in the midst of a steep rise.

According to the analytics firm, the growing number of Bitcoin hodlers looks similar to two years ago when Bitcoin rose from around $30,000 to $64,000 in just a few months.

“There is a rising rate of Bitcoin hodlers as traders seem to have become increasingly content in keeping their bags unmoved for the long-term. We saw a similar trend from January 2021 through April 2021 when BTC rose above $64,000 for the first time.”

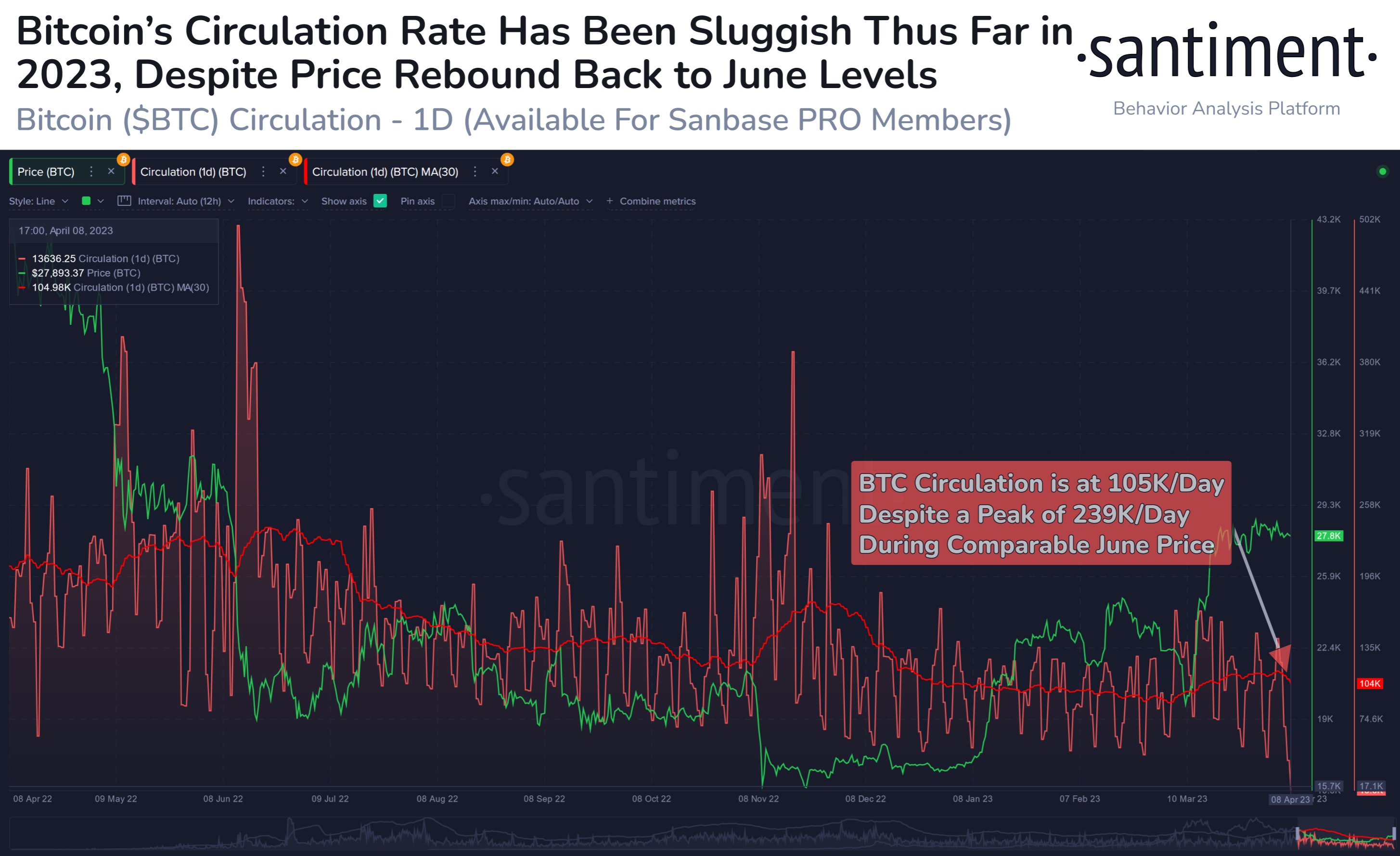

Although Bitcoin is showing a bullish on-chain reading, Santiment says that one metric appears to be an area of concern. The firm says Bitcoin’s circulation rate has been sluggish throughout 2023 even though BTC’s value has risen to price levels last seen in June 2022.

Santiment notes that the number of unique BTC moved per day currently stands at 105,000 tokens, which is significantly less than the 239,000 Bitcoin that circulated per day in June last year.

“Bitcoin is back below $28,000, and unique tokens moved continues to be a point of concern. When looking for validation of mid/long term bull runs, utility should be rising. For now, 105,000 BTC is moving per day, 56% less than its one-year peak in June ’22.”

At time of writing, Bitcoin is trading for $28,338.

Original Article: https://dailyhodl.com/2023/04/10/rapid-rise-in-population-of-long-term-bitcoin-holders-reminiscent-of-2021-bull-market-analytics-firm-santiment/