When the Chase Sapphire Reserve® Card debuted in 2016, everyone talked about its high reward rate, lucrative six-figure welcome bonus, and amazing benefits. In fact, there was so much interest in the card that the company was depleted of metal credit cards when they couldn’t keep up with demand.

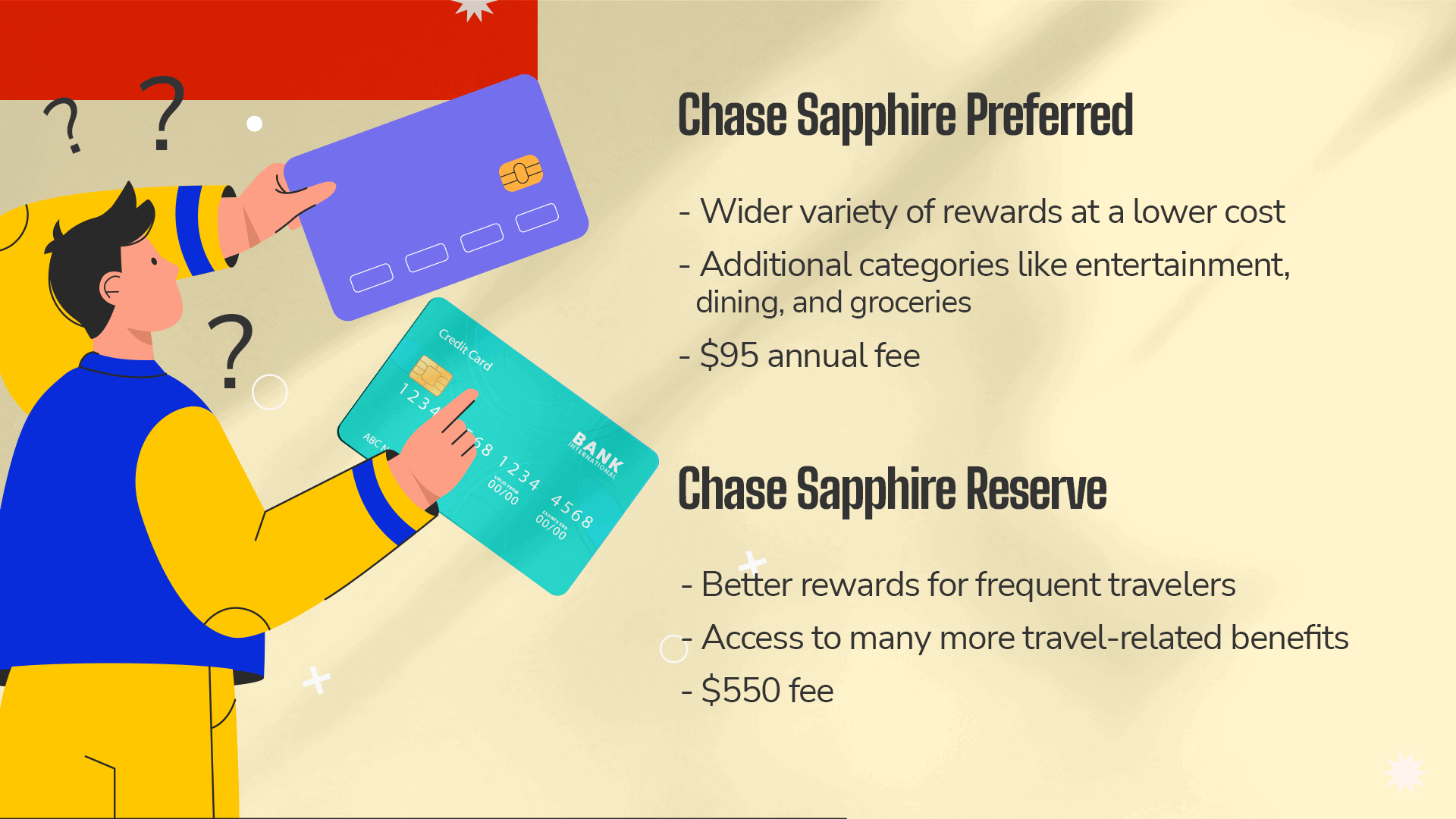

For years, the Chase Sapphire Reserve® — despite its much higher annual fee — was considered the more cost-effective charge card over the Chase Sapphire Preferred® Card due to Reserve’s generous point system and perks, which outweighed its $550 annual fee.

But with a recent refresh of the Chase Sapphire Preferred® card, accompanied by an annual fee hike for the Sapphire Reserve® card (it jumped from $450 to $550 in 2020), the $95-annual-fee Chase Sapphire Preferred® card has now become the top choice for many consumers looking for a standout travel rewards credit card.

But which one is right for you? Let’s look at each card’s details and help you answer that question.

Overview

Both the Chase Sapphire Preferred® Card and its premium cousin, the Chase Sapphire Reserve®, are some of the most well-recognized travel rewards credit cards with consumers. They both earn valuable bonus points on travel and dining and offer various perks for Peloton and DoorDash.

We’re always asked for credit card suggestions by our readers, and these two are almost always mentioned.

While the cards have several similarities in terms of earning rates, redemption options, and the same ability to transfer your points at a 1:1 ratio to 14 travel loyalty programs, the Chase Sapphire Preferred® charges a much lower annual fee and includes many of the same benefits as the Chase Sapphire Reserve®.

Sign-up bonus

Each card has a welcome bonus — but one is vastly superior.

Chase Sapphire Preferred®

Chase just announced the launch of an elevated sign-up bonus of 80,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $1,000 when you redeem through Chase Ultimate Rewards®. Since Chase Ultimate Rewards® points hold a standard 1:1 value, with one point equal to one cent, but you can get much better value from your points by transferring to one of Chase’s travel transfer partners.

Chase Sapphire Reserve®

A far cry from its inaugural sign-up offer back in 2016, new Chase Sapphire Reserve® cardholders can earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Ultimate Rewards®.

Sapphire Reserve® cardholders receive an elevated 50% redemption value (1.5 cents per point) for travel booked through Chase Ultimate Rewards®.

Verdict

Easy. The Chase Sapphire Preferred® is the winner with a newly elevated 80,000-point bonus. The Chase Sapphire Preferred® Card takes round 1.

Rewards

Rewards is where the cards vary significantly.

Chase Sapphire Reserve® provides users with higher rewards in dining out, car rentals, and hotel stays, while the Chase Sapphire Preferred® shines for online grocery purchases, streaming services, and dining in or out.

Chase Sapphire Preferred®

Chase Sapphire Preferred® cardholders enjoy bonus points in the following categories:

- 5x points per dollar spent on travel reservations through Chase Ultimate Rewards®.

- 3x points per dollar spent on select streaming services.

- 3x points per dollar spent on dining, which includes eligible takeout and delivery services.

- 3x points per dollar spent on online grocery purchases (excludes Target, Walmart, and wholesale clubs).

- 2x points per dollar spent on travel not purchased through Chase Ultimate Rewards®.

- 1x point per dollar spent on all other purchases.

Points are worth 1.25 cents when you use Chase Ultimate Rewards® to redeem them.

Chase Sapphire Reserve®

For the Chase Sapphire Reserve®, the reward points are quite different. This is where this card may come out ahead, depending on where you spend your money. The Sapphire Reserve® offers:

- 10x points per dollar spent on Chase Dining Purchases booked through Chase Ultimate Rewards® (limitations apply).

- 10x points per dollar spent on car rentals and hotel stays when booked through Chase Ultimate Rewards® (after spending $300 on travel annually).

- 5x points per dollar spent on flights when booked through Chase Ultimate Rewards®.

- 3x points per dollar spent on dining and travel not booked through Chase Ultimate Rewards®.

- 1x point per dollar spent on all other purchases.

When redeeming rewards through Chase Ultimate Rewards®, points are equal to 1.5 cents.

Verdict

It depends on where you spend your money. If you’re a frequent traveler, enjoy dining out, and plan to earn and redeem your points by booking travel through the Chase Ultimate Rewards® portal, then the Sapphire Reserve® may be an excellent fit.

However, if you want a broad amount of spending categories where you can earn bonus points, and these categories align with your everyday spending habits, you may want to opt for the Chase Sapphire Preferred®.

The result? Tie.

The better option will depend on your spending patterns on each card’s bonus categories.

Travel benefits/insurance

Here is an area where the Chase Sapphire Reserve® outweighs the Chase Sapphire Preferred® Card.

The Chase Sapphire Preferred® Card provides basic travel coverage, insurance for trip delays or cancellations, car rentals, and baggage delays. It’s worth noting that the Chase Sapphire Preferred® delivers primary auto rental coverage insurance when you use your card to pay for your rental vehicle. That means you do not have to file a claim with your insurance company first if you’re in a fender bender or if the rental car is stolen. That’s an impressive perk for a card with an annual fee of only $95.

On the other hand, Chase Sapphire Reserve® includes emergency medical and dental coverage with airport lounge perks. It treats cardholders as VIPs in this area.

Chase Sapphire Preferred® Card

Chase Sapphire Preferred® cardholders will enjoy:

- Purchase protection when you use your card.

- Extended warranty protection.

- Reimbursement for lost luggage essentials.

- Insurance for baggage delay.

- Trip cancellation or interruption insurance.

- Waiver for automobile collisions.

- Emergency and travel assistance services.

Chase Sapphire Reserve®

Chase Sapphire Reserve® goes above and beyond here, with many more perks than the Chase Sapphire Preferred® card for insurance coverage and travel extras. Cardholders can expect:

- Access to Reserved by Sapphire restaurants.

- Benefits for the Luxury Hotel & Resort CollectionSM, such as early check-in, late check-out, and complimentary upgrades.

- Priority Pass™ Select lounge membership (value is $429).

- Credit for NEXUS, Global Entry, and TSA PreCheck® fees.

- Emergency dental and medical insurance.

- Car rental insurance.

- Trip cancellation/interruption insurance.

- Emergency transportation and evacuation.

- Lost luggage reimbursement.

- Trip delay insurance.

- Purchase and extended warranty protection.

- Auto rental damage waiver for collisions.

Another difference in insurance is that Chase Sapphire Preferred® charges a fee per call for roadside assistance. The Sapphire Reserve® card allows four free service calls, up to $50 each.

Both cards also offer up to $50,000 in annual purchase protection. However, the Sapphire Reserve® offers $50,000 yearly (up to $10,000 per claim), while the Chase Sapphire Preferred® provides $50,000 per account (up to $500 per claim).

Verdict

The Sapphire Reserve® wins hands-down in the categories of insurance and travel perks. Just remember that all those bells and whistles come with that $550 annual fee.

Additional benefits

These benefits are extra perks that come with each card. While both cards are quite similar in their benefits, the Chase Sapphire Reserve® comes out slightly ahead in this area.

Chase Sapphire Preferred® Card

Cardholders receive a $50 statement credit annually on hotel accommodations booked through the Chase Ultimate Rewards® portal. Upon your one-year (account) anniversary, you’ll also earn bonus points equal to 10% of your total purchases made the previous year.

You can also transfer your points at a 1:1 ratio with up to 14 travel partners, including popular names like Southwest, JetBlue, United, Hyatt, and Marriott.

Chase Sapphire Reserve®

A generous benefit of the Sapphire Reserve®, which helps to offset at least a portion of its lofty annual fee, is a $300-per-year travel credit. This card’s annual $300 travel credit can be applied to a wide range of charges, from flights, hotels, rental cars, and even parking and tolls — making it incredibly easy to use. This essentially makes the Sapphire Reserve® a $250 annual fee card ($550 annual fee – $300 travel credit), which may help you justify the more premium card option.

Sapphire Reserve® cardholders also gain access to over 1,300+ airport lounges worldwide via Priority Pass™ Select. Users are also reimbursed $100 every four years when they use their card to pay for a TSA PreCheck®, Global Entry, or NEXUS application fee.

Verdict

Once again, the Sapphire Reserve® wins — but only if you’re a frequent traveler who will use the $300 travel credit and lounge access to justify the higher annual fee. Otherwise, if you want a well-rounded travel rewards card and your focal point is to amass a nice chunk of points, the Chase Sapphire Preferred® is your best bet.

Why choose Chase Sapphire Preferred®?

Most people prefer the Chase Sapphire Preferred® credit card because it rewards you better for each dollar you spend at a lower cost. Even though the Chase Sapphire Reserve® has an incredible 10x earning potential in some categories, the Chase Sapphire Preferred® card is popular because of its wider variety of everyday spending categories.

This can be the best reward card for dining out for those who enjoy entertainment or date nights. Mostly everyone uses a streaming service to watch shows and movies, and online grocery purchases are becoming more commonplace. So, if you are doing these things anyway, you may as well get rewarded for your spending and consider the Chase Sapphire Preferred®.

With this card, you can add up to six extra users at no extra cost.

Additionally, the card has a nice anniversary bonus that the Chase Sapphire Reserve® doesn’t offer: a 10% bonus on total purchases during the previous year. That’s 1,000 bonus points if you spend $10,000 on the card.

In comparison, Chase Sapphire Reserve® charges users $75 annually per authorized user. While this isn’t unusual for a luxury card, the cost quickly adds up if you need to share the account with others.

The annual fee is significantly lower for the Chase Sapphire Preferred® card, so if you aren’t sure whether you will use all the benefits offered (or are sure you won’t), it doesn’t make sense to pay the hefty annual fee for the Sapphire Reserve® card.

This is when the Chase Sapphire Preferred® card becomes the better option. With 1:1 points transfer with partners and a cheaper annual fee (by a whopping $455), this option may be more attractive to some users.

Read our full Chase Sapphire Preferred® card review for more information.

Why choose Chase Sapphire Reserve®?

Frequent travelers will benefit from the Chase Sapphire Reserve® credit card. Both reward cards allow you to transfer reward points to 14 airline and hotel partners at a 1:1 ratio. However, if you book travel through Chase Ultimate Rewards®, you will receive a superior 1.5 cents per point redemption with the Sapphire Reserve® compared to 1.25 cents per point with the Chase Sapphire Preferred®.

The Sapphire Reserve® also comes with an easy-to-use $300 annual statement credit that can be used for many travel expenses — including things not so obviously categorized as “travel,” like ferries, campground fees, timeshares, and more. This $300 credit compensates for a large part of the annual fee and is just as good as cash for many for its ease of use, bringing the annual fee down to a more reasonable $250. If you redeem your points through the Ultimate Rewards® portal at the rate of 1.5 cents per point and use the other accompanying perks, you can easily get enough value to outweigh the annual fee.

Sapphire Reserve® is also the only card between the two that has Priority Pass™ Select. This allows users to access over 1,300+ airport lounges globally, with complimentary beverages and snacks.

The Sapphire Reserve® not only offers a Priority Pass™ Select lounge membership with access to airport lounges globally, but it also reimburses you up to $100 for TSA PreCheck®, Global Entry, and NEXUS application fees every four years so that you can move more quickly through customs and security on your next trip.

Read our full Chase Sapphire Reserve® card review for more information.

How do you determine which card is right for you?

Off the bat, I would be remiss if I didn’t mention that both Chase Sapphire cards are subject to Chase’s 5/24 rule. What’s this rule you ask?

Well, here it is: if you have opened five or more new cards in the last 24 months, Chase will almost certainly deny you for either card. If you’re unsure if you’ve applied for five or more cards, from any credit card issuer, in the last 24 months, go to Credit Karma and look at how many credit card accounts you’ve opened over the previous two years.

When deciding which card would benefit you the most, you need to consider your spending habits and determine your most common everyday purchases. If you spend money in categories like rental cars, plane tickets, and hotel stays, then the Chase Sapphire Reserve® card may be worth the investment.

However, there are more common spending categories on the Chase Sapphire Preferred® card that the Sapphire Reserve® doesn’t possess. As a reminder, the Chase Sapphire Preferred® earns three points per dollar on groceries purchased online (does not include wholesale clubs, Target, or Walmart), dining out and takeout, plus certain streaming services. If this is where most of your spending goes, the Chase Sapphire Preferred® is hard to pass up.

When you compare annual fees to credits side by side:

Chase Sapphire Preferred®:

$95 annual fee – $50 reimbursement for hotel bookings = $45 per year annually

Chase Sapphire Reserve®:

$550 annual fee – $300 reimbursement for travel purchases = $250 annually

While everyone may want the elaborate luxury card, not everyone can use it to its full potential. That’s why it’s important to analyze your spending habits and lifestyle needs. If you’re convinced that the Chase Sapphire Preferred® is the right fit for you, now may be the best time to consider applying, as its elevated 80,000-point bonus won’t stick around forever.

Alternatives to the Chase Sapphire Preferred® and Sapphire Reserve® cards

While the Chase Sapphire Preferred® and Reserve® cards each come highly recommended, neither may suit your personal situation.

Here are some alternatives to consider, along with reasons why you might want to choose one of them instead.

Chase Freedom Unlimited®

Not interested in paying an annual fee? Then the $550 annual fee for the Sapphire Reserve® is likely a dealbreaker for you. If you’re not a big spender, you may be unable to take advantage of enough rewards and perks to make such a fee worth it.

If you’re looking for a card with no annual fee, then the Chase Freedom Unlimited® card is a great alternative.

This card offers unlimited 1.5% cash back on all purchases. It also comes with an introductory offer that lets you earn an additional 1.5% on all purchases (up to $20,000 spent in the first year). That’s up to $300 cash back!

After your first year or $20,000 spent, you’ll earn 5% cash back on travel booked through Chase Ultimate Rewards® — plus 3% on dining and drugstore purchases and 1.5% on all other purchases.

The Chase Freedom Unlimited® card also comes with a 0% Intro APR on Purchases for 15 months and 0% Intro APR on Balance Transfers for 15 months. After the 15-month introductory period, your APR will range between 19.74% – 28.49% Variable, depending on your creditworthiness.

To qualify, you’ll need a good credit score — specifically, 700 or higher. This is a bit lower than the excellent credit score of 750 or higher that’s required for both the Chase Sapphire Preferred® and Chase Sapphire Reserve® cards.

Capital One Platinum Secured Mastercard®

Don’t have good or excellent credit? Then a secured card, like the Capital One Platinum Secured Credit Card, might be the alternative that you need.

Even if your credit score is poor (below 600), you can get approved for the Capital One Platinum Secured Credit Card.

This card comes with a $0 annual fee, which is rare for secured cards.

The Capital One Platinum Secured Credit Card doesn’t come with all of the bells and whistles that the Chase Sapphire Preferred® and Chase Sapphire Reserve® cards offer. But it’s a great way for students — or anyone with poor or no credit — to start building their credit history.

Just by using this card, you will be automatically considered for a higher credit line in as little as six months, with no extra deposit needed.

The APR on this card is a bit higher, at 29.99% (Variable). However, the whole point of this card is for you to build your credit score by paying off your balance in full each month.

Your Capital One Platinum Secured Credit Card includes standard benefits, like Concierge Service as well as a $0 Fraud Liability that ensures you won’t have to pay anything if your card is stolen.

You also get access to the Capital One mobile banking app and Capital One digital wallet so that you can track your spending at all times. Finally, you get Master RoadAssist® Roadside Service throughout the United States and an Extended Warranty on eligible purchases.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Citi Custom Cash℠ Card

If a year (or more) at 0% APR is essential to you, then the Citi Custom Cash℠ Card is an alternative that’s hard to beat.

This card has no annual fee and an introductory rate of 0% for 15 months on purchases and balance transfers. After the introductory period, you’ll be charged 18.74% – 28.74% (Variable), depending on your creditworthiness.

In addition to the lengthy 0% APR period, the Citi Custom Cash℠ Card features a flexible reward program. You’ll earn 5% cash back on up to $500 each billing cycle in your top spending category out of the following:

- Select streaming services

- Drugstores

- Fitness clubs

- Gas stations

- Grocery stores

- Home improvement stores

- Live entertainment

- Restaurants

- Select travel and transit expenses

You’ll also earn 1% back on all other purchases or any amount that exceeds $500 per month in your top spending category.

You can also earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening.

Citi ThankYou® points can be redeemed at a rate of 1 cent each on items like gift cards, cash back, and travel (rental cars, hotels, and airfare) through the Citi ThankYou® portal.

The Platinum Card® from American Express

The Platinum Card® comes with a hefty annual fee of $695 — even higher than the Chase Sapphire Reserve® card’s fee. But if you spend a large amount on travel, shopping, and entertainment each year, then you’ll get more than your money’s worth in benefits.

Benefits include:

- A $200 hotel credit per year

- A $200 airline fee credit per year

- $200 in Uber Cash per year ($15 per month to use on eligible orders with Uber Eats and rides with Uber, plus a $20 bonus in December)

- 5X Membership Rewards® points on eligible prepaid travel

- A $240 digital entertainment credit. Up to $20 in statement credits each month when you use your card on eligible purchases, like Audible, Disney+, Hulu, SiriusXM, or the New York Times.

Plus, too many other perks and benefits to list here!

Summary

The Chase Sapphire Preferred® and Chase Sapphire Reserve® cards both offer amazing rewards and benefits.

The Chase Sapphire Preferred® features a lower annual fee and a wider variety of everyday spending categories. It’s a great card for earning rewards on things like groceries, dining out, and streaming services.

The Chase Sapphire Reserve® is best for frequent travelers. While its annual fee is $455 higher than that of the Chase Sapphire Preferred® card, much of that can be easily offset with its $300 annual statement credit on many eligible travel expenses. By redeeming their points through the Ultimate Rewards® portal at a rate of 1.5 cents per point, higher spenders should be able to get enough value to offset the card’s high annual fee.

Original Article: https://www.moneyunder30.com/chase-sapphire-reserve-vs-preferred