Investing in high-quality businesses trading at historical discounts is a prudent strategy with the potential for market-beating returns. In this article, we will explore three such exceptional stocks that not only exhibit compelling valuations but also possess top Zacks Ranks, enhancing their near-term prospects.

Visa (V – Free Report) , renowned for its dominant position in the global financial services industry, InMode (INMD – Free Report) , a leading player in the rapidly expanding medical aesthetics market, and VeriSign (VRSN – Free Report) , a trusted provider of domain name registry services, all demonstrate robust business fundamentals, a track record of growing earnings, and competitive advantages within their respective sectors.

Visa

Visa is the world’s leader in in credit card transactions. Visa currently processes 61% of all card based transactions in the US and 40% worldwide making it the world’s largest card processor by transaction volume.

The company essentially enjoys a tax on all credit card-based purchases thanks to its incredible network. And though Visa has built out deep penetration into the world’s payment solutions, there is still plenty of room to grow. Internationally, cash is still the most popular method of payment for point-of-sale transactions at 59%, so Visa has room before the market is saturated.

Visa has a Zacks Rank #2 (Buy), indicating upward trending earnings revisions. Current quarter earnings are projected to grow just 1% YoY, however FY23 earnings are expected to climb 14.4% YoY.

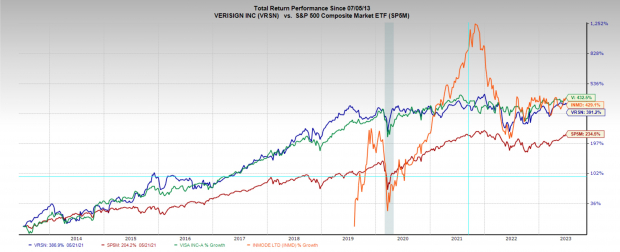

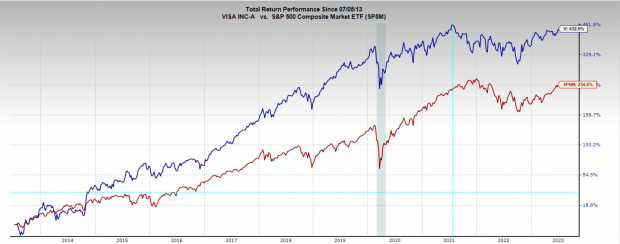

Because of Visa’s exceptional business economics, 99% gross margins and 50% net margins, as well as industry dominance and steady earnings growth, its stock has enjoyed enviable performance. Over the last ten years it has compounded at an annual rate of 18%, far outperforming the broad market.

However, in the performance chart below, we can see that the steady climb higher has slowed, and over the last three years the stock has made little progress. This creates a great opportunity for discerning investors as its valuation has had the opportunity to moderate, since the stock price has stagnated while earnings have continued to grow.

Visa is now trading at a one-year forward earnings multiple of 27.7x, which is below its five-year median of 30.5x and well off its high valuation of 45x. While almost 28x forward earnings isn’t a screaming discount, great companies like V rarely go on sale, so now is as good an opportunity as any.

InMode

InMode is an industry leading medical technology company growing at an impressive pace. INMD has developed a diverse portfolio of minimally invasive and non-invasive devices offering innovative solutions for body contouring, skin rejuvenation, facial treatments, and women’s health. By combining radiofrequency, laser, and other energy-based technologies, InMode delivers effective and customizable procedures, earning recognition among physicians worldwide.

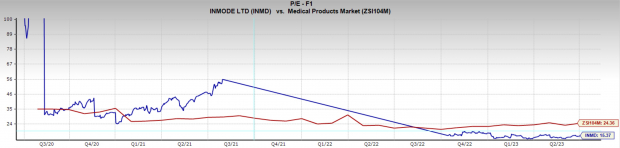

During 2022, INMD stock experienced a brutal correction of nearly -80%, however the stock has still compounded at an annual rate of 55% since its IPO.

InMode has grown sales from $100 million in 2018 to nearly $500 million today, and that growth is expected to continue. FY23 sales are projected to grow 18% YoY and FY24 are expected to grow 16.4% YoY.

Earnings estimates have begun to experience revisions higher giving InMode a Zacks Rank #2 (Buy). FY23 earnings estimates have been revised higher by 2% and are projected to grow 12% YoY to $2.71 per share. FY24 earnings estimates have been revised higher by 1.5% and are expected to grow 13.7% YoY to $3.06 per share.

Along with many other high-growth stocks, INMD experienced a painful 2022 correction. Now a year after the lows, the stock has built out a large base, from which it can begin a new bull sequence.

InMode stock has bumped into selling every time the stock has traded up to the $37.50 level. But the more a level gets tested, the more likely it is to fail. If the price can trade above the $37.50 level again, it may propel the stock significantly higher. Alternatively, if it loses the $35 level, it may take some time before the next bull run.

The 2022 correction has also brought INMD down to a very appealing valuation. It is now trading at a one-year forward earnings multiple of 15.4x, which is below the industry average of 24.4x, and well below its three-year median of 31x. As a company growing at such a pace, and with the technical chart pattern as a catalyst, InMode may be setting up for a big move.

Image Source: Zacks Investment Research

VeriSign

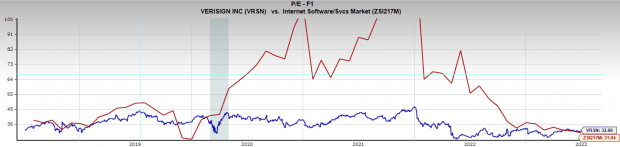

VeriSign is a trusted provider of domain name registry services, playing a critical role in the functioning of the internet. As the exclusive operator of the .com and .net domain registries, VeriSign ensures the secure and reliable resolution of millions of internet domain names globally. With its robust infrastructure and expertise in managing domain name systems, VeriSign maintains the stability, security, and availability of these vital online assets.

The company’s strategic position and long-term contracts with ICANN (Internet Corporation for Assigned Names and Numbers) provide a solid foundation for sustainable revenue generation. As internet usage and digital transformation continue to expand, VeriSign stands to benefit from the growing demand for domain names and the increased importance of online presence.

VeriSign is a Zacks Rank #1 (Strong Buy) demonstrated by upward trending earnings revisions. FY23 earnings estimates have been revised higher by 2.7% and are projected to grow 11% YoY to $6.92 per share. FY24 estimates have been upgraded by 4.5% and are forecast to climb 11% YoY to $7.68 per share.

VeriSign is trading at a one-year forward earnings multiple of 32.7x, which is just above the industry average of 31x, and below its five-year median of 37.1x. While 31x forward earnings is not a deep value investment, VRSN’s critical role in the internet all but assures its business future. And with improving earnings estimates, and a valuation below its historical median there may not be an opportunity to buy it at a cheaper valuation.

Bottom Line

It is hard to go wrong buying industry-leading stocks at historical discounts. While picking stocks is always fun, investors should keep risk management top of mind and take into account their exposure and max risk per trade.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Original Article: https://www.zacks.com/commentary/2116186/3-top-tier-stocks-trading-at-historical-discounts?art_rec=home-home-top_stories-ID03-txt-2116186