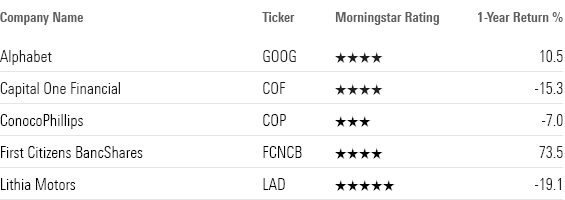

“Our thesis for owning Alphabet has been the same since we originally purchased it: GAAP accounting does not give them credit for the venture capital spending that they’re doing in areas like Waymo, for autonomous cars, or in artificial intelligence, where we think investors have come around to the point of view this year that Alphabet may not be behind at all,” says Nygren.

In addition, Alphabet has also consistently had a large amount of cash on the balance sheet that is generating substantial interest income, Nygren says.

Based on traditional accounting measures, Alphabet is trading at a price/earnings ratio of 23, well above the market. But when Harris factors in the investments in the nonsearch businesses of Google, along with the cash holdings and other elements, it arrives at a price/earnings ratio of roughly 14 times. “In our opinion, to not own Alphabet today, you would need to believe that it can’t grow as rapidly as the S&P 500.”

One other twist in its approach to Alphabet is to own the voting GOOGL share class of stock, rather than the GOOG shares, which come without voting rights. The nonvoting shares are economically identical, entitled to the same dividends, same cash flows,” Nygren notes. However, “the voting shares trade 1% cheaper.”

First Citizens BancShares FCNCA, FCNCB

“If you asked 100 people who Jamie Dimon is, you’d get 100 answers. But if you asked the same question about who Frank Holding is, you’d get 95 blank stares,” Nygren says.

The answer is that Frank B. Holding Jr. is chief executive of what is now the 15th largest bank in the country, First Citizens BancShares. Its shares, Nygren says, have been the best performing bank stock since 2008. This year, First Citizens BancShares stock has surged more than 67%.

Founded 125 years ago and run by three generations of Holdings since 1935, First Citizens has for the most part flown under the radar. “It’s probably the largest unknown company in the banking industry,” Nygren says.

That changed somewhat in March of this year, when First Citizens stepped in to acquire Silicon Valley Bank after it collapsed and was taken over by the Federal Deposit Insurance Corp. “They have one of the oddest core competencies I’ve ever seen for a bank,” Nygren says. “They are the leader at purchasing failed banks from the FDIC,” with more than a dozen such acquisitions in the past 15 years, he says.

The bank’s stock is cheap in their estimation, changing hands around $1,250 per share. Even with this year’s rally, “at its current price, it is trading below an about $1,400 tangible book value, and it’s expected to earn about $160 per share this year,” Nygren says.

Similar to the story with Alphabet, Oakmark owns the bank’s class B shares, which come with super-voting rights but trade at roughly a 10% discount to regular Class A shares. The class B shares are very illiquid, which Nygren says likely accounts for the discount.

A stock that hasn’t worked:

Lithia Motors LAD

Founded in 1946, Lithia is the largest U.S. auto dealer, with roughly 300 stores in 28 states plus Canada. In the aftermath of the coronavirus pandemic, when used-car prices skyrocketed, Lithia’s stock surged to a high of $418 in March 2021 from under $70 a year earlier. But as car prices have come back to earth and worries about a recession have grown, the stock has stumbled. It’s now trading at roughly $232.

“We got interested last year after the stock fell under $300,” Nygren says. “It was trading in the high $200 with trailing earnings of over $40 a share and anticipated future earnings in the mid $30s.”

Lithia’s core business model has been that of a consolidator of dealerships. “When the owner nearing retirement doesn’t have a successor there, (Lithia) will … bring it into their own system, increase the sales. They’ve got their policies they use to maximize service revenue, maximize used-car sales, also maximize new-car sales. So after they purchase, they increase the sales, they also increase the margins.” Nygren says. “And in the past 11 years, earnings are growing thirteenfold and sales have grown tenfold”—much faster than the auto industry in general.

However, Lithia shares have struggled. For “almost anything auto-related, it’s been a tough year,” Nygren says. That’s largely due to fears of a recession, along with softening used-car prices and lingering supply-chain issues that have hampered the availability of semiconductor chips for new cars.

Meanwhile, Nygren says some observers are raising concerns about the long-term viability of dealerships because electric vehicles require less regular servicing—a major source of revenue—than internal combustion engine cars.

But Nygren says that even with greater adoption of electric vehicles, “it’s going to be a very long time until the internal combustion engine cars are off the road and not requiring servicing. So I think those are the risks that get people who are more concept-oriented to steer away from, and this leaves the stock to those handful of us that are still long term, fundamental value investors.”

Two more stocks from Nygren:

Capital One Financial COF

While it’s been a tough 2023 for many banks, Capital One stock has kept pace with the overall market, in part thanks to a pop higher in mid-May on news that Warren Buffett’s Berkshire Hathaway had taken a stake in the company.

Trading at roughly $105 a share, tangible book value on the company is $99 per share, and it’s trading at roughly 7.5% expected earnings, Nygren says.

“Capital One is very different from the banks that investors have been worried about,” Nygren says. Unlike some struggling regional banks, Capital One is not sitting with big losses on their government-bond portfolios, he says. At the same time, the mark to market on its loans—which is primarily composed of credit card receivables and auto loans—is showing a profit, Nygren says.

While there may be concerns about the impact of any recession on Capital One’s client base—which tends to be borrowers with lower credit scores and not the wealthier customers sought by the big retail banks—Nygren thinks those concerns are overblown. He points to a continued strong jobs labor market where lower-paid workers are in high demand. “I think it’s entirely possible that the bottom half of Capital One’s customer base comes through this next recession relatively unscathed,” he says.

ConocoPhillips COP

For Nygren, much of the thesis behind owning ConocoPhillips stock is the company’s focus on returning capital to shareholders.

“One of many things we like about this management team is they are comfortable making long-term forecasts,” he says. “At their analyst day, they said if oil averages $70 a barrel over the next decade, which is actually a little bit below where it is right now and certainly no adjustment for inflation, they will pay out 50% of their operating cash flow to shareholders either through stock repurchases or dividends.”

“They expect that they would pay out $130 a share and that they would end the decade a business that is 50% larger than it is today,” he says.

Nygren compares that potential return with that of 10-year Treasury bonds yielding 4% a year, where investors would collect a little under 40% of their original investment over the life of the original investment plus a return of the original investment. However, bond investors are exposed to inflation risk, he notes.

“That contrasts with ConocoPhillips where you get about 125% back at the end of that 10-year period and your investment would be worth 50% more than it is today,” he says. “I think that’s a pretty stunning comparison, and ConocoPhillips gives you good inflation protection.”