The stock market can seem complicated and confusing at times, even to seasoned investors. Individual stocks can move up or down seemingly without reason. Your favorite company reports terrible earnings but the stock surges. The price of oil dropped and economic data comes in better than expected, but the major indices nosedive. Often, the market’s reaction to the news is much more important than the news itself.

In the stock market, we don’t necessarily need to know why something is happening – we just need to know that it’s happening. Financial analysts are paid to decipher company fundamentals in an effort to produce buy and sell ratings on stocks. But how many times have you seen a stock with poor fundamentals soar, while one with superb fundamentals plunges?

For the average investor, following a system rather than relying on predictions is going to produce much more favorable results over time. We don’t necessarily need to know exactly why a stock is moving in a certain direction, we just need to know which way it’s most likely to go.

Let’s take a look at a simple example. We want to target stocks whose buying pressure is exceeding any selling pressure and avoid stocks that are experiencing heavy selling. Moving averages are a great way to ‘smooth’ out the price trend for a given stock. In our example, we’ll stick with the simple 50-day moving average as our guide in conjunction with the Zacks Rank system, which harnesses the power of positive earnings estimate revisions.

Below we see a 6-month chart of Novo Nordisk (NVO – Free Report) , a Zacks Rank #1 (Strong Buy). Notice that NVO is in an uptrend and how the stock is trading above the 50-day moving average (blue line). The 50-day moving average has acted as support throughout the powerful upside move. NVO has soared more than 57% over the past six months.

Image Source: StockCharts

Novo Nordisk is a health care company that is engaged in the research, development, and marketing of pharmaceutical products. The company focuses on manufacturing products for diabetes, obesity, and rare diseases.

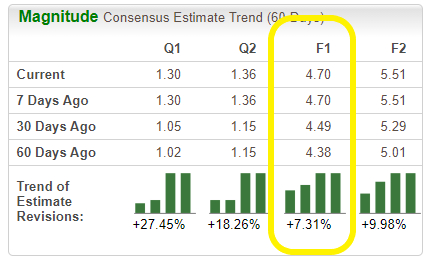

NVO stock has been making a series of 52-week highs and is experiencing positive earnings estimate revisions. Analysts are in agreement and have been raising EPS estimates across the board. For the current year, estimates have increased 7.31% in the past 60 days. The 2023 Zacks Consensus Estimate now stands at $4.70/share, reflecting potential growth of 35.84% relative to last year.

Image Source: Zacks Investment Research

Now let’s examine a stock whose selling pressure is exceeding its buying pressure. Below we can see a year-to-date chart of Clearfield (CLFD – Free Report) , a Zacks Rank #5 (Strong Sell). Notice that CLFD is in a downtrend and how the 50-day moving average has been steadily falling. 2023 has not been kind to CLFD, as the stock has lost more than half its value. The 50-day moving average is sloping down and CLFD is making a series of 52-week lows.

Image Source: StockCharts.com

Clearfield designs and manufactures passive connectivity products, such as its FieldSmart fiber management platform. Its fiber-based products support a wide range of panel configurations and densities and are utilized by exchange carriers, wireless operators, cable TV companies, and data center markets.

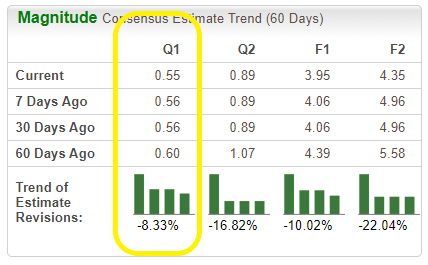

CLFD is also witnessing negative earnings estimate revisions. Analysts are in agreement and have decreased estimates across the board. For the first quarter, estimates have been slashed by -8.33% in the past 60 days. The Q1 Zacks Consensus Estimate now stands at $0.55/share, translating to negative growth of -16.67% relative to the same quarter in the prior year.

Image Source: Zacks Investment Research

We can see the power behind following a system and how it can help us both locate winning stocks and avoid losing ones. The next time you want to buy a stock, use the Zacks Rank to ensure the company is witnessing positive earnings estimate revisions. Incorporating simple technical analysis using moving averages is another great way to narrow down the playing field.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.